Shares Outstanding: Types, How to Find, and Float

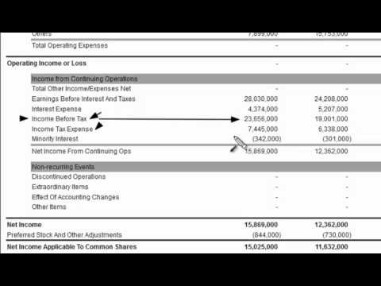

The Motley Fool reaches millions of people every month through our https://www.bookstime.com/ premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. Obviously, those option holders in theory could exercise their options to create new shares. Should they do so, however, they would also contribute $50 million in cash to the corporate treasury. Authorized shares, meanwhile, are the maximum number of shares a company can issue, based on its corporate charter. Generally speaking, stocks with smaller floats will experience more volatility than those with larger floats. Evaluating the trend of this number provides useful insights to investors.

- This figure is important because it translates a company’s overall performance into per-share metrics, making an analysis much easier regarding a stock’s market price at a given time.

- Although this decreases liquidity due to fewer shares, it can deter short sellers by making it harder to borrow shares for short selling.

- However, these stock benefits are not included in the tally of shares outstanding until shares are fully issued.

- For many companies, however, even those executing buybacks, the number of outstanding shares and the number of issued shares is the same.

Company

If a company considers its stock to be undervalued, it has the option to institute a repurchase program. The issue of preference shares or dividends announced to preference shareholders have no effect on this number. Basic shares outstanding can be sourced from multiple places in a company’s financial statements. Below lists two commons sources starting with the preferred source if available. Issued shares is the total number of shares a company can issue in the market. Outstanding shares are often confused with float and market capitalisation.

Which of these is most important for your financial advisor to have?

If you want to understand how to make money trading stocks, it’s critical to understand the different kinds of shares that companies make available. Calculating the number of outstanding shares a company has can help you to understand what proportion of a company’s stock is held by its shareholders. This, in turn, tells you which investors hold the largest numbers of shares, and therefore have the most influence at shareholder meetings. This number is also used to calculate several key financial metrics, so it’s important to understand how to calculate outstanding shares.

- A company could issue new shares, buy back shares, retire existing shares, or even convert employee options into shares.

- Changes in the number of outstanding shares can affect the stock price by altering supply and demand dynamics.

- Understanding a company’s financials is crucial to successful investing.

- Investors use this information to gauge the company’s financial health and potential for growth.

- There are a number of different types of stocks that companies issue.

- It also lets you know what portion of ownership your shares represent.

- Other companies may explicitly list their outstanding shares as a line item in the equity section of their balance sheet.

How to calculate outstanding shares

Several factors can cause a company’s number of outstanding shares to rise or fall, with one of the most common being stock splits. A company may announce a stock split to increase the https://www.instagram.com/bookstime_inc affordability of its shares and grow the number of investors. For instance, a 2-for-1 stock split reduces the price of the stock by 50%, but also increases the number of shares outstanding by 2x. Weighted average shares outstanding is used as a substitute for the number of outstanding shares in some equations while calculating important financial ratios. Weighted average shares must be used when you want to find out how many common stock were in effect during a specific time frame. Common examples would be calculating the company’s earnings per share or per-day outstanding share.

- Understanding how to calculate outstanding shares for a public company would appear to be a simple matter.

- It’s worth noting that a company’s basic number of shares outstanding can differ from its fully diluted number of shares.

- Convertible debt is treated on an “as-converted” basis if the company’s stock is trading above the conversion price.

- These may later appear in the form of a secondary offering, through converting convertible securities, or issued as part of employee compensation such as stock options.

How are weighted average shares outstanding different than basic shares outstanding?

- Many of the financial ratios used in the fundamental analysis include terms like outstanding shares and the float.

- To calculate the weighted average of outstanding shares, multiply the number of outstanding shares per period by the proportion of the total time covered by each period.

- A company’s stock float does not include closely-held shares that are held by company insiders or controlling investors.

- The earnings per share calculation for the year would then be calculated as earnings divided by the weighted average number of shares ($200,000/150,000), which is equal to $1.33 per share.

- The seven billion floating shares are the shares considered for the free float, market capitalization index weightings.

Changes in outstanding shares can influence a company’s stock price, impacting investor sentiments. Outstanding shares play a pivotal role in determining a company’s market capitalization, earnings per share (EPS), and shareholder influence. Investors use this how to calculate shares outstanding information to gauge the company’s financial health and potential for growth.

The Best Accounting Software for Medium Sized Businesses

For companies with fixed assets, depreciation tracking is easy and straightforward. They are excellent solutions for small businesses, featuring user-friendly dashboards and all the key features you’d expect from accounting software. But as your business grows, the transactions add up and your needs become more complex, it could be time to move on. Xero includes extensive features that make it suitable to handle complex accounting processes for small- and medium-sized businesses as well as larger ones. The software makes it easy to pay bills, claim expenses, accept payments, track projects, manage contracts, store files and more. FreshBooks offers accounting software programs for small to medium-sized businesses.

Find a plan that’s right for you

Oracle NetSuite even automates the billing workflow process with recurring, time-based, and project-based functionality. Billing features include automatically sending an invoice once the order fulfillment process is complete and reducing errors in the overall sales to fulfillment workflow. Oracle NetSuite also offers custom billing types, including individual transactions, subscriptions, usage-based methods, and hybrids of all three. And, both headquarters- and subsidiary-level custom billing options exist, automatically consolidating subsidiary billing into a single invoice to be paid centrally. The software offers many more features for business owners who want to plan ahead.

- This information flows directly to each dashboard, report, and analytical tool seamlessly.

- Each solution for best accounting software for midsize companies has unique features, ease of use with a good user interface, and industry applications that could best meet your business needs.

- Take the time to carefully evaluate your options, invest in the best solutions for your needs, and continuously iterate and improve your processes.

- This tax software provides easy access to customer direct deposits and fast cash deposits.

- Batch processing for several functions (checks, deposits, invoices, bills, credit memos, etc.) is also available.

Sage Intacct

The built-in Bill Tracker for accounts payable ensures that you always know what’s paid, unpaid, and unbilled (e.g., purchase orders). Access Financials integrates with other native solutions within medium business accounting the Access product suite, including expense management software and project accounting software. If you’re still relying on on-premise accounting software you’re missing out on several big benefits.

Best accounting software for UK medium sized businesses 2023

Think real-time reporting, time and expense management, project accounting, and revenue management among other options. With the intuitive mobile app, you can send invoices, track expenses, and communicate with customers all from the convenience of your phone or tablet. Time management tools allow you to track the time spent so that invoicing becomes simple and easy. When tax time arrives, you’ll have all of the information you need to get through the season.

When this happens, it pays to have accounting software that grows with your business. Zoho Books can accommodate your growth and meet increasing demand effortlessly, helping you deliver optimum results every time. When it comes to accounting for your mid-market business, there are many hurdles you must cross. It can be difficult to find scalable software that supports automation and can help with bank reconciliation, budgeting, tax compliance, and reporting.

The companies that make small business accounting software have worked hard to make it as simple and pleasant as possible. Wave, TrulySmall Accounting, and FreshBooks are among the easiest accounting programs to use. With this software, you gain access to instant analytics and reporting, including automatically generated P&L, Balance Sheets, cash flow reports, and best sellers across all your online channels. These reports are tailored to meet your specific needs, simplifying your financial analysis. You can set up a separate department to monitor and control accounts receivables, while your accountants can focus on those accounts that require closer attention.

The best accounting software for medium sized businesses in 2023

- With a keen focus on price, Xero is an accounting software provider that will appeal to mid-sized business owners who don’t wish to spend hundreds per month.

- While basic accounting software like QuickBooks Online, Xero, and FreshBooks are powerful accounting systems for startups and small businesses, many companies eventually outgrow them.

- Both the Growing and Established plans offer unlimited invoices and bills.

- Set up regular check-ins to discuss system performance, address any issues, and explore opportunities for optimization.

- Finance automation with Tipalti software is a best-in-class solution for your midsize company that will scale with you as your business expands with revenue growth in global locations.

Xero at a Glance

- If you’re traveling and have expenses on the road, you can usually take pictures of receipts with your smartphone and upload them to your accounting app.

- Use secure file sharing, real-time document collaboration, and in-app communication tools to streamline workflows and ensure everyone has access to the most up-to-date financial information.

- Wave makes its money to support its free offering on its payment gateway.

- Employee productivity and the marketing process are improved because of the ERP platform and all the available automations, so the extra cost for a full ERP may be justifiable.

- As the owner of a firm whose business is all about clients’ sensitive data, Jaques Nack needed a more efficient software that could provide secure details on JNN’s books at all times.

- In addition to accounting software, Zoho offers more than 40 enterprise-level online applications to grow sales, market your business, communicate with teammates, provide customer service and more.

Are Dividends An Expense

Each quarter, companies retain or accumulate their profits in retained earnings, which is essentially a savings account. Retained earnings is located on the balance sheet in the shareholders’ equity section. The cash within retained earnings can be used for investing in the company, repurchase shares of stock, or pay dividends. In financial modeling, it’s important to have a solid understanding of how a dividend payment impacts a company’s balance sheet, income statement, and cash flow statement. In CFI’s financial modeling course, you’ll learn how to link the statements together so that any dividends paid flow through all the appropriate accounts. Companies distribute stock dividends to their shareholders in a certain proportion to their common shares outstanding.

- While cash dividends are not an expense, they still have a negative impact on a company’s cash and tend to reduce it.

- This means your dividend payment will be slightly higher than it would have been otherwise.

- Companies may still make dividend payments even when they don’t make suitable profits to maintain their established track record of distributions.

- A stock dividend functions essentially like an automatic dividend reinvestment program (more on that below).

- The dividends, however, influence the cash flow statement of the business.

As a thank you for all their hard work and belief in the company, Allison decides to pay a third of that back to her employees and investors in the form of dividends. Usually, there are two main categories of expenses, and they are operating and non-operating expenses. Operating expenses are the costs that are related to the core business activities, while non-operating expenses are the expenses that are not related to the core business operations. Investors in high tax brackets often prefer dividend-paying stocks if their jurisdiction allows zero or comparatively lower tax on dividends. For example, Greece and Slovakia have a lower tax on dividend income for shareholders, while dividend gains are tax exempt in Hong Kong. However, a reduction in dividend amounts or a decision against a dividend payment may not necessarily translate into bad news for a company.

Where do dividends appear in the financial statements?

It’s a positive sign for you and the people who invested time or money into your business that the company is on a lucrative path (and a great way to thank the people who have helped get you there). We are a team of finance experts with experience of about seven years of investing in equity markets. Through this website, we are trying to share the knowledge and experience we gained. Dividends are taxed based on whether they’re qualified dividends or ordinary dividends. With a dividend yield of 3.8%, ExxonMobil has managed to persistently increase the dividend annually each year for the last 35 years. The maximum pensionable earnings for CPP will increase from $66,600 to $68,500, which will result in a $113 CPP tax increase for both employers and employees in the 2024 tax year.

- For publicly traded companies the amount of stock issued is based upon the current market price.

- The concept of dividends often brings up questions for both novice and experienced individuals in the world of finance.

- Assume that a different profitable corporation pays $100,000 in interest to its lenders.

Since shares of XYZ are valued at $75 per share, though, the dividend yield is only 1%. The dividends payable will be based upon owners of the shares as of a specific date. Once the dividend distribution has been made, quality synonyms the dividend payable is removed. This is essential for shareholders to receive a return on their invested capital. If the company never paid dividends the owners of the corporation would never share in the profits.

Accounting Treatment of Stock Dividends

For a brief period of time, until the dividends are paid, they are considered a current liability and show up on the company’s balance sheet. Dividends paid to preferred stockholders are shown on the income statement. This is because the income statement calculates the earnings of the business for common stockholders.

How Do Dividends Impact Stock Prices?

Dividends have to paid proportionally, which means if there are two partners that one 50%, they have have to receive the same dividend amount during the year. The largest problem with property dividends is determining the value of the property to be distributed. A Montreal man has been charged with inciting hatred toward an identifiable group after allegedly making anti-Jewish statements on social media. Several major cities have approved or proposed major property tax hikes this year as municipalities struggle with inflation, high interest rates, crumbling infrastructure and soaring demand for services. The new reporting requirements require trustees of bare trusts to file annual T3 trust returns for tax years ending after December 30, 2023. In 2023, many Canadians moved away from more expensive city centres like Vancouver and Toronto to reduce their cost of living.

This crucial difference demonstrates why dividends do not qualify as expenses. They are also accounted for on the company’s cash flow statement, under the financing segment. Until the payment has been made, they will be considered a current liability of the company towards its shareholders.

AccountingTools

Instead, dividends impact the shareholders’ equity section of the balance sheet. Dividends, whether cash or stock, represent a reward to investors for their investment in the company. The two types of dividends, cash, and stock dividends have a different impact on the overall shareholder equity. Moreover, operational expenses are defined as expenses that the business bears on a day-to-day business. Similarly, the cost of goods sold is the cost of building the finished goods.

However, it does lower the Equity Value of the business by the value of the dividend that’s paid out. Thanks to free and low-cost e-filing software, filing your taxes has never been easier. However, the downside is that many taxpayers fail to take full advantage of tax credits.

Definition of Dividends

The corresponding effect would be a credit to the cash account by the $340,000 in the balance sheet, thereby reducing the business’s ending cash balance. For taxation purposes, the business regards dividends as redistributing the residual earnings from business operations. Therefore, the business is giving dividends from retained earnings and technology. Such profits cannot be regarded as an expense as they are with the business itself. However, if the business is given the authority to regard the dividends as expenses, it would start writing them off and report near-zero values as profits.

What Constitutes a Business Expense?

A well-laid out financial model will typically have an assumptions section where any return of capital decisions are contained. A dividend is a share of profits and retained earnings that a company pays out to its shareholders and owners. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend. The annual dividend per share divided by the share price is the dividend yield.

Debits and Credits: A beginner’s guide

With the single-entry method, the income statement is usually only updated once a year. As a result, you can see net income for a moment in time, but you only receive an annual, static financial picture for your business. With the double-entry method, the books are updated every time a transaction is entered, so the balance sheet is always up to date. The main differences between debit and credit accounting are their purpose and placement. Debits increase asset and expense accounts while decreasing liability, revenue, and equity accounts.

For every debit (dollar amount) recorded, there must be an equal amount entered as a credit, balancing that transaction. Most businesses, including small businesses and sole proprietorships, use the double-entry accounting method. This is because it allows for a more dynamic financial picture, recording every business transaction in at least two accounts. The debit balance, in a margin account, is the amount of money owed by the customer to the broker (or another lender) for funds advanced to purchase securities.

When the card is used in a transaction, the money comes out of the linked account either immediately or after a brief interval. If you don’t have enough money in the account to cover the transaction, your card may be rejected. When a business incurs a net profit, retained earnings, an equity account, is credited (increased). When you increase assets, the change in the account is a debit, because something must be due for that increase (the price of the asset). There are a few theories on the origin of the abbreviations used for debit (DR) and credit (CR) in accounting. To explain these theories, here is a brief introduction to the use of debits and credits, and how the technique of double-entry accounting came to be.

Alert: highest cash back card we’ve seen now has 0% intro APR until 2025

A debit reduces the amounts in liability and owner’s (stockholders’) equity accounts. Debit and credit cards are widely used throughout the world, and although they look similar, there are major differences between them. For example, a debit card takes funds directly from your bank account, while a credit card is linked to a credit line that you can pay back later. In this article, we look at how each type of card works and whether it’s better to use one or the other. To know whether you should debit or credit an account, keep the accounting equation in mind. Assets and expenses generally increase with debits and decrease with credits, while liabilities, equity, and revenue do the opposite.

- The Equity section of the balance sheet typically shows the value of any outstanding shares that have been issued by the company as well as its earnings.

- But there is still a threshold that some traders adhere to when it comes to each.

- Kashoo offers a surprisingly sophisticated journal entry feature, which allows you to post any necessary journal entries.

- The convenience and protection that they offer are hard to beat, but they have important differences that could substantially affect your pocketbook.

- When an item is purchased on credit, the company now owes their supplier.

First, your cash account would go up by $1,000, because you now have $1,000 more from mom. Let’s do one more example, this time involving an equity account. In addition to adding $1,000 to your cash bucket, accrual accounting we would also have to increase your “bank loan” bucket by $1,000. An accountant would say we are “debiting” the cash bucket by $300, and would enter the following line into your accounting system.

Rules for Debit and Credit

All accounts that normally contain a debit balance will increase in amount when a debit (left column) is added to them and reduced when a credit (right column) is added to them. The types of accounts to which this rule applies are expenses, assets, and dividends. As you process more accounting transactions, you’ll become more familiar with this process. Take a look at this comprehensive chart of accounts that explains how other transactions affect debits and credits. A company’s general ledger is a record of every transaction posted to the accounting records throughout its lifetime, including all journal entries.

Accounting Journal Entries

This is particularly important for bookkeepers and accountants using double-entry accounting. We post such transactions on the left-hand side of the account. In accounting terminology, the individual who receives the benefit is debited as he is placed under an obligation. On the contrary, the one who provides or gives a benefit is credited because he is entitled to a return of the obligation. He discovered the concept of a double-entry system of book-keeping.

Using credit

Let’s go into more detail about how debits and credits work. If you don’t have enough cash to operate your business, you can use credit cards to fund operations or borrow from a line of credit. You’ll pay interest charges for both forms of credit, and borrowing money impacts your business credit history. This discussion defines debits and credits and how using these tools keeps the balance sheet formula in balance.

General ledger accounting is a necessity for your business, no matter its size. If you want help tracking assets and liabilities properly, the best solution is to use accounting software. Here are a few choices that are particularly well suited for smaller businesses. Make a debit entry (increase) to cash, while crediting the loan as notes or loans payable. You will also need to record the interest expense for the year.

Assets are resources owned by the company that are expected to provide future benefits. They can include cash, accounts receivable, inventory, buildings, and equipment. When you increase an asset account, you debit it, and when you decrease an asset account, you credit it. In double-entry accounting, CR is a notation for “credit” and DR is a notation for debit. Accounts payable is a type of liability account, showing money which has not yet been paid to creditors. An invoice which has not been paid will increase accounts payable as a debit.

Debits and credits are utilized in the trial balance and adjusted trial balance to ensure that all entries balance. The total dollar amount of all debits must equal the total dollar amount of all credits. Understanding debits and credits is a critical part of every reliable accounting system. However, when learning how to post business transactions, it can be confusing to tell the difference between debit vs. credit accounting. Debit entries are posted on the left side of each journal entry.

Navigate your financial life

This means that if you have a debit in one category, the credit does not have to be in the same exact one. As long as the credit is either under liabilities or equity, the equation should still be balanced. If the equation does not add up, you know there is an error somewhere in the books. The dual entries of double-entry accounting are what allow a company’s books to be balanced, demonstrating net income, assets, and liabilities.

What Is Bookkeeping? Duties, Pay, and How to Become a Bookkeeper

Following established processes and procedures with unwavering discipline ensures accuracy and reliability in financial records. A disciplined approach to Bookkeeping instils confidence in clients and colleagues, showcasing the Bookkeeper’s commitment to maintaining high standards. Bookkeeping requires attention to detail, which, in turn, requires an immense amount of time. Meeting deadlines for financial reporting, tax submissions, and other obligations requires effective time management. Thus, a skilled Bookkeeper prioritises tasks, allocates time efficiently, and ensures that all responsibilities are met on time. As a result, they contribute to the overall success of financial operations.

Communication skills

In this course, you will be introduced to the role of a bookkeeper and learn what bookkeeping professionals do every day. You will dive into the accounting concepts and terms that will provide the foundation for the next three courses. You will learn how to work your way through the accounting cycle and be able to read and produce key financial statements. Bookkeeping is the process of keeping track of a business’s financial transactions. These services include recording what money comes into and flows out of a business, such as payments from customers and payments made to vendors. While bookkeepers used to keep track of this information in physical books, much of the process is now done on digital software.

A Guide to Bookkeeping: Skills, Salaries, and Careers

- Bookkeepers handle a lot of confidential information, so you need to have a high sense of integrity and transparency.

- If your company is larger and more complex, you need to set up a double-entry bookkeeping system.

- If you use cash accounting, you record your transaction when cash changes hands.

- And with no requirements for special certification and education, there are almost no downsides to seeing if it’s a good fit.

- As a bookkeeper, you may also receive client payments and deposit them at your company’s financial institution.

Mentioning traits like basic bookkeeping knowledge, strong mathematical and communication skills, including knowledge of accounting principles can help in strengthening your resume. Having the ability to prepare an accurate financial picture of an enterprise and keep records organized is essential for being a bookkeeper. As a bookkeeper, you will need to learn how to create balance sheets, invoices, cash flow statements, income statements, accounts receivable reports, and more. Although software and calculators do most of the math, basic skills such as addition, subtraction, multiplication, and division are essential to helping you catch errors quickly. Bookkeeping is the process of recording all your business’s financial transactions systematically.

- If yes, then possessing a comprehensive set of Bookkeeping Skills can become a to your success.

- Integrity and trustworthiness are important qualities to cultivate as a bookkeeper.

- A lot goes into it—from managing payables and receivables to balancing books.

- Our bookkeeping videos will help you deepen your understanding of debits and credits, general ledger accounts, double-entry bookkeeping, adjusting entries, bank reconciliation, and more.

- Are you someone new to the field of Financial Management or someone looking to upskill themselves?

What Do You Need to Set Up Bookkeeping for Your Business?

Though having a two-year or four-year degree isn’t always required to be hired as a bookkeeper, some companies may prefer candidates who do. According to the US Bureau of Labor Statistics (BLS), the median salary for bookkeepers in the US is $45,860 per year as of 2021 [1]. You can sometimes choose between full-time and part-time positions, and you may go to work https://www.growablegowns.com/how-to-dress-professionally-when-you-are-plus-size/ in an office or work from home. Identifying and solving financial problems is another skill you need to possess as a bookkeeper. You need to be able to spot irregularities and discrepancies as soon as they materialize to avoid compromising your clients’ financial well-being. In addition, you must be able to handle any issues with a calm and productive approach.

Bookkeeping Training

Accrual accounting provides a more accurate picture of a business’s financial health than cash accounting, as it considers all of the financial transactions for a given period. This accounting method is useful for businesses with inventory or accounts payable and receivable. Spending too much time on bookkeeping tasks, struggling to understand your financial data, and needing help with tasks like tax planning or financial forecasting are important signs.

- After you have a bookkeeping system in mind, the next step is to pick an accounting software.

- Accounts payable are usually what the business owes to its suppliers, credit cards, and bank loans.

- If you’re a bookkeeper or accountant new to FreshBooks, joining the free Partner Program is the fastest way to learn the software and get access to the FreshBooks Accounting Certification.

- Once you’ve had some bookkeeping training, you’re ready for real-world bookkeeping jobs or experience.

- Their priorities are to maintain consistency in how they record financial data and to make sure it’s accurate.

One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system. If you are operating a small, one-person business from home or even a larger consulting practice from a one-person office, you might want to stick with cash accounting. Remembering past transactions, patterns, and details without https://www.greenbuildessexcounty.org/LandscapeDesign/landscape-design-of-private-house-domain relying solely on documentation aids in the quick identification of anomalies. A Bookkeeper with a sharp memory can navigate through data more efficiently, contributing to the accuracy and precision of financial records. QuickBooks Online users can choose QuickBooks Live Bookkeeping to get year-round access to verified experts who are focused on their success.

Bookkeepers are important professionals in today’s economic and financial fields. Every company, even a small one, requires bookkeeping to maintain a healthy financial position. For small businesses, user-friendly software with essential features may be sufficient, while larger businesses may require more advanced features. Evaluate the cost of the software, including any monthly or annual subscription fees, and ensure it fits within your budget. Steer clear of common mistakes like not keeping receipts, miscategorizing expenses, and mixing personal finances with business ones. “These can be avoided by maintaining meticulous records and using the right software,” Pierce says.

One of the easiest ways to simplify your bookkeeping process is to automate recurring transactions. By setting up automated invoicing, bill payments, and payroll, http://novokuz.net/cnews181.html you can save a lot of time. “This reduces manual entry errors and ensures timely transactions, which are crucial for cash flow management,” Schmied says.

In Bookkeeping, effective communication is a Skill that goes beyond numbers. A Bookkeeper needs to convey complex financial information in a clear and understandable manner, whether to clients, colleagues, or auditors. The ability to articulate financial insights facilitates collaboration and ensures that all stakeholders are on the same page. To better understand these concepts and how to apply them, take bookkeeping courses that will allow you to practice them.

What to Expect for Refunds This Year Internal Revenue Service

Content

- Tax Refund FAQ

- Refund Related

- Sign up to our latest Newsletter

- IRS Enforcement and Compliance Operations

- Tax agency now pays 4% interest to waiting individual filers; it made $3.3 billion in interest payments last fiscal year

- Delayed refunds. Poor service. Why even the IRS says the 2022 tax season will be a mess

- IRS to refund late-filing penalties for 2019 and 2020 returns

Your financial institution may also play a role in when you receive your refund. Since some banks don’t process financial transactions during the weekends or holidays, you may experience a delay in processing. At one time, the IRS issued an annual tax refund schedule to let taxpayers know when they were likely to receive their refunds. Though the IRS no longer does this, we’ve put together estimates of when your refund may arrive in 2023 based on the schedule in previous years. The IRS says if you file early and electronically, you’ll typically receive your tax refund in fewer than 21 days. “We remain focused on doing everything possible to expedite processing of these tax returns, and we continue to add more people to this effort as our hiring efforts continue this summer,” Rettig said.

- According to the IRS, the best way to avoid delays on your tax refund is to file an accurate tax return using e-file software to file electronically and opting to receive your refund via direct deposit.

- For most filers, the tax deadline is April 18, and the IRS urges Americans to prepare before filing to avoid processing and refund delays, along with future IRS notices.

- The delays compound the very cash flow problems the credit was meant to help businesses avoid.

- That’s why Loyd targets a mid-March filing date, to make sure clients have all the necessary forms — including documents that may need corrections.

If the return includes errors or is incomplete, it may require further review that may slow the tax refund. Having all information available when preparing the 2021 tax return can reduce errors and avoid delays in processing. Requesting refunds via direct deposit is among three leading recommendations by IRS and Treasury officials to help taxpayers. They’ve also urged accurate, electronic filing to help taxpayers stay out of paper processing, though some 10 percent of taxpayers have continued filing paper returns. Processing paper returns is labor-intensive for IRS workers, who also must contend with e-filed tax returns flagged for errors that require manual review. Some returns, filed electronically or on paper, may need manual review, which delays the processing, if our systems detect a possible error or missing information, or there is suspected identity theft or fraud. Some of these situations require us to correspond with taxpayers, but some do not.

Tax Refund FAQ

When payments are delivered automatically to those whose 2019 taxes have been processed, the IRS can’t deduct other money a taxpayer owes to the federal government, except for child support. However, when they are claimed as credits on 2020 taxes — which will happen to millions of people simply because the IRS is behind in processing returns — all of those debts will be subtracted from the credit given. Both letters include important information that can help people file an accurate 2021 tax return. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

Typically, skipping these details triggers an automated notice from the IRS, which may delay processing or take time to resolve, he said. Crapo, the top Republican on the Finance Committee, pushed back on Wyden’s assertion in the April 7 hearing, arguing the IRS has long failed to adopt technology and practices that could speed processing of tax documents. Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news. Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments. Annuity.org partners with outside experts to ensure we are providing accurate financial content. Managing editor Emily Miller is an award-winning journalist with more than 10 years of experience as a researcher, writer and editor.

Refund Related

But the situation could have been handled better, according to Roger Harris, president of a small business accounting firm called Padgett Business Services that has clients still waiting on millions of dollars worth of claims. “While this was welcome news, there is a continued risk that low- and middle-income filers will receive confusing notices while they wait for IRS to process their correspondence or returns,” said Rep.

https://intuit-payroll.org/payer service sites nationwide, which are typically only staffed Mondays through Fridays, are now open on weekends too. “I can’t stress this enough to people, but if you need an extension, just go ahead and file that form 4868 with the IRS,” Khalfani-Cox said. “That will give you an extra six months and then you’ll have until Monday, Oct. 16, to actually submit your taxes.” “In 2021, parents were getting what folks call the enhanced child tax credit,” Khalfani-Cox said. “It was either $3,000 for children under 18 or $3,600 for kids under 6 years old.” Because of the government response to the COVID-19 pandemic, many Americans got a $1,400 stimulus check in 2021, the third of such payments. Second, now is a great time to check your credit report and make sure that there are no issues.

Sign up to our latest Newsletter

The IRS encourages everyone to have all the information they need in hand to make sure they file a complete and accurate return. Having an accurate tax return can avoid processing delays, refund delays and later IRS notices.

- “Particularly for lower income taxpayers who receive Earned Income Tax Credit benefits, tax refunds may constitute a significant percentage of their household income for the year,” Collins wrote.

- Erb offers commentary on the latest in tax news, tax law, and tax policy.

- “When we look at our consumer trends data from the prior-year tax returns, what we saw was four to six times the number of clients taking unemployment, and starting their own side hustle or small business.

- Taxpayers in Maine or Massachusetts have until April 19, 2022, to file their returns due to the Patriots’ Day holiday in those states.

- However, as of Jan. 8, the IRS said it still had 2.3 million unprocessed Forms 1040-X in its inventory.

If you are claiming your children as dependents, make sure they are not claiming themselves on any Irs Distributing Tax Refunds Slower Than Usual This Year After Delayed Start they file. “If that happens, that can delay your refund,” says Rodriguez Reiffert. Divorced couples must make sure only one parent is claiming any children as dependents, notes Deerwater.

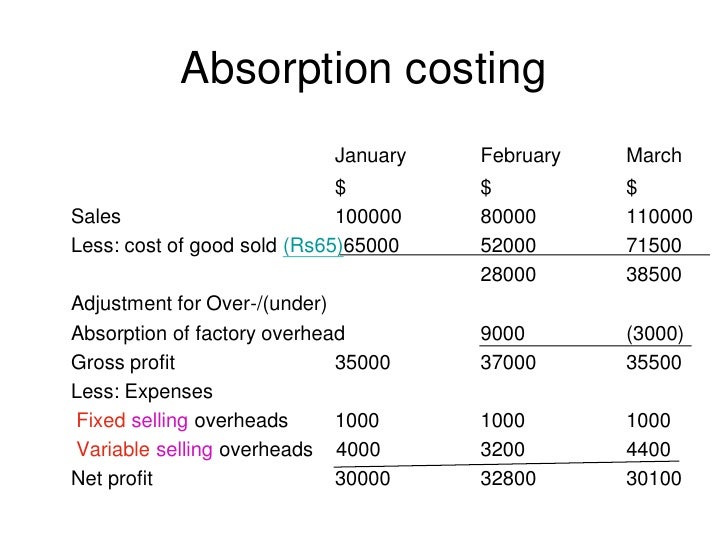

Income Statement Under Absorption Costing: Explanation, Example, And More

In the article about income statements under marginal cost, we discussed that marginal costs give a higher net profit figure as compared to absorption costing. Here, we are going to discuss the income statement under absorption costing and see how the net profit differs. Before we look at the income statement, let us have a look at what absorption costing is. Absorption costing is the accounting method that allocates manufacturing costs based on a predetermined rate that is called the absorption rate. It helps company to calculate cost of goods sold and inventory at the end of accounting period. Both the above methods are accounting techniques that companies use to allocate the cost of production over the total number of units produced.

New Segment Reporting Disclosures

Moreover, the method can provide a more stable basis for performance evaluation, as it avoids the potentially misleading cost fluctuations that can arise from only considering variable costs. When doing an income statement, the first thing I always do is calculate the cost per unit. Under absorption costing, the cost per unit is direct materials, direct labor, variable overhead, and fixed overhead. In this case, the fixed overhead per unit is calculated by dividing total fixed overhead by the number of units produced (see absorption costing post for details).

Chapter 6: Variable and Absorption Costing

- Once you have the cost per unit, the rest of the statement is fairly easy to complete.

- Calculate the unit cost first, as that is the most difficult portion of the statement.

- It includes all product costs, which are both fixed and manufacturing product costs.

- Careful COGS calculation as per GAAP standards is essential for accurate financial reporting.

- Managers can manipulate income by changing the number of units produced Producing more products gives a higher income.

Unlike variable costing, it covers fixed costs and inventories while calculating the cost per unit. If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit. Although fixed costs do not vary with changes in production or sales volume, they may change over time. Each unit of a produced good can now carry an assigned total production cost.

Net Income Determination in Absorption Costing

This artificially inflates profits in the period of production by incurring less cost than would be incurred under a variable costing system. Under the absorption costing method, all costs of production, whether fixed or variable, are considered product costs. This means that absorption costing allocates a portion of fixed manufacturing overhead to each product. The adoption of absorption costing has direct implications for a company’s tax liabilities.

Key Principles of Absorption Costing

Advocates of absorption costing argue that fixed manufacturing overhead costs are essential to the production process and are an actual cost of the product. They further argue that costs should be categorized by function rather than by behavior, and these costs must be included as a product cost regardless of whether the cost is fixed or variable. Under absorption costing, the inventory carries a portion of fixed overhead costs in its valuation. This means the cost of ending inventory on the balance sheet is higher compared to variable costing methods. Compared to variable costing, absorption costing income statements tend to show less volatility in operating income from period to period. This is because fixed costs are smoothed into COGS rather than impacting the period they are incurred.

Variable costing considers the variable overhead costs and does not consider fixed overhead as part of a product’s cost. It is not in accordance with GAAP, because fixed overhead is treated as a period cost and is not included in the cost of the product. While companies use absorption costing for their financial statements, many also use variable costing for decision-making.

Calculate the unit cost first, as that is the most difficult portion of the statement. Absorption costing is typically used in situations where a company wants to understand the full cost of producing a product or providing a service. This includes cases where a company is required to report its financial results to external stakeholders, such as shareholders or how to estimate bad debt expense regulatory agencies. Include an amount for “other items,” which is the difference between the total relevant expense caption on the income statement and the aggregate of separately disclosed expense categories. An ethical and evenhanded approach to providing clear and informative financial information regarding costing is the goal of the ethical accountant.

Absorption costing is an accounting method that captures all of the costs involved in manufacturing a product when valuing inventory. The method includes direct costs and indirect costs and is helpful in determining the cost to produce one unit of goods. Additionally, absorption costing can obscure the true variable cost of production, making it more challenging to conduct break-even analysis and perform cost-volume-profit (CVP) analysis. Managers seeking to make decisions based on the marginal cost of production may find the data less accessible, as fixed costs are distributed across units regardless of the actual production level.

The absorption cost per unit is the variable cost (\(\$22\)) plus the per-unit cost of \(\$7\) (\(\$49,000/7,000\) units) for the fixed overhead, for a total of \(\$29\). Despite its widespread use and compliance with accounting standards, absorption costing is not without its detractors. One of the primary critiques is that it can potentially distort a company’s financial performance, particularly in the short term. By deferring the recognition of fixed costs, absorption costing can inflate profits in periods of increasing inventory, which may not accurately reflect the economic reality of a company’s operations. This can lead to decisions that prioritize production over market demand, resulting in excess inventory and potential write-downs in the future. The service sector presents a different set of challenges for absorption costing due to the intangible nature of its products.

What is the difference between debt and liability?

However, if your liabilities become too great for your income level and you no longer have the assets necessary to pay your debts when they’re due, you might find yourself considering bankruptcy. While this legal process resolves liabilities due to an inability to pay, it also has an adverse effect on your credit score and ability to borrow in the future. When some people use the term debt, they are referring to all of the amounts that a company owes. The flip side of liabilities is assets — resources the company uses to generate income. Assets include inventory, machinery, savings account balances, and intellectual property. For example, buying new equipment may mean taking out a loan to finance the purchase.

One—the liabilities—are listed on a company’s balance sheet, and the other is listed on the company’s income statement. Expenses are the costs of a company’s operation, while liabilities are the obligations and debts a company owes. Expenses can be paid immediately with cash, or the payment could be delayed which would create a liability.

A lot of times, liabilities are debts that are assumed to be the same thing. Debt is a financial arrangement between an organization and the lender, where the lender generally extends finance to the seller. There are three broad categories in which all classes are categorized, which include assets, liabilities, and equity. During the normal course of the business, numerous different transactions occur within the firm. All transactions are supposed to be recorded in the financial statements under separate headings. It’s like when you join a fitness training program or weight loss program, you want to see the results early.

Debt

Current assets represent all the assets of a company that are expected to be conveniently sold, consumed, used, or exhausted through standard business operations within one year. Current assets appear on a company’s balance sheet and include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, prepaid liabilities, and other liquid assets. Short-term debt, also called current liabilities, is a firm’s financial obligations that are expected to be paid off within a year.

Or I may have the capability, but it’s not up to the standard we need. At that point, I can say for the next job, I don’t need to hire a ‘director of X,’ I need to hire to solve these gaps I just identified. How does one go from the investment banking world to the role of CFO? In Ralph Leung’s case, he didn’t take the more common path by nabbing what is the accumulated depreciation formula a job in corporate development. Instead, he took a CFO position at a small company, a route he calls “super humbling.” It meant learning about 80% of the role on the job, and making many mistakes in the process. The investment banker-turned-CFO discusses the company’s mission, finance’s hiring strategy, and the importance of working capital.

- However, if your liabilities become too great for your income level and you no longer have the assets necessary to pay your debts when they’re due, you might find yourself considering bankruptcy.

- That’s why interest rates will normally be higher for this type of debt.

- To cut down on your liabilities, you can take a personal inventory of everything you have.

- The most common accounting standards are the International Financial Reporting Standards (IFRS).

When the company pays its balance due to suppliers, it debits accounts payable and credits cash for $10 million. The indebtedness of a company must be proportionate to its operating capacity. It is reasonable, and even necessary at times, to resort to external capital to boost activity, but always with good planning. In any case, it is convenient to review the accounts and reduce the indebtedness or total liabilities as much as possible. A very high ratio generates a lot of dependencies and drives away new investors because in the event of insolvency it will be more difficult to recover the money. Many times, having to go into debt is a consequence of a moment of lack of cash.

Your Credit History and Score

Liabilities are categorized as current or non-current depending on their temporality. They can include a future service owed to others (short- or long-term borrowing from banks, individuals, or other entities) or a previous transaction that has created an unsettled obligation. The most common liabilities are usually the largest like accounts payable and bonds payable. Most companies will have these two line items on their balance sheet, as they are part of ongoing current and long-term operations.

What are Total Liabilities?

If a company’s product requires repairs or replacement, the company needs the funds available to honor the warranty agreement. Liability is an obligation to render goods or services or an economic obligation to be discharged off at a future date. If you’re unhappy with your net worth figure and believe liabilities are to blame, there are steps you can take. Strategies like debt consolidation and the “debt avalanche” — attacking debts with the highest interest rates first — can help you pay off debt efficiently.

What Is a Liability?

The term of the agreement to which the debt is to be paid back is called the interest. The arrangement for debt payback varies from an individual or organization to the other. This charge is always called the interest, and it is always calculated in terms of the percentage of the principal money received. In some cases, this may mean your liability transforms into an asset, like a mortgage balance becoming full home equity.

Understanding Short-Term Debt

When something in financial statements is referred to as “other” it typically means that it is unusual, does not fit into major categories and is considered to be relatively minor. In the case of liabilities, the “other” tag can refer to things like intercompany borrowings and sales taxes. On a balance sheet, liabilities are listed according to the time when the obligation is due.

It is important to understand that proper asset management facilitates cash flow, fuels cash, and eliminates unnecessary risk. In general, a liability is an obligation between one party and another not yet completed or paid for. Current liabilities are usually considered short-term (expected to be concluded in 12 months or less) and non-current liabilities are long-term (12 months or greater).

Chart of Accounts Example Format Structured Template Definition

As time goes by, you may find yourself wanting to create a new line item for each transaction, but doing so could litter your company’s chart and make it difficult to navigate. Current liabilities are classified as any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report. He frequently speaks at continuing education events.Charles consults with other CPA firms, assisting them with auditing and accounting issues.

Where does the revenue show up?

It’s also worth saying that depending on the idustry and a business’s structure, more accounts can form the COA. The basic set of accounts is similar for all businesses, regardless of the type, size, or industry. This way, whether you’re setting up restaurant bookkeeping or ecommerce accounting, you follow the standard chart of accounts. In the United States businessesand organizations widely use a standardized chart of accounts.

COA Structure

As mentioned, besides the standard five accounts, the chart of accounts may contain additional accounts, created for the sake of more granularity or to cater to a business’s particular needs. They can vary, but the most typical here are the COGS, gains and losses, and other comprehensive income accounts. Revenue appears at the top line of the income statement, showing the total amount of money earned from sales or other business activities.

And when it comes to audits (those thorough checks of financial records), having a clear COA makes everything a lot easier, keeping everyone happy and following the rules. So, a chart of accounts, as mentioned, organizes a company’s finances in an easy-to-understand way. It helps everyone in the company know exactly where the money is coming from and where it’s going.

Every transaction affects at least two accounts – one gets debited and another credited. Double-entry bookkeeping is a fundamental requirement for recording financial transactions under GAAP (Generally Accepted Accounting Principles), so you can’t record your transactions differently. The chart of accounts (COA) current liabilities and difference between current assets and liabilities is a list of accounts a company uses to record its financial transactions. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have.

- The chart of accounts provides the name of each account listed, a brief description, and identification codes that are specific to each account.

- But the final structure and look will depend on the type of business and its size.

- The most liquid assets (such as cash) are listed first, followed by less liquid assets (such as inventory and PP&E).

- Unlike a trial balance that only lists accounts that are active or have balances at the end of the period, the chart lists all of the accounts in the system.

If you don’t give your chart of accounts the early love it deserves, you may regret it. Creating a new accounting systems six years out, for example, would be a major headache. First, let’s look at how the chart of accounts and journal entries work together. To do this, she would first add the new account—“Plaster”—to the chart of accounts. But experience has shown that the most common format organizes information by individual account and assigns each account a code and description.

Organize account names into one of the four account category types

The COA, in this case, might include revenue accounts like Service fees and Consulting revenue to track earnings. An expense account named Professional fees can be added to monitor costs for hiring professionals. Marketing expenses is another expense account to track promotional costs.

Well, this should be listed between the cash and accounts receivable in the chart, but there isn’t a number in between them. A chart of accounts is a critical tool for tracking your business’s funds, especially as your company grows. An easy way to explain this is to translate it into personal finance terms. When you log into your bank, typically compute direct materials used you’ll get a dashboard that lists the different accounts you have—checking, savings, a credit card—and the balances in each.

With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done. For example, if you need to create a new account for ‘PayPal Fees’, instead of creating a new line in your chart of accounts, you can create a sub-account under ‘bank fees’. Similarly, if you pay rent for a building or piece of equipment, you might set up a ‘rent expense’ account with sub-accounts for ‘building rent’ and ‘equipment rent’. You’ll notice that each account in the chart of accounts for Doris Orthodontics also has a five-digit reference number preceding it.

Investing Activities Accounting for Managers

Also, proceeds from the sale of a division or cash out as a result of a merger or acquisition would fall under investing activities. It represents cash inflows; in a sense, the company receives some money from the sale. Operating activities are about how companies make money from the supply of goods and services. Investment activities are about how to grow a business and make more money in the future.

Investment can be through the purchase of new machines or acquisitions, and both require payment. And financing such investments, for example, by issuing shares or bonds, is a cash flow component of financing activities. Investing activities are business activities related to growing a business and bringing profits to the company in the long term. It involves buying and selling long-term assets and other business investments. When adding a new machine, for example, the company can produce more output. Likewise, with acquisitions, it makes a company more efficient or increases revenue.

Furthermore, monitoring net cash flow from investing activities can help businesses to identify potential opportunities for growth and expansion. It is important to note that net cash flow from investing activities does not include any cash generated from the sale of investments, such as stocks or bonds. This cash flow is only related to the purchase and sale of physical assets, such as land, buildings, and equipment. To grow production, companies need to buy new machines or build new factories.

Zimmer Biomet Announces Second Quarter 2023 Financial Results – BioSpace

Zimmer Biomet Announces Second Quarter 2023 Financial Results.

Posted: Tue, 01 Aug 2023 10:57:25 GMT [source]

When making payments, the company records cash outflows, and it will appear in the investment activity section. Cash flow from investing activities typically refers to the cash generated in a company by making or selling investments and/or earning from investments. Here’s a short list of common cash inflows and outflows listing in the investing section of the cash flows statement.

What are Investing Activities?

Likewise, if a company sells one of its vehicles, the cash proceeds are listed in this section as well. However, companies can have negative cash flow, even profitable companies. For example, a company might be investing heavily in plant and equipment to grow the business. These long-term purchases would be cash-flow negative, but a positive in the long-term. The second section of the cash flow statement involves investing activities. We will again be chatting about inflows and outflows as it relates to investments.

Therefore, buying and selling activities of cash equivalents that are highly liquid and securities for trading purposes are not part of investment activities. Instead, they fall into the category of cash flow from operating activities. By tracking net cash flow from investing activities, businesses can also gain a better understanding of their financial position and make more informed decisions about their investments. This can help them to identify areas where they may need to make changes or adjustments in order to maximize their returns.

Any changes in the cash position of a company that involves assets, investments, or equipment would be listed under investing activities. This can include anything from purchasing equipment, or expanding a current building. While these expenses are considered negative cash flow, they can be a sign that a business is flourishing. Most businesses do not spend a lot of money on improvements if they aren’t doing well.

Cash Flow From Investing Activities FAQs

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. For example, depreciation is added back and income receivable is reduced.

We will remove the truck from the balance sheet, and stop the depreciation, but whatever we received in cash for the truck will show up on our investing section on our cash flow statement. It is also important for businesses to consider the long-term implications of their investments. While short-term gains may be attractive, businesses should also consider the potential for long-term growth and sustainability when making investment decisions.

Examples of fixed assets are buildings and property, machinery, equipment, vehicles, and computers. If we purchased the truck for $25,000, from a cash perspective, we had a $25,000 outflow, right? So even though the truck goes to the balance sheet, we need to note the entire purchase price (if we paid cash) on our cash flow statement. The net cash used in investing activities was calculated by subtracting the positive cash flow of $1,395 million from the negative cash flow of $25,431 million. As you’ll see below, the statement is separated into three parts, where investing activities come in between operating activities and financing activities. This section reconciles the net profit to net cash flow from operating activities by adjusting items on the income statement that are non-cash in nature.

Cash flow from investing activities

To buy a machine, for example, a company must spend money to pay for it. Buying and selling fixed assets is an example of an investment activity. Fixed assets are various tangible assets to support operational activities.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Unlike operating and financing activities, a year with investing activities negatively affecting cash flow isn’t always a bad sign.

- As the value of these assets increases, the amount of net Cash Flow available to the company over time increases.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

A business selling a part of their business, or fixed assets like equipment results in positive cash flow. This can include a manufacturing plant selling equipment or a chain of stores selling one of its locations. The money brought in from these transactions brings cash into the business. Unlike operating and financing activities, a year with investing activities negatively affecting cash flow isn’t always a bad sign.

Cash Flow From Investing: Definition and Examples

Negative Cash Flow from investing activities means that a company is investing in capital assets. As the value of these assets increases, the amount of net Cash Flow available to the company over time increases. Cash flow from investing (CFI) activities comprises all the cash purchases and disposals of non-current assets that produce benefits for the company in the long run. Cash flow is important because it is what ultimately gives you a paycheck. So, it is essential to the health of a business to understand what investing activities are and how they impact cash flow.

Axalta Releases Second Quarter 2023 Results – InvestorsObserver

Axalta Releases Second Quarter 2023 Results.

Posted: Tue, 01 Aug 2023 20:15:00 GMT [source]

These activities often involve buying or selling assets with the intention of generating a profit or other value. Investing activities also encompass other areas such as investing in stocks, bonds, and other investments. On CFS, investing activities are reported between operating activities and financing activities. The sum of all three results in the net cash flow of the company for the year. Cash flow from investing activities comprises all the transactions that involve buying and selling non-current assets, from which future economic benefits are expected. In other words, such assets are expected to deliver value and benefits in the long run.

Net cash flow from investing activities is the amount of cash generated or used by a business from its investing activities. To calculate net cash flow from investing activities, the business must subtract cash used in investing activities from cash generated in investing activities. For example, if a business spends $100,000 on equipment but sells a parcel of land for $200,000, the net cash flow from investing activities would be $100,000 ($200,000 – $100,000).

But, capital expenditure may not be efficient if it does not increase profits. Therefore, you need to learn about the company’s specific investment strategy. For example, you can use internal rate of return (IRR) to assess whether purchasing a machine or building a new facility is profitable or not.

- Cash flow from investing (CFI) activities comprises all the cash purchases and disposals of non-current assets that produce benefits for the company in the long run.

- Additionally, businesses should consider the impact of their investments on their overall financial health and the potential for future returns.

- It is also important for businesses to consider the long-term implications of their investments.

- The purchase or sale of a fixed asset like property, plant, or equipment would be an investing activity.

- Investing activities also encompass other areas such as investing in stocks, bonds, and other investments.

The income statement reports the revenue and expenditure of a company during a specific period, while the balance sheet reports the assets, liabilities, and capital. Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors. Alternative investments are often sold by prospectus that discloses all risks, fees, and expenses. They are not tax efficient and an investor should consult with his/her tax advisor prior to investing. The value of the investment may fall as well as rise and investors may get back less than they invested.

It can simply mean a business is investing in improvements that could increase the value of the company over time. Cash flow from investment activities also depends on the type and age of the company. depreciable assets They need significant capital expenditure to develop their business and be competitive in the market. Changes in fixed assets in the balance sheet are a representation of investment activities.

Likewise, FASB requires that all interest payments and receipts be classified as operating activities. As the statement of cash flows indicates, Walmart made a significant capital expenditure in 2019 since it has a net cash outflow of $24,036 million in investing activities. The two main activities that fall in the investing section are long-term assets and investments. Long-term assets usually consist of fixed assets like vehicles, buildings, and machinery. When a company purchases a new vehicle with cash, the cash outflows are listed in the investing section.