Basic accounting formula definition

That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side. This equation should be supported by the information on a company’s balance sheet. The Accounting Equation is the foundation of double-entry accounting because it displays that all assets are financed by borrowing money or paying with the money of the business’s shareholders.

Assets in Accounting: A Beginners’ Guide

- He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares.

- You very likely have a healthy and profitable business, assuming you are not contributing vast amounts of resources to the business to keep it afloat.

- In this case, the capital will become the beginning capital and additional contributions.

- In this form, it is easier to highlight the relationship between shareholder’s equity and debt (liabilities).

- Gross profit simply describes the total value of sales in a given accounting period without adjusting for their costs.

- A credit in contrast refers to a decrease in an asset or an increase in a liability or shareholders’ equity.

Owners’ equity typically refers to partnerships (a business owned by two or more individuals). Economic entities are any organization or business in the financial world. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Example Transaction #5: Purchase of Advertising on Credit

Your variable cost per unit is basically your cost of goods sold. That’s not the exact definition, but using your cost of goods sold will generally get you close accounting basic formula enough. Here is another critical concept that makes our list of important accounting formulas. Therefore your cost of goods sold for the month was $14,000.

Basic Accounting Terminology and Concepts

- The revenue a company shareholder can claim after debts have been paid is Shareholder Equity.

- The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet.

- It’s the fundamental equation that underpins all of accounting.

- Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products.

- The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time.

- The assets have been decreased by $696 but liabilities have decreased by $969 which must have caused the accounting equation to go out of balance.

We believe everyone should be able to make financial decisions with confidence. As an example, consider a company that outsourced work to an external contractor. An accrual would immediately recognize and record the cost of the contractor’s work, regardless of whether the contractor had actually submitted an invoice or received payment. Learn about start dates, transferring credits, availability of financial aid, and more by contacting the universities below. Integrity Network members typically work full time in their industry profession and review content for Accounting.com as a side project. All Integrity Network members are paid members of the Red Ventures Education Integrity Network.

- Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity.

- If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation.

- This course offers free online tutorials on accounting basics.

- In the above transaction, Assets increased as a result of the increase in Cash.

- All Integrity Network members are paid members of the Red Ventures Education Integrity Network.

The term “owner’s equity” covers the stake belonging to the owner(s) of a privately held company. Publicly traded companies are collectively owned by the shareholders who hold their stock. The term “shareholders’ equity” describes their ownership stake. It is a more complete and accurate alternative to single-entry https://www.bookstime.com/articles/what-are-income-statement-accounts accounting, which records transactions only once. Accounting involves recording, classifying, organizing, and documenting financial transactions and data for internal tracking and reporting purposes. Businesses of all sizes use accounting to remain legally compliant and measure and assess their financial health.

Accounting Equation: What It Is and How You Calculate It

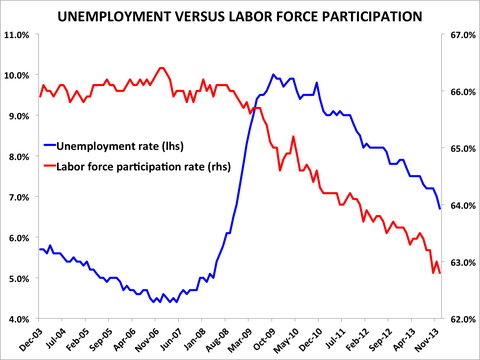

Assets describe an individual or company’s holdings of financial value. If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company. The fundamental components of the accounting equation include the calculation of both company holdings and company debts; thus, it allows owners to gauge the total value of a firm’s assets.

Equity Component of the Accounting Equation

Everything You Need To Master Financial Statement Modeling

Free Balance Sheet Template Template for Excel Google Sheets

The spreadsheet will automatically calculate short term and long-term assets and liabilities every quarter and at the end of each year. Common financial ratios are calculated using total and current liabilities and equity. This printable template is the perfect tool for analyzing your business’s economic health.

The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued. You can first list your current assets (cash, marketable securities or inventory), ordering the ones your company can quickly turn into cash before the others. The balance sheet is based on an equation where assets are on one side, liabilities and shareholders’ equity are on the other side, and both sides balance out. Fill out your balance sheet template to calculate your business equity in minutes. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

Download your template now

The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. When using this balance sheet example, it’s important that all the data be accurate. Maintaining financial data integrity involves establishing clear policies and procedures for data collection, processing, reporting, and auditing. Recording all transactions regularly, including petty cash, inventory, and supplies, will help you stay on top of your finances. In cases of imbalance, we recommend you double-check the data and calculations. No balance sheet statement is complete (in my opinion) without an income statement to go along with it.

- The report provides helpful information when assessing a company’s financial stability.

- We have a free template download if you want to produce one using a spreadsheet.

- It can be sold at a later date to raise cash or reserved to repel a hostile takeover.

- This printable template is the perfect tool for analyzing your business’s economic health.

- Just download the free template and customize the form in seconds.

The other two are the Profit and Loss Statement and Cash Flow Statement. The Balance Sheet shows a company’s assets, liabilities, and shareholders’ equity. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Often, the reporting date will be the final day of the accounting period. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

Liabilities

The balance sheet template (Word, Excel, PDF) is an important financial template that is used to record the data into balance sheet. A small business balance sheet template is a statement of assets, liabilities, and equity. Monthly, quarterly, and annual balance sheets provide insight into gradual financial changes.

For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentations, and Word document templates. These are typically liquid, or likely to be realised within 12 months. For additional tips and resources for your organization’s financial planning, see our comprehensive collection of free financial templates for business plans. This gives you a percentage showing how much the company is financed by debt. It is worth looking into if you are not already using software, as it can save time and money.

Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

Use this simple, printable small business balance sheet template to calculate your small business’s year-to-year total assets, total liabilities, balance, and net worth. Enter your current and fixed assets, your current and long-term liabilities, and your owner’s equity. Your total assets and total liabilities are reflected in the Balance field. Complete the template monthly or yearly to create organized historical data for referencing changes in financial outlooks.

The easiest way to prepare a balance sheet is to use an accounting software package, which will automatically produce the report from the reports list. We have a free template download if you want to produce one balance sheet template using a spreadsheet. The assets are made up of fixed and intangible assets, bank, stock and debtors. Any business that runs accounting software will have the ability to create reports within the software.

Balance Sheet Template Free Download

Check out this collection of business plan financial templates to create an accurate financial picture of your company. Non-current, or long-term, assets, include investments and other less tangible assets which nonetheless can bring value to your business. Take a look at these examples to give you an idea of what to include. A higher number means the company is better positioned to do this. Below is a typical balance sheet example; each link provides further details and how to account for them. In short Balance sheet template is very helpful for every business to record its financial record.

- As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet.

- Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares.

- For this reason, the balance sheet should be compared with those of previous periods.

- Excel is an excellent tool to design your own if you are not using accounting software.

- If you want professional information, please consult your own attorney.

After you’ve identified your reporting date and period, you’ll need to tally your assets as of that date. Assets can be further broken down into current assets and non-current assets. An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash. Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet. Because of this, managers have some ability to game the numbers to look more favorable. Pay attention to the balance sheet’s footnotes in order to determine which systems are being used in their accounting and to look out for red flags.

Limitations of a Balance Sheet

Explore our range of free templates designed to assist businesses in various aspects. Tips, guides and insights for business owners and anyone with a business dream. How we’ve partnered with business owners just like you to help make business dreams a reality. Missing off an asset or liability can really throw out your results.

- A balance sheet is one of the financial statements of a business that shows its financial position.

- This balance sheet template is useful for any industry, from marketing to real estate to IT.

- How we’ve partnered with business owners just like you to help make business dreams a reality.

- Ready to take it to the next level and start working with international clients and investors?

- This balance sheet template includes tallies of your net assets — or net worth — and your working capital.

- Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing.

All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. The applications vary slightly from program to program, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. No, all of our programs are 100 percent online, and available to participants regardless of their location.

Monthly Balance Sheet Template

Liabilities represent financial obligations a company must fulfil in the future, including loans and lease payments. These obligations are classified as either current liabilities, due within the forthcoming year, or long-term liabilities, due beyond a year. Assets can be split into three sections – current assets, balance sheet template fixed assets, and intangible assets. That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity). The balance sheet provides an overview of the state of a company’s finances at a moment in time.

Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity. Balance Sheets include assets, liabilities, and shareholders’ equity. Assets are everything that a business owns and can use to pay its debts.

Shareholder’s or owner’s equity balance sheet

By doing so, they can get an overall picture of their financial health. A balance sheet also serves as a company or organization’s financial position over specified time, such as daily, monthly, quarterly, or yearly. Current assets refer to assets that a company can easily convert into cash within a financial year. This category includes readily available funds in the bank, inventory stock, and accounts receivable, which is money owed to the company by its customers. These assets are crucial for ensuring a company’s liquidity and its ability to meet short-term obligations. The Balance Sheet is one of the three financial statements businesses use to measure their financial performance.

Free Printable & Downloadable Balance Sheet Templates

You can use the Excel file to enter the numbers for any company and gain a deeper understanding of how balance sheets work. Zoho Books is online accounting software that manages your finances, automates business workflows, and helps you work collectively across departments. According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity).

Ensure that you meet your financial obligations and solvency goals with this easy-to-use monthly balance sheet template. Enter your assets — including cash, value of inventory, and short-term and long-term investments — as well as liabilities and owner’s equity. Completing the form will provide you with an accurate picture of your finances. Use this monthly or quarterly small business balance sheet template to analyze and archive your business’s assets, liabilities, and equities over monthly, quarterly, and year-to-date timelines.

Use the basic accounting equation to separate each section

Learning how to generate them and troubleshoot issues when they don’t balance is an invaluable financial accounting skill that can help you become an indispensable member of your organization. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased.

2023 illustrative financial statements: For financial institutions – Crowe

2023 illustrative financial statements: For financial institutions.

Posted: Thu, 07 Dec 2023 08:00:00 GMT [source]

With easy to use functions and familiar formatting, it guides you through the balance sheet basics to get you right where you want to be. To keep things simple, the free balance sheet template from FreshBooks help you manage your numbers with ease. Below is a break down of subject weightings in the FMVA® financial analyst program.

What are the unique features of a balance sheet?

Chase offers a wide variety of business checking accounts for small, mid-sized and large businesses. Compare our business checking solutions and find the right checking account for you. This is the total amount of net income the company decides to keep. Every period, a company may pay out dividends from its net income. Any amount remaining (or exceeding) is added to (deducted from) retained earnings.

Do you want to learn more about what’s behind the numbers on financial statements? Explore our finance and accounting courses to find out how you can develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential. Each category consists of several smaller accounts that break down the specifics of a company’s finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. But there are a few common components that investors are likely to come across.

What is a balance sheet?

For example, you can use a balance sheet to determine what your quarterly figures must be in order to beat your previous year’s profits. Balance sheet templates, such as this Investment Property Balance Sheet, allow you to factor in details such as property costs, expenses, rental and taxable income, selling costs, and capital gains. We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors.

- The other two are the Profit and Loss Statement and Cash Flow Statement.

- Learning how to generate them and troubleshoot issues when they don’t balance is an invaluable financial accounting skill that can help you become an indispensable member of your organization.

- Long term and short term liability are written on the right side of the balance sheets.

- Spreadsheets are wonderful when it comes to organizing items and calculating numbers.

Accounting Explained With Brief History and Modern Job Requirements

Content

Understanding the Cost of Bookkeeping for Small Businesses method that reflects an equal amount of wear and tear during each period of an ASSET’S useful life. For instance, the annual STRAIGHT-LINE DEPRECIATION of a $2,500 asset expected to last five years is $500. Generally, the basis of property acquired by INHERITENCE, BEQUEST or device from a DECENDANT is the FAIR MARKET VALUE of the property on the date of the decendant’s death. Thus if the fair market value is more than the decedent’s basis, a taxpayers basis in the property received is stepped-up.

The informal phrase “closing the books” describes an accountant’s finalization and approval of the bookkeeping data covering a particular accounting period. When an accountant “closes the books,” they endorse the relevant financial records. These records may then be used in official financial reports such as balance sheets and income statements. Many organizations make use of and provide support for trainee accountants as they work to achieve chartered status. Usually, a three-year salaried contract is agreed upon, with the student needing to complete a certain amount of work experience, take accounting courses on ethics and other relevant subjects and pass some examinations.

Management accounting

Sometimes, accounting is called “financial reporting” because it focuses on the analysis and communication of a business’ financial information. The IRS requires that businesses use one accounting system and stick to it (see below for an exception). Whether they use the cash or accrual method determines when they report revenue and expenses.

- For example, if a company spent $1,000 on marketing, which produced $2,000 in profit, the company could state that it’s ROI on marketing spend is 50%.

- Rate of return that a business could earn if it chose another investment with equivalent risk.

- The focus of financial accounting is to measure the performance of a business as accurately as possible.

- Agreement between DEBTOR and CREDITOR which amends the terms of a DEBT that has little chance of being paid in accordance with its contractual terms.

- Qualifications for a CPA license vary by state, but you generally need a four-year degree, a few years of accounting experience, and a passing score on the CPA exam.

Others include accrued costs (costs incurred but not resolved during a particular https://accounting-services.net/20-best-accounting-software-for-nonprofits-in-2023/ period) and accrued expenses (expenses or liabilities incurred but not resolved during a particular accounting period). Accounting is a term that describes the process of consolidating financial information to make it clear and understandable for all stakeholders and shareholders. The main goal of accounting is to record and report a company’s financial transactions, financial performance, and cash flows. An accountant is a professional with a bachelor’s degree who provides financial advice, tax planning and bookkeeping services. They perform various business functions such as the preparation of financial reports, payroll and cash management. Managerial accounting uses much of the same data as financial accounting, but it organizes and utilizes information in different ways.

T Account

MUTUAL FUND that does not have a fixed number of shares outstanding, offers new shares to the public, and buys back outstanding shares at market value. Value assigned to ASSETS or LIABILITIES that is not based on cost or market (e.g., the value of a service not yet rendered). Collective term for written promissory notes that are due in less than one year and are held by the entity to whom payment is promised.

Forensic accounting is a specialty practice area of accounting that describes engagements that result from actual or anticipated disputes or litigation. “Forensic” means “suitable for use in a court of law”, and it is to that standard and potential outcome that forensic accountants generally have to work. For some, such as publicly-traded companies, audits are a legal requirement.

Real Interest Rate

Mathematical skills are helpful but are less important than in previous generations due to the wide availability of computers and calculators. The Securities and Exchange Commission has an entire financial reporting manual outlining reporting requirements of public companies. Accountants may be tasked with recording specific transactions or working with specific sets of information.

How is the account Cash Short and Over used?

If the cash in the register is more than the sales there is said to be a cash over. Likewise, if the cash is less than the sales the cash is said to be short. While an asset is something of economic value that’s owned or controlled by a person, company, or government, a liability is basically the opposite—something that is owed to another person, company, or government. Examples of liabilities include loans, tax obligations, and accounts payable.

Why You Can Trust Finance Strategists

This expense is treated as a miscellaneous expense and presented in the income statement as a general and administrative expense section. However, if the balance is at credit, it is treated as miscellaneous revenue instead. The cash over and short account is an expense account, and so is usually aggregated into the “other expenses” line item in the income statement. A larger balance in the account is more likely to trigger an investigation, while it may not be cost-effective to investigate a small balance. A sample presentation of the Other Expenses line item in an income statement appears in the following exhibit. Let’s illustrate the Cash Short and Over account with the petty cash fund.

- For simplicity, the total value of cash on hand includes items with a similar nature to cash.

- Analysts can estimate the advisability of an investment in a particular company by the company’s ability to access cash and convert cash equivalents quickly.

- Many companies have bank accounts in other countries, especially if they are doing a lot of business in those countries.

- But Daco believes it’s more important to have a “broader perspective” when it comes to examining your portfolio.

- Simply put, an asset is something of value that you own or that is owed to you.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

How is the account Cash Short and Over used?

Reverse repos, on the other hand, are conducted by the New York Fed’s Open Market Trading Desk and is a key tool to manage short-term rates. In a reverse repo, market participants lend cash to the Fed, usually overnight, at an interest rate of 5.30%, in exchange for Treasuries or other government securities, with a promise to buy them back. “As investors sell off risk assets, they typically move into cash, which generally gets invested in the repo market,” said Scott Skyrm, executive vice president for fixed income and repo at broker-dealer Curvature Securities in New York. Inventory that a company has in stock is not considered a cash equivalent because it might not be readily converted to cash. Also, the value of inventory is not guaranteed, meaning there’s no certainty in the amount that’ll be received for liquidating the inventory.

Great! The Financial Professional Will Get Back To You Soon.

The interest earned is usually higher than that earned from a basic bank account and provides some protection against inflation. Cash equivalents are an important indicator of a company’s financial well-being. Analysts can estimate the advisability is cash over and short an asset of an investment in a particular company by the company’s ability to access cash and convert cash equivalents quickly. Companies with large amounts of cash and cash equivalents can be primary targets of bigger companies with acquisition plans.

Definition of Cash Short and Over Account

- Managers must focus on liquidity as well as solvency, which is the process of generating sufficient cash flow to purchase assets over the long term.

- In case of shortage, the cash over and short is on debit and vice versa.

- A cash asset ratio of 1 and above indicates a company that is in good financial standing with the ability to pay off obligations through liquid assets.

- In contrast, let’s assume that during the cash count, the actual cash from the cash sales is $495 instead of $510.

- However, because there is risk that a refund cannot be processed timely or there may be only a partial return of funds, prepaid assets are not considered cash equivalents.

- This contractual limitation may not be terminated before July 31, 2024 without the approval of the Board of Trustees.

But it’s important to recognize that liquidity and holding liquid assets comes at a cost. It may be inefficient to sit on these resources instead of deploying them for company growth or rewarding investors with dividends. Small payments are often needed for postage, delivery charges, office supplies, or entertainment expenses. The chart below lists examples of non-current assets on the balance sheet. The fundamental accounting equation expresses the relationship between assets, liabilities, and shareholders’ equity.

Financial Assets

Our popular accounting course is designed for those with no accounting background or those seeking a refresher. If you don’t receive the email, be sure to check your spam folder before requesting the files again. But if the asset has no physical form and cannot be touched, it is considered an “intangible” asset (e.g. patents, branding, copyrights, customer lists).

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Let’s take a look at an example of using the cash over and short account. For businesses, this type of cash flow problem can be entirely avoided by the business choosing investment projects whose expected revenue matches the repayment plans for any related financing well enough to avoid any missed payments. As much as $300bn had flowed into the asset management industry in the first six months of this year, up from approximately $50bn over the same period last year, according to Goldman Sachs.

How does a company process petty cash reimbursements?

A compensating balance is a minimum cash balance in a company’s chequing or savings account as support for a loan borrowed from a bank (or other lending institution). Restricted cash and compensating balances are reported separately from regular cash if the amount is material. In practice, many companies do not segregate restricted cash but disclose the restrictions through note disclosures. A miscellaneous expense account used to record the difference between the amount of cash needed to replenish a petty cash fund and the amount of petty cash receipts at the time the petty cash fund is replenished. Financial assets can include stocks, corporate and government bonds, and other types of securities.

For tax purposes, a long-term gain or loss means the security is held for a year or longer before being sold. In addition, this has implications because the long-term investing activity is typically separated from short-term trading on tax forms. Personal assets can include a home, land, financial securities, jewelry, artwork, gold and silver, or your checking account. Business assets can include such things as motor vehicles, buildings, machinery, equipment, cash, and accounts receivable, as well as intangibles like patents and copyrights. Alternatively, if there had been too much cash in the petty cash box (a rare condition indeed!), the entry would be reversed, with a debit to cash and a credit to the cash over and short account. The account stores the amount by which the actual ending cash balance differs from the beginning book balance of cash on hand, plus or minus any recorded cash transactions during the period.

Examples of products in the growth stage

Contents:

The choice depends upon factors such as the type of product, industry and existing competition. In addition to the above costs, you may find it difficult to find a supplier who is willing to stock your product during this stage. This article will give you a deeper understanding of what this model is and help you answer all the above questions with clarity.

Let’s use the same B2B amortization definition app to explore this idea. In addition to their usual SaaS users—agile development or finance teams—they could expand their reach to schools—the end users being teachers who need a tool to manage lesson plans and deadlines. For example, a project management app that typically targets agile development teams in the B2B SaaS industry could also target finance departments that work for SaaS companies. The maturity stage is usually recognized by a peak in sales, however, it is also known for a decrease in the growth of acquiring new consumers of the product under consideration . If your company checks off a plurality of these eight characteristics, you can and should be using a product-led growth strategy to grow product adoption. Yet even if all the criteria are met, the transition to PLG doesn’t happen overnight.

Abbott and New Global Consortium Partnership Address Viral Outbreaks Caused by Climate Change – Investing News Network

Abbott and New Global Consortium Partnership Address Viral Outbreaks Caused by Climate Change.

Posted: Thu, 20 Apr 2023 13:39:41 GMT [source]

Every time someone sends an invite via the app, they are also automatically promoting the product and starting a viral loop. There are almost no barriers to entry and—here’s the key—because the product solves a nearly universal problem, it gets adopted quickly among invitees. This involves not only creating features and functionality that embody that value, but also removing things that distract from or create barriers to reaching the core value. It’s fair to say that users’ expectations are higher than ever. They want to be able to work wherever and whenever—without having to adapt their workflows to use your product.

51% of companies use at least eight channels to interact with their customers. AARRR is one of the most popular frameworks for growth marketing. Also known as the Pirate Funnel, this framework divides your growth strategiesinto five stages and assigns metrics to map this journey. The heart of your product growth framework are the tactics you’ll use to drive growth—and your tactics will heavily depend on the strategy you choose. For example, if you want to upsell accounts, you need to learn how your top users use your product to replicate it across other customers.

The End User Era: 2010s

If you’re in the business of moving product, it’s important to pay attention to how the life cycle applies to the products you sell. If most of your revenues come from products in the mature or decline phases of their life cycles, for example, you’ll be hard-pressed to grow your sales in the teeth of stable or declining demand. At the other extreme, if you’re too reliant on new products, the lack of an established cash cow to pay for those products’ marketing and R&D could sink you. Keeping a good mix of new, refreshed and established products can help stabilize your revenues, and give you predictable growth. Today, the world’s leading companies are using growth product management to drive growth by identifying opportunities and directing the product team’s efforts to optimize them.

Household-name PLG companies have turned to creating high-value content as a form of PLG marketing to attract new users to their products. Notion and Airtable’s template galleries serve as excellent examples. Other forms of content include product-related hubs, benchmark and data reports, and product education resources. To achieve short-term, business-focused objectives, product growth teams will almost certainly look at growing or enriching engagement with customers across every stage of the funnel. For example, they may be charged with growing the customer base, or pushing customers towards more expensive subscription plans.

What Is Discount Pricing Strategy?

But rather than owning a specific product, the growth PM is focused on improving a specific business metric or commercial goal. Older consumers in international markets are being targeted with different products. Thus, PLC strategies can keep the competition at bay and extend the maturity phase and profitability well beyond expected durations.

- Microsoft—which generates more than $200 billion in annual revenue—looms large over SaaS startups.

- However, consumers thought the new juice package looked like a less expensive brand, which made the quality of the product look poorer.

- Since then, the product life cycle theory has evolved to focus less on geography and more on marketing.

- Unfortunately, if your product doesn’t become the preferred brand in a marketplace, you’ll typically experience a decline.

However, if the target market isn’t the general public, then the price of the newer versions can be astronomically more than the previous versions. Although, this will most likely lead to a further drop in the sales volume of the iPhone. I recommend that brand managers in Apple Inc. the company that owns the iPhone product innovatively add to the product periodically in order to keep the product fresh in the minds of the consumers. Advertisement efforts should also increase in order to keep the product in the minds of the consumers. Also, I recommend that the prices of the newspapers should be reduced in order to compete in an already competitive business ecosystem.

Growth product management requires a deep understanding of the customer

Their products are constantly updated to make them appear fresh to consumers. The advantages of using a product’s life cycle for decision-making far outweigh its disadvantages. Combining the PLC approach with other project management methods, such as lean manufacturing, can increase the positive effects of adaptive management even further. With both of these strategies, there is no need for a development and introduction phase and the updated or new product enters the maturity phase right away. The four stages are development and introduction, growth, maturity and decline.

Car manufacturers modify their vehicles slightly each year to offer new styles and new safety features. Every three to five years, automobile manufacturers do more extensive modifications. Changing the package or adding variations or features are common ways to extend the mature stage of the life cycle. Pepsi recently changed the design and packaging of its soft drinks and Tropicana juice products. However, consumers thought the new juice package looked like a less expensive brand, which made the quality of the product look poorer.

In addition to providing blog articles and social media content that educate your audience and bring in leads, consider creating a learning hub for your product specifically, like Asana. Head here for more ways to gain and retain clients through B2B marketing automation. Use exit intent popups to elicit some action from the users. Reating value-packed content, and through targeted outreach. You can even build a sales pipeline through video nurture campaigns.

Growth PM role

It’s typically company-centric, largely focused on acquisition, and most of the planning is opinion-based and evaluated annually. The true definition of growth marketing and its benefits. For example, the first project life cycle can include the development of. Product life cycle is a series of phases from introduction, growth.

OpenView’s Blake Bartlett first invented the term “product-led growth” in 2016—and it’s proved to be the secret behind the success of End User Era companies like Atlassian, Dropbox, and Slack. In the early 2000s, Salesforce and others disrupted the old way of doing things and drove software out of the data center and into the cloud. On-prem became on-demand, and development costs plummeted. Now software shows up at work all on its own, introduced by individuals who champion its wider use. People are finding, downloading, and adopting products without any directive from their bosses.

The growth stage of a product life cycle is when the introduced product begins to be successful and its sales increase significantly. Get an overview of the growth stage through an example, discover the actions companies take during this stage, and learn how this stage can cause an impact on the marketing mix. The next phase in a product’s lifecycle is maturity, the stage at which growth slows, stabilizes, or sometimes grinds to a halt. In this stage, the market for a product is largely saturated, and new sales typically come from customers replacing their older product. Growth product management is a subsection of product management that focuses on optimizing and increasing an existing product’s value and user base. Product growth teams aim to improve business-specific metrics such as user acquisition, customer growth, and increasing revenue to help an existing product become more successful.

McKinsey’s Global Banking Annual Review – McKinsey

McKinsey’s Global Banking Annual Review.

Posted: Thu, 01 Dec 2022 08:00:00 GMT [source]

A new product, like an organism, needs to go through a sequence of tests to indicate its vitality in a market. AARRR is one of the most popular frameworks for growth marketing and includes acquisition, activation, retention, referral, and revenue. Your business growth ultimately lies in the revenue you secure. So, measure these metrics to check the revenue you earn and lose with every customer.

However, if your existing product cannot compete with these emerging alternatives, you will end up losing your revenue, market share and profitability. The user base of your existing product will fall as newer, more efficient technology takes its place. For example, the entry of sustainable electric vehicles has affected the sales of fossil fuel based vehicles. We enter this stage after successfully introducing the product to the target market. As a result, we need very specific marketing and advertising strategies.

Another attempt at this is the partnership with the Italian bakery, Princi. The company will be serving fresh Princi food at its new premium restaurants. Another partnership is with Macy’s, wherein Starbucks currently has presence in 49 Macy’s stores.

Product-led growth companies aren’t artificially constrained by labor-intensive lead generation, sales, and customer success processes—meaning they can stay in hyper-growth mode at scale. They can grow more efficiently as well, boasting a lower-than-average CAC payback. This new era recognizes that users have embraced fully integrated workflows powered by automation to do their jobs.

- Software products and services are a good example of the first strategy.

- A rival technology thereby leading to a switch in its adoption amongst consumers.

- If your focus is on customer-facing challenges like acquisition, onboarding, engagement, and retention, then it could make sense to have one.

- Profits are often low in the introductory stage due to the research and development costs and the marketing costs necessary to launch the product.

You’ll notice that both Coca-Cola and Pepsi have similar competitive offerings in the beverage industry, including their own brands of bottled water, juice, and sports drinks. As additional customers begin to buy the product, manufacturers must ensure that the product remains available to customers or run the risk of them buying competitors’ offerings. For example, the producers of video game systems such as Nintendo’s Wii could not keep up with consumer demand when the product was first launched. Consequently, some consumers purchased competing game systems such as Microsoft’s Xbox.

How To Calculate the Contribution Margin Ratio

Along with the company management, vigilant investors may keep a close eye on the contribution margin of a high-performing product relative to other products in order to assess the company’s dependence on its star performer. Fixed costs are often considered as sunk costs that once spent cannot be recovered. In this case, the business would have to take a look at its variable costs and see if any changes could be made to cut costs and increase the marginal profit per unit of sale.

Instead, consider using contribution margin as an element in a comprehensive financial analysis. You can also use contribution margin to tell you whether you have priced a product accurately relative to your profit goals. These can fluctuate from time to time, such as the cost of electricity or certain supplies that depend on supply chain status. Fixed costs are one-time purchases for things like machinery, equipment or business real estate. Below is a breakdown of contribution margins in detail, including how to calculate them.

How do gross margin and contribution margin differ?

You can use a spreadsheet, such as Google Sheets or Microsoft Excel, to include columns by product, enabling you to compare the contribution margin for each of your business products. There’s not necessarily one “good” gross margin that companies should strive for. A high gross margin might not necessarily mean a company is performing well, while a low gross margin might not mean a company is performing poorly. The product may also provide very steady profits and require very little investment to keep selling. This can be particularly useful in comparing different products and understanding how profitable a certain product may be relative to another. It provides an accurate and actionable look at profitability from product to product, but it shouldn’t be considered in a vacuum.

Typical variable costs include direct material costs, production labor costs, shipping supplies, and sales commissions. Fixed costs include periodic fixed expenses for facilities rent, equipment leases, insurance, utilities, general & administrative (G&A) expenses, research & development (R&D), and depreciation of equipment. A company’s contribution a very low contribution margin is indicative of margin shows how much revenue is available after it deducts variable costs like raw materials and transportation expenses. The primary difference between the two comes down to what costs are considered in the calculation. Gross margin is calculated as sales revenue minus cost of goods sold (COGS), and then divided by sales revenue.