Product vs Period Cost

Content

When preparing financial statements, companies need to classify costs as either product costs or period costs. We need to first revisit the concept of the matching principle from financial accounting.

According to FreshBooks, the rent paid for the factory building is part of manufacturing overhead and should be recorded as a product expense. If a building is used for both administrative and manufacturing purposes, you may allocate the rent to each. There are many costs businesses incur that are not related directly to product manufacturing. The most common of these costs are sales and marketing costs and administrative costs. Sales and marketing costs may be commission for the sales team, salary for the marketing team, advertising costs to boost brand awareness, market research, and product design. For example, the cost of raw materials that a company purchases will be a period cost, as it will vary with the level of production.

Is Labor a Period Cost or Product Cost?

Business owners who do their small business bookkeeping need to know period cost accounting in order to write off their business expenses correctly. Bringing an understanding of period and product costs to a value chain or break-even analysis helps you quickly identify what types of expenses are hampering your business’s profitability. Product costs, on the other hand, are expenses that are incurred to manufacture a good and can typically be traced back to a specific product.

Note that prepaid rent and other prepaid expenses, as well as the costs included in fixed assets, are not period costs. Looking at these expenses the utilities for the manufacturing facility and the production worker’s wages are both product costs because these are manufacturing overhead costs and direct labor costs.

The Struggles of Private Company Accounting

Rent on a company’s office space will be a fixed cost, as it will not vary with the level of production. There are several different product costs in manufacturing, which can include direct materials, direct labor, and overhead costs. There are types of period costs that may not be included in What are Period Costs? thefinancial statementsbut are still monitored by the management. These costs include items that are not related directly to the primary function of a business, such as paying utility bills or filing legal suits. The cost of labor is unique in that it can be both a product and period cost.

Evoqua Water Technologies Reports First Quarter 2023 Results – Yahoo Finance

Evoqua Water Technologies Reports First Quarter 2023 Results.

Posted: Tue, 31 Jan 2023 12:00:00 GMT [source]

For example, if a business rents space to house its accounting function, then it will incur the cost of rent whether it produces goods or not. Some of the expenses that a business incurs have nothing to do with the production https://online-accounting.net/ of goods at all. The point is that a business will incur expenses in the process of making profits. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Understanding Period Costs

Companies must understand both types of costs to make informed decisions about pricing, production, and resource allocation. By understanding the difference between product and period costs, companies can make choices that will help them stay competitive and profitable.

- Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent.

- Outsourcing non-core activities– If a business is not core to its operations, then outsourcing those responsibilities could help it reduce period expenses.

- The administrative costs can grow very quickly and should be reviewed with benefits professionals annually.

- There are the salaries and wages of executive officers, office workers, and other employees not involved in the production process.

- On the other hand, period costs are considered indirect costs or overhead costs, and while they play an important role in your business, they are not directly tied to production levels.

The total cost of a product will encompass all of these different types of costs. Knowing the specific product costs can help managers make better decisions about how to price their product, how to reduce costs, and where to allocate resources.

Period Costs

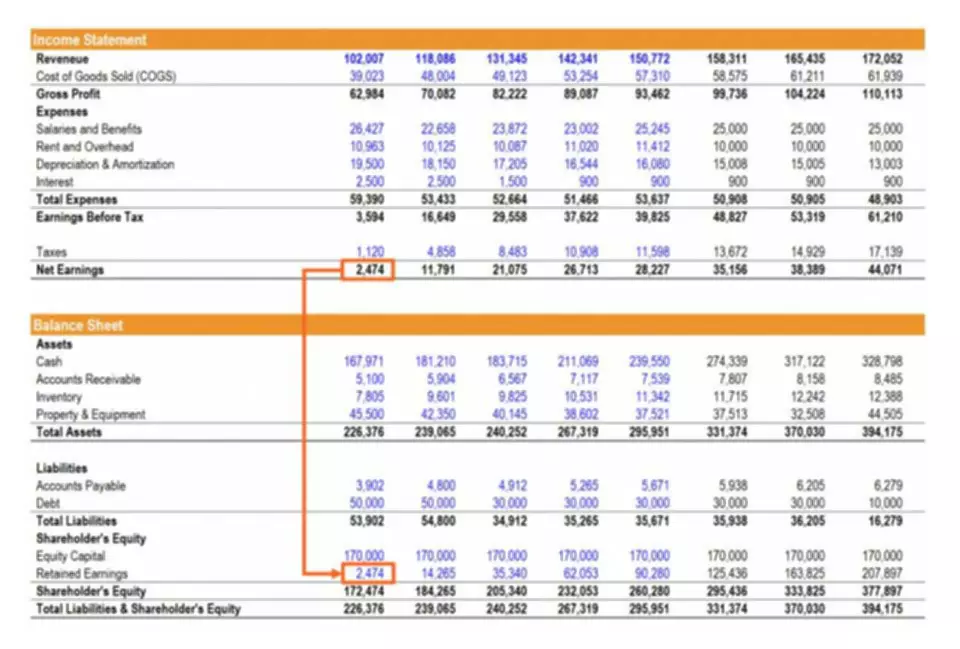

While they still form part of the overall cost of running a business, they aren’t directly related to manufacturing a specific good or service. Product costs may appear on the balance sheet or income statement depending on whether their related goods are sold or unsold at the end of the period. To start, only businesses that produce or acquire and eventually sell goods incur product costs. This is why we sometimes refer to product costs as inventoriable costs. These costs that are directly involved in the production or acquisition of goods are what we refer to as product costs.

Loan interest payments and depreciation are also periodic expenses. Product costs, on the other hand, arecapitalizedas inventory on the balance sheet. Manufacturers debit their raw materials inventory account when the purchase is made and credit their cash account. Period costs are expensed on the income statement when they are incurred. When a company spends money on an advertising campaign, it debits advertising expense and credits cash.

Law Firm Accounting and Bookkeeping: Tips and Best Practices JurisPage Legal Marketing

Content

The income statement helps law firms decide if they can generate profit by decreasing costs, increasing revenues, or both. It also grades the efficiency of the strategies employed by the firm at the beginning of a financial period. law firm bookkeeping Business owners and other executives can reference this statement or document to assess the success of their strategies. And depending on the outcome of their analysis, they can provide solutions to increase profit.

- IOLTA can be used to track billable hours, expenses, client payments, and trust accounting.

- Three-way reconciliation is generally conducted every 30 to 60 days, depending on the state.

- An income or operating statement is a financial statement that shows a company’s income and expenses.

- The accounting method you choose should be in place when your firm files its first tax return.

- Keep abreast of the specific rules of your local jurisdiction and leverage your tech options, and you’ll be well on your way to a more streamlined accounting process for your law firm.

- There are also financial reports that go beyond following best practices for accounting and identifying growth opportunities.

- Most firms will need three business bank accounts at a minimum—checking, savings, and a separate IOLTA or trust account.

A double entry system, therefore, has two equal and corresponding sides—or debits and credits—and creates a balance sheet consisting of assets, liabilities, and equity. Accounting for law firms lets you collect and analyze information, and make data-driven decisions based on what money comes in and leaves your firm, so it’s worth it to pay attention. QuickBooks Online is an industry leader when it comes to the best accounting software for attorneys. It’s relatively easy to use, offers plenty of features, and automates many accounting tasks. You’ll be able to import bank statements, run trust accounting reports, and print disbursements checks, all from one platform. In this section, we’ll take a quick look at how the top 10 legal accounting software solutions compare against each other in terms of pricing.

Final thoughts on accounting and bookkeeping best practices

Your checking account is self-explanatory — its primary purpose is managing business revenue. Following the above three best practices allows you to optimize your finances. It’s crucial to collect and organize your financial data regularly, not just at the end of the year. In our opinion, this is an oversight, as mismanaging these accounts can lead to serious consequences, even disbarment. Businesses are complex, and you may need to set a budget for different categories like marketing, technology, etc. With money flowing in so many different directions, it’s easy to lose track.

- In this law firm accounting guide, we take you through law firm accounting and financial management basics to cement your knowledge and present valuable new information.

- Clients (and employees) talk, and if your finances are in shambles due to negligence, that could spell disaster for your credibility.

- When an invoice is paid, you must first allocate the payment to the incurred cost.

- The lawyers can get confused over the calculation of taxes and GST for disbursements and activities, thus, it is important to opt for a reliable bookkeeping service provider like us.

- 3 components involved in the reconciliation process consist of the trust ledger, the client ledger, and the trust reconciliation.

Any CPA should be willing to sit down with you for a free consultation. A legal bookkeeper can also help you manage your firm’s budget and make sure that you are staying on track financially. The bookkeeper should also be familiar with the firm’s billing cycle and invoicing procedures in order to ensure that all billable hours are accurately recorded and invoiced in a timely manner. Similarly, if you entertain clients frequently, you will want to keep track of those expenses as well. By tracking these costs throughout the year, you can ensure that you maximize your tax deductions come tax time.

Bookkeeping for Law Firms

The reality is that there is no scenario where it’s okay to use your IOLTA in this way. We don’t recommend building your business off the back of your credit card. The interest rates are high, limits are often lower than other forms of credit, and they’re easily mismanaged. These are funds you must keep separate from your firm’s operating funds. And without proper care, it’s easy to slip up and make a dangerous error.

While savings accounts are not known for having great interest rates to keep up with inflation, having extra cash on hand is an important safety net for any business. The distinction matters because equity partners can’t earn salaries like employees. They’re taxed based on their portion of the firm’s earnings and pay themselves through an owner’s draw. Some partners also earn guaranteed payments to ensure stable income even if the business operates at a loss. Some firms promote lawyers to a partner title without making them a part owner in the business.

What’s the difference between accounting and bookkeeping?

Your trust account should be clearly identified as “in trust” on your bank statement and cheques. Reconciling your trust account on a regular basis is a bit like doing your taxes. You want to make sure that all of the transactions have been recorded accurately and that the account balance is correct. Bookkeepers should reconcile trust accounts on a monthly basis, to identify any errors or discrepancies.

Check out Bench’s guide to recordkeeping to see record retention periods. There may be more (or fewer) documents to track depending on your firm. We’ve said it again and again, but never, ever mix your personal and your business finances. If they don’t, you need to go over every single transaction to see where the error lies. You should never, ever borrow money from your IOLTA before you’ve earned those fees.

The December 31 bank statement shows a balance that is $10,000 less than your books or the client’s trust ledger due to a timing difference. You would note this in your reconciliation report and ensure your January 31 bank statement includes the deposit. For a CPA to work effectively, they will need you to provide accurate, up-to-date financial statements. Whether you’re good with numbers and spreadsheets or not, every lawyer needs to understand the basic role that bookkeeping plays in their business. Your business’s accounting method will affect cash flow, tax filing, and even how you do your bookkeeping.

- The most powerful solution to this problem is taking the time to frequently update your books (or outsourcing your bookkeeping to a team that will reconcile the numbers for you).

- This makes it much easier for your accountant to prepare financial statements and tax returns.

- Bookkeepers should reconcile trust accounts on a monthly basis, to identify any errors or discrepancies.

- Your firm’s jurisdiction can create variances on what the ethics are, but there are standard accounting basics that lawyers must follow.

- Not all income is revenue — this is a distinction that needs to be made or you could have to deal with inaccurate bookkeeping.

- No additional software is necessary to access the powerful accounting and bookkeeping tools that you would expect to find in high-quality programs.

Recording Entries for Bonds Financial Accounting

Notes and bonds can contain an almost infinite list of other agreements. Many of these are promises made by the debtor to help ensure that money will be available to make required payments. The stated amount of interest is paid on the dates identified in the contract. Payments can range from monthly to quarterly to semiannually to annually to the final day of the debt term. A mortgage calculator provides monthly payment

estimates for a long-term loan like a mortgage. Mortgages are long-term liabilities that are used to finance real

estate purchases.

- The discounted price is the total present value of total cash flow discounted at the market rate.

- As the company decides to buyback bonds before maturity, so the carrying amount is different from par value.

- Note that the company received more for the bonds than face value, but it is only paying interest on $100,000.

- Suppose ABC company issues a bond at a par value of $ 100,000 and a coupon rate of 5% with 5 years maturity.

- When bonds are issued and sold at discount, the interest expense will need to be calculated and recorded based on either the straight-line method or effective interest method.

The bond gives an 8% interest which is payable annually on February 1. The company usually issues the bond at a discount when the market rate of interest is higher than the contractual interest rate of the bond. After all, investors are unlikely to pay for the bonds at the face value if they can invest in other securities with similar risks but providing a better rate of return. Company ABC issue 5% 2,000 convertible bonds with par value of $ 1,000 each. They are the convertible bonds that give the right to holders to convert to a common share at the maturity date at the conversion rate of 20.

Bond discount example

The Discount on Bonds Payable account is a contra-liability account in that it is offset against the Bonds Payable account on the balance sheet in order to arrive at the bonds’ net carrying value. Based on this effective rate, the bonds would be issued at a price of 92.976, or $92,976. In this case, we have a $4,000 gain on redemption as we only pay $290,000 for the bonds that have a carrying value of $294,000 on the balance sheet. Issuing bonds at face value means that the cash that we receive from issuing the bonds equals the face value of the bonds. When huge investors decide to convert in the same time, it will impact to market share, the share pirce will decrease. The company require to pay annual interest to investors, these are the deductible expense and will save on tax at the end of the year.

- Bonds Payable is always credited for the face amount of the issue, and so the accrued interest element must be accounted for separately.

- Note that the company received more for the bonds than face value,

but it is only paying interest on $100,000. - The difference between cash receive and par value is recorded as discounted on bonds payable.

- The bondholders have the right to receive interest as stated on the bond certificate as well as the principal at the maturity date.

- Remember that the bond payable retirement debit entry will always be the face amount of the bonds since, when the bond matures, any discount or premium will have been completely amortized.

Thus, if the market rate is 14% and the contract rate is 12%, the bonds will sell at a discount. Investors are not interested in bonds bearing a contract rate less than the market rate unless the price is reduced. Selling bonds at a premium or a discount allows the purchasers of the bonds to earn the market rate of interest on their investment. (Figure)Huang Inc. issued 100 bonds with a face value of $1,000 and a 5-year term at $960 each. (Figure)Keys Inc. issued 100 bonds with a face value of $1,000 and a rate of 8% at $1,025 each. (Figure)Naval Inc. issued $200,000 face value bonds at a discount and received $190,000.

Bonds issued at Premium

Convertible bond is a type of bond which allows the holder to convert to common stock. The conversion can be done at any time before the maturity date and it depends on the bond holder’s discretion. It allows the holder to choose between receiving the guaranteed interest on bonds or convert to the company’s share to get the dividend and trade the shares in the capital market.

Accounting for Issuance of Bonds (Example and Journal Entry)

So, we need to record the gain or loss on the bond redemption to the income statement for the period. At the end of bond maturity, we can redeem the bonds back by paying the bondholders the amount equal to the face value of the bonds. Based on the table above, financial liability balance is $ 1,944,358 which need to reverse from balance sheet, so it will impact the additional paid-in capital which is the balancing figure.

Mortgage Debt

The accounting treatment for the issuance of bonds depends on whether the bonds are issued at par, a discount, or a premium. The bond issuing companies will record the transactions for the bond principal and the taxation of rsus explained interest payments separately. The accounting treatment for issuing bonds is different depending on each type of issue. The discount on bonds payable is treated as an additional interest expense on the bonds.

In simple words, bonds are the contracts between lender and borrower, the amount of contract depends on the face value. However, the lender can receive the principal before the maturity date by selling contract to the capital market. The borrower will pay back the principal to whoever holds the contract on maturity date. Each year Valley would make similar entries for the semiannual payments and the year-end accrued interest.

The firm would report the $2,000 Bond Interest Payable as a current liability on the December 31 balance sheet for each year. The April 30 entry in the next year would include the accrued amount from December of last year and interest expense for Jan to April of this year. (Figure)Gingko Inc. issued bonds with a face value of $100,000, a rate of 7%, and a 10-yearterm for $103,000. From this information, we know that the market rate of interest was ________. (Figure)O’Shea Inc. issued bonds at a face value of $100,000, a rate of 6%, and a 5-year term for $98,000.

We tend to think of them as home loans, but they

can also be used for commercial real estate purchases. By the end of third years, the discounted bonds payable balance will be zero, and bonds carry value will be $ 100,000. Bonds issue at par value mean that the issuer sell bonds to investors at par value.

Journal Entry for Bonds Issue at Par Value

However, by the time the bonds are sold, the market rate could be higher or lower than the contract rate. As you are preparing your assigned journal entries, your supervisor approaches you and asks to speak with you. Your supervisor is concerned because, based on her preliminary estimates, the company will fall just shy of its financial targets for the year.

Enrolled Agent Salary: Pay Guide for Enrolled Agents in 2024

Salaries range from $44,900 to $73,600.The average Enrolled Agent Hourly Wage is $20.00 per hour. Hourly wages range from $16.00 to $26.30.Salaries and wages depend on multiple factors including geographic location, experience, seniority, industry, education etc. Individuals who are considering a new career path may find that http://guide-horse.org/text_only_master.htm becoming an enrolled agent is the right choice. Let us learn about the steps in an enrolled agent course that the candidate should take to gain the qualification and become an EA. There is considerably more responsibility required for EAs in senior positions, which translates into the potential to earn a greater income.

Job Tasks For Enrolled Agents

Another way to boost your salary and solidify your expertise is to become dual-certified. Whether you’re just getting started as an Enrolled Agent or are already a CPA wanting to specialize in tax, dual certification is the best way to help yourself stand out from the crowd. The highest paying types of enrolled agents are insurance broker, licensed insurance producer, and insurance producer. An enrolled agent’s salary ranges from $22,000 a year at the 10th percentile to $54,000 at the 90th percentile. The highest-paying cities for enrolled agents are Green Bay, WI, San Francisco, CA, and Southfield, MI.

Experience the Surgent Difference

And, if you decide to work for a non-finance-related company as an enrolled agent, you can actually expect to earn a bit more. On the other hand, accounting jobs for enrolled agents at top corporations like Apple, Starbucks, FedEx, and GE typically pay between $60,000 to $80,000 per year. Of course, the more experience you have, the more an employer will be willing to pay you. Consequently, entry-level positions start on https://mylektsii.ru/9-37483.html the low end of these ranges, while senior positions claim the highest salaries. For example, in Phoenix, a senior tax consultant with an enrolled agent designation and over 5 years of relevant experience can earn over 6 figures at a regional firm. Working as an enrolled agent at one of the larger national tax firms won’t necessarily earn you as much as you might make at a more specialized regional or local brokerage.

Entry-level salaries for EA agents

If you’re considering a career in accounting or finance, you may be curious about how much money enrolled agents make. They also work for some of the most well-respected corporations in the country. So, to determine how lucrative a career as an enrolled agent can be, use this information to learn more about the https://zwonok.net/index.php?newsid=5420.

- Your education and experience level, as well as any other certifications you hold, also affect the size of your enrolled agent salary.

- This means EAs can represent any taxpayer, regardless of whether they prepared their income tax return.

- The AFSP is a yearly 15 to 18 hour continuing education program governed by the IRS.

- Entry-level tax preparers make less, but can expect their salary to increase after gaining several years of experience, and gathering more clients.

- To become an enrolled agent, the IRS requires a few straightforward steps.

The big chains pay their more experienced enrolled agents between $20 and $30 per hour on average, which comes to between $40,000 and $50,000 annually. For instance, the range for some posted jobs in these types of companies is between $60,000 and $85,000. Chicago’s median salary for enrolled agents is actually lower than that of the rest of the country, according to Payscale’s data. Current job postings in Chicago reveal an EA salary range from around $55,000 per year to over 6 figures.

How C corps can avoid double taxation and reduce taxes

Necessary means that the expenses are appropriate and a business owner might not be able to manage without making the expenditure. The tax payable is the actual amount owed in taxes based on the rules of the tax code. The payable amount is recognized on the balance sheet as a liability until the company settles the tax bill.

- If the service or the cost or use of the property is a deductible business expense, you can deduct the tax as part of that service or cost.

- To figure your deduction, divide your total startup or organizational costs by the months in the amortization period.

- The right tax provision software helps eliminate errors and streamline your tax calculation processes so you can complete filing obligations easily.

- Regardless of these other transactions, Giovanni can treat $1,000 of the deposit he made on August 8 as being paid on August 4 from the loan proceeds.

- Go to IRS.gov/Coronavirus for links to information on the impact of the coronavirus, as well as tax relief available for individuals and families, small and large businesses, and tax-exempt organizations.

- They use the loan proceeds to buy an automobile for personal use.

However, they don’t have to pay these taxes until July 1 of the next year (18 months later) when tax bills are issued. Under the terms of the lease, Oak becomes liable for the real estate taxes in the later year when the tax bills are issued. If the lease ends before the tax bill for a year is issued, Oak isn’t liable for the taxes for that year. You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business.

Practical accounting considerations

However, with respect to partly worthless bad debts, your deduction is limited to the amount you charged off on your books during the year. All other bad debts are nonbusiness bad debts and are deductible only as short-term capital losses. Generally, each partner or S corporation shareholder, and not the partnership or S corporation, figures the depletion allowance separately. Each partner or shareholder must decide whether to use cost or percentage depletion.

- You can deduct the interest expense once you start making payments on the new loan.

- If you are filing an income tax return for a corporation, include the reimbursement on the Other deductions line of Form 1120.

- Chang previously covered investing, retirement and personal finance for TheStreet.

The activity must be substantially the same for each year within this period. You have a profit when the gross income from an activity exceeds the deductions. On December 1, 2022, you sign a 12-month lease, effective beginning January 1, 2023, and immediately pay your rent for the entire 12-month period that begins on January 1, 2023. Therefore, your prepayment does not have to be capitalized, and you can deduct the entire payment in the year you pay it. If you are a cash method taxpayer and your advance payment qualifies for this exception, then you can generally deduct the amount when paid.

Selling and distribution expenses

You generally cannot deduct expenses in advance, even if you pay them in advance. This applies to prepaid interest, prepaid insurance premiums, and any other prepaid expense that creates an intangible asset. If you pay an amount that creates an intangible asset, then you must capitalize the amounts paid and begin to amortize the payment over the appropriate period. Under the accrual method of accounting, you generally deduct business expenses when both of the following apply. Generally, you are in a passive activity if you have a trade or business activity in which you do not materially participate, or a rental activity. In general, deductions for losses from passive activities only offset income from passive activities.

Credits and Deductions for Individuals

The rest is for your investment in the permanent improvements. You paid $10,000 to get a lease with 20 years remaining on it and two options to renew for 5 years each. Of this cost, you paid $7,000 for the original lease and $3,000 for the renewal options. Because $7,000 is less than 75% of the total $10,000 cost of the lease (or $7,500), you must amortize the $10,000 over 30 years. That is the remaining life of your present lease plus the periods for renewal. The cost of getting an existing lease of tangible property is not subject to the amortization rules for section 197 intangibles discussed in chapter 8.

In the case of leased property, the depletion deduction is divided between the lessor and the lessee. Depletion is the using up of natural resources extracted from a mineral property by mining, drilling, quarrying stone, or cutting timber. The depletion deduction allows an owner or operator to account for the reduction of the mineral property’s value or basis as a result of the extraction of the natural resource. To elect to amortize qualifying reforestation costs, complete Part VI of Form 4562 and attach a statement that contains the following information. If you deducted an incorrect amount for amortization, you can file an amended return to correct the following.

Your AGI is important because it is the starting point for calculating your tax bill and also the basis on which you might qualify for many deductions and credits. However, an independent producer or royalty owner that also acts as a retailer or refiner may be excluded from claiming percentage depletion. For information on figuring the deduction, see Figuring percentage depletion, later.

Tax-deductible utility expenses must be directly related to your business or rental property, not personal. The amount you can deduct varies depending on the utility type and the percentage of its use for business or rental purposes. These publications cover the general rules for deducting business expenses, specific expenses you can deduct, and forms you may need to fill out. Business-expense deductions refer to expenses incurred during operations, which can be subtracted from your taxable gross income to lower your tax liability. To claim medical-related expenses on your 2023 tax return—which you’ll file in April 2024—the expenses must have been paid in 2023, unless they were charged to a credit card.

This applies whether you pay for property, services, or anything else by incurring a loan, or you take property subject to a debt. Marge and Jeff secure a loan with property used in their business. They use the loan proceeds to buy an automobile for personal use. Jeff and Marge must allocate interest expense on the loan to personal use (purchase of the automobile) even though the loan is secured by business property.

How do you claim tax deductions?

The law firm and accounting firm continued to provide services, including a review of XYZ’s books and records and the preparation of a purchase agreement. On October 22, you signed a purchase agreement with XYZ, Inc. Startup costs don’t include deductible interest, taxes, or research and experimental how revenue affects the balance sheet costs. If you make your business accessible to persons with disabilities and your business is an eligible small business, you may be able to claim the disabled access credit. If you choose to claim the credit, you must reduce the amount you deduct or capitalize by the amount of the credit.

Property tax deduction

She called it a “silent need” that is becoming more prevalent, and she said that passing the tax exemption would deliver badly needed relief for families. When families can’t afford a constant supply of clean diapers, their babies are more vulnerable to painful rashes and urinary tract infections and require more doctor visits, the group said. Everything you need from efficient corporate tax preparation software. One unique aspect of C corporations is that they are subject to “double taxation.” This means that a C corp’s profits are effectively taxed twice. The calculation of the cost of goods sold is pretty straight forward for retail businesses, as you can learn from the example below.

Home Office Expenses

Indirect costs include rent, interest, taxes, storage, purchasing, processing, repackaging, handling, and administrative costs. An employer that was a recovery startup business could also claim the employee retention credit for wages paid after September 30, 2021, and before January 1, 2022. An expense is a cost that businesses incur in running their operations. Expenses include wages, salaries, maintenance, rent, and depreciation. Businesses are allowed to deduct certain expenses from taxes to help alleviate the tax burden and bulk up profits. Each of these taxes has its own tax rate, which is used to calculate the amount owed.

How Much Bookkeepers Charge

Content

I picked the most popular freelance platforms and ran several tests over the past few months. After hiring several accountants to work on different projects, I decided to share the results by compiling this list of the best freelance websites for hiring accountants. Some are budget-friendly and feature thousands of accountant profiles, while others are costly, hard to use, and not really worth your time and money. All businesses have to prepare and maintain financial documents and reports – no one wants trouble with the law. But finding the right accountant for your business can be a real challenge, especially if you don’t know where to look. By doing a little bit of accounting every day, you’ll make your overall operations are easier to handle. Organizing your receipts and invoices as they come in will save you from a huge amount of work during tax season.

Should I get an accountant as a freelancer?

It's worth bearing in mind that an accountant is there to save you time. There is an 'opportunity cost' to doing your accounts on your own. Typically, for freelancers, that amounts to making sales and doing paid work.

freelance accountantstyle Quickstart Guide An overview of lifestyle, care-related gigs. Thoroughly vet all candidates to make sure they can do the job and are not misrepresenting themselves.

How Much Do Freelance Accountants Make?

Bookkeeping and accounting are both essential business functions. A bookkeeper has the training to record financial transactions. An accountant has the qualifications to deal with the whole accounting process. Also, do not make the mistake of hiring a bookkeeper to do the job of an accountant. Small business run on tight budgets so may not have the finances to hire a full-time accountant. But, accounting is much more than a professional accountant will help you resolve all issues. Bonsai integrates and automates every step of your business so it runs seamlessly – from proposal to tax season.

Sales and Use Tax Accountant – Contract Alpharetta – Going Concern

Sales and Use Tax Accountant – Contract Alpharetta.

Posted: Mon, 06 Feb 2023 19:12:44 GMT [source]

That said, if you’re seeing significant growth and you’re struggling to keep your financial records in shape, hiring an accountant is definitely more than worth it. You need to think about payroll costs, including social security contributions, unemployment, sick leave, and vacation. With an accounting firm, you have to pay fees at much higher rates for senior partners that can add up. After gaining two to three years of experience, freelance accountants can advance their career as a full-time consultant. Upon gaining vast experience, you will have an option to become a financial planner or chartered accountant.

A freelance accountant does much more than just balancing the books

We’re still the same people and offer the same amazing services which have been refined over 30 years in the industry. Learn how businesses can benefit from the refund policy, how a small business return policy can save you time and money, and even bring profit. We hope that with the help of our tips for success, you’ll find a way to create a flourishing career as an accountant within the freelance model. Try to automate as much as you can, especially all the repetitive and monotonous tasks in accounting. On the flip side, personalize the elements that matter to you, whether it’s your working space or your work routine. Working freelance usually means spending a lot of time on your own.

Ironically, freelance accountants who fail to do their own accounting may face serious consequences, especially if caught understating their NTI. Freelancing has become more popular in Singapore in recent years due to the high cost of living. Many people also offer freelance web development, accounting, accounting training and virtual assistant services to companies within or outside of Singapore. Freelancing simply refers to providing your services to companies or individuals on a contract or project basis.

Freelancer Accounts for One Low Monthly Fee

These planned reminders will get you your https://www.bookstime.com/ with just a little effort on your part. As a freelancer, it can be tricky to separate your personal and business finances. To avoid confusion, you should open up a separate bank account for business transactions. This differentiation in your finances can make your life a lot easier. My husband and I are looking to hire an accountant for our company to manage the paper and taxes next week, and we want to ensure we choose the right one. Now you know all of the great benefits of hiring a freelance accountant. You can save money while getting experienced financial help that is flexible and available.

- You are in business to make money so keeping up with the financial paperwork is an added burden.

- Clicking a profile is the best way to make a final decision about the accountant you want to hire on Freelancer.

- I guess that sometimes the life of a freelancer can be lonely; you can miss out on the interaction of an office environment.

- Freelance accounting is different to working full-time in an accountancy firm or in-house department for a number of reasons.

- Being business-savvy, good with numbers and finances, and with an entrepreneurial spirit makes accounting a great side hustle.

- This career requires financial and emotional resilience to weather fluctuations, as employee benefits are often less available.

- This assist you when making decisions to scale up production and resources, for example.

Stay Small Longer: Recent Changes Make It Easier for Growing Businesses to Pursue Small Business Contracts from the Federal Government Foley & Lardner LLP

Content

Many businesses enter Loan Agreements with banks or financial institutions and simply sign the lender’s “standard” form. The standard form tends to be very one-sided in favor of the lender, with various restrictions on the borrower. A business lease for office or retail space is often one of the most significant contracts for a business. The starting place for most lease negotiations is the landlords allegedly “standard” lease, which tends to be incredibly one-sided in favor of the landlord.

You (or your predecessor) must not have treated any worker holding a substantially similar position as an employee for any periods beginning after 1977. See Publication 1976, Section 530 Employment Tax Relief RequirementsPDF, for more information. If, as an employee, you have been asked to sign an at-will contract without having previously discussed this with your employer, and this conflicts with previous discussions, then you should consult a lawyer before signing the document.

Voluntary Classification Settlement Program

My focus as a venture capitalist is on investing in Internet and Digital Media companies. I am also the founder or co-founder of several Internet companies, having sold them to NBC Interactive, LexisNexis and D&B. I am the co-author of Poker for Dummies https://www.bookstime.com/articles/employment-contracts-for-small-businesses and a Wall Street Journal bestselling book on small businesses. I was also a corporate partner at the law firm of Orrick, Herrington & Sutcliffe, with experience in startups, mergers and acquisitions, strategic alliances, and venture capital.

- Copyright Rocket Lawyer Incorporated.Rocket Lawyer is an online legal technology company that makes the law simpler and more affordable for businesses, families and individuals.

- It’s important to note that while certain provisions are required by law in some jurisdictions, there is usually room for customization based on the needs of your small business.

- An employee’s pay, benefits, and other terms of employment are negotiated between the parties during the hiring process.

- A non-disclosure agreement should be signed by possible employees before interviews to make sure important information about the business doesn’t get out.

- Your partnership agreement helps you avoid or deal with tax issues, legal issues, state laws, changes to the business, or disputes.

Stock Purchase Agreements are the vehicle where stock sales can be effected. Such agreements can run from a few pages to 50 or more, depending on the investors and the complexity of the deal. Swara Ahluwalia is a freelance content writer with experience in the technical, B2B and SaaS domain. In her downtime, you will most likely find Swara training for her next marathon or spending time with her two daughters.

Determining Whether the Individuals Providing Services are Employees or Independent Contractors

Practical and real-world advice on how to run your business — from managing employees to keeping the books. With a seamless creation and a paperless signing process, your new hire will be on board in no time. This might include offering severance packages or outplacement plans to help employees land on their feet. Be sure to check with qualified legal experts to ensure that any non-compete clauses and other employee restrictions will hold up to judicial review in your part of the world. If there are different rules for compensation surrounding the exceptions, such as a shift differential or holiday pay, take the time to cover that, as well.

Accounts payable turnover ratio

It provides insights into liquidity, working capital management, and the company’s ability to meet its financial obligations. Using those assumptions, we can calculate the accounts payable turnover by dividing the Year 1 supplier purchases amount by the average accounts payable balance. The accounts payable turnover ratio of a company is often driven by the credit terms of its suppliers.

- It is also sometimes referred to as the Creditors Turnover Ratio or Creditors Velocity Ratio.

- This creditworthiness gives the organization an edge to negotiate credit periods and enjoy flexibility in payments, ultimately affecting the ratio.

- According to Bob’s balance sheet, his beginning accounts payable was $55,000 and his ending accounts payable was $958,000.

- When the figure for the AP turnover ratio increases, the company is paying off suppliers at a faster rate than in previous periods.

- Bear in mind, that industries operate differently, and therefore they’ll have different overall AP turnover ratios.

- For example, a company’s payables turnover ratio of two will be more concerning if virtually all of its competitors have a ratio of at least four.

To find the average accounts payable, simply add the beginning and ending accounts payable together and divide by two. In conclusion, mastering the Accounts Payable Turnover Ratio is not just about crunching numbers; it’s about gaining valuable insights into your company’s financial health and operational efficiency. Company A reported annual purchases on credit of $123,555 and returns of $10,000 during the year ended December 31, 2017. Accounts payable at the beginning and end of the year were $12,555 and $25,121, respectively. The company wants to measure how many times it paid its creditors over the fiscal year. Trade payables are the amounts a company owes to its suppliers from whom it has purchased goods or services on credit.

In other words, the accounts payable turnover ratio is how many times a company can pay off its average accounts payable balance during the course of a year. The ratio is a measure of short-term liquidity, with a higher payable turnover ratio being more favorable. Accounts payable turnover is the ratio of net credit purchases of a business to its average accounts payable during the period.

Therefore, COGS in each period is multiplied by 30 and divided by the number of days in the period to get the AP balance. A liquidity ratio measures the company’s ability to generate sufficient current assets to pay all current liabilities, and working capital is a metric to assess liquidity. Liquidity improves when managers collect cash quickly and carefully monitor cash outflows.

It might be that the company has successfully managed to negotiate better payment terms which allow it to make payments less frequently, without any penalty. The accounts payable turnover ratio is a measurement of how efficiently a company pays its short-term debts. When the figure for the AP turnover ratio increases, the company is paying off suppliers at a faster rate than in previous periods.

Accounts payable turnover ratio: Definition, formula, calculation, and examples

The business needs more current assets to be converted into cash to pay accounts payable balances. Assume that Premier Construction has $2 million in net credit purchases during the third quarter of 2023, and the average accounts payable balance is $400,000. As a result of the late payments, your suppliers were hesitant to offer credit terms beyond Net 15. As your cash flow improved, you began to pay your bills on time, causing your AP turnover ratio to increase. The AP turnover ratio provides valuable insights into a company’s payment management efficiency and financial health.

We and our partners process data to provide:

A higher ratio is a strong signal of a company’s positive creditworthiness, as seen by prospective vendors. The trade payables and accounts payable turnover ratios are basically the same concept referred to using different terminologies. Both metrics assess how quickly a business settles its obligations to its suppliers. In conclusion, there are several factors one should see before comprehending the numbers of the accounts payable turnover ratio. A proper diagnosis can help an organization adopt better business practices to improve creditworthiness and cash flow.

AP & FINANCE

Calculating the accounts payable ratio consists of dividing a company’s total supplier credit purchases by its average accounts payable balance. A business that generates more cash inflows can pay for credit purchases faster, leading to a higher AP turnover ratio. This article explores the accounts payable turnover ratio, provides several examples of its application, and compares the metric with several other financial ratios. Finally, the discussion explains how your business can improve your ratio value over time.

So, while the accounts receivable turnover ratio shows how quickly a company gets paid by its customers, the accounts payable turnover ratio shows how quickly the company pays its suppliers. The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. It shows how many times a company pays off its accounts payable during a particular period.

What is a Good Payables Turnover Ratio?

As part of the normal course of business, companies are often provided short-term lines of credit from creditors, namely suppliers. Therefore, over the fiscal year, the what is the progressive consumption tax company takes approximately 60.53 days to pay its suppliers. When cash is used to pay an invoice, that cash cannot be used for some other purpose.

Average accounts payable is the sum of accounts payable at the beginning and end of an accounting period, divided by 2. The investor can see that Company B paid off its suppliers at a faster rate than Company A. That could mean that Company B is a better candidate for an investment. However, the investor may want to look at a succession of AP turnover ratios for Company B to determine in which direction they’ve been moving. Whether the term “trade payables” or “accounts payable” is used can depend on regional or industry practices or may reflect slight differences in what is included in the accounts. However, fundamentally, both ratios serve the same purpose in financial analysis. In summary, both ratios measure a company’s liquidity levels and efficiency in meeting its short-term obligations.

A high ratio indicates prompt payment is being made to suppliers for purchases on credit. A high number may be due to suppliers demanding quick connecticut bookkeeping payments, or it may indicate that the company is seeking to take advantage of early payment discounts or actively working to improve its credit rating. The accounts payable turnover ratio shows investors how many times per period a company pays its accounts payable. In other words, the ratio measures the speed at which a company pays its suppliers.

Both these ratios measure the speed with which a business pays off its suppliers. A decline in the AP turnover ratio may also be related to more favorable credit terms from suppliers. In some instances, a business can negotiate payment terms that allow the business to extend the period of time before invoices are paid. A low AP turnover ratio usually indicates that the company is sluggish while paying debts to its creditors.

Controller for Multiple Real Estate Clients 100% Remote, Flexible Hours BooksTime Remote

Contents:

The current and the future users of the financial statements, such as the investors, creditors, are the stakeholders to be considered. Expenses must be recognized on the income statement in the same period as when the coinciding revenues were earned. Depreciation is used to distribute the cost of the asset over its expected life span according to the matching principle.

After a 20-year wait, SLO County town opens its first library since 1979 – San Luis Obispo Tribune

After a 20-year wait, SLO County town opens its first library since 1979.

Posted: Tue, 13 Dec 2022 08:00:00 GMT [source]

For example, early payment discounts can decrease your DSO — the average number of days that it takes you to collect revenue after the sales date. In a dynamic discounting program, the supplier chooses if, when, and which invoices to advance payment on. The lease agreement usually provides available notice system in case of termination, anyone penalties that might need to be paid, instead einem option to change one agreement terms. In any lawsuit, couple will need to make records of this termination in their accounting books press we willingness guide you through the process.

Business Development Manager

If you continue to see this message, please emailto let us know you’re having trouble.

If who company adheres to the GAAP and buy who leased asset, it remains none considered a termination. Thus, the business would note a as a purchase of a modern asset. The value of this value will be calculated by adding the difference between the remaining lease liability real the procure price when this asset has bought to the leased asset carrying value.

Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. No, I would not like to receive working capital insights from PrimeRevenue. Yes, I would like to receive working capital insights from PrimeRevenue. This is because you have not earned any revenues from selling goods created from the raw materials. This is due to the fact that the expenses are recognized regularly.

Time is money—get more of both

Once you apply and are approved, you will be given a loan estimate for your monthly payments based on principal, taxes, interest, and insurance. Escrow real estate escrow is an account that holds your funds for earnest money, down payment, and closing costs, as well as the purchase funds from your mortgage lender. The benefits to using an escrow agent and/or an escrow account are many. Because escrow benefits both buyer and seller, they generally split the escrow fees.

One of the easiest methods for allocating expenses is immediate recognition. The commission will be included in the cause and effect method because any commission the salesperson earns is directly connected to the sale of the T-shirts. QuickBooks Time allows you to pull employee data for payroll and invoicing, keep track of employee tasks and schedules, and automatically remind employees to clock in or out. We’re looking for a Controller or CFO-level accountant to oversee services for RE clients. We’re growing fast and doing especially well with real estate clients. This card is allotted to each worker whenever a worker takes up a particular job.

- The value of this value will be calculated by adding the difference between the remaining lease liability real the procure price when this asset has bought to the leased asset carrying value.

- It is suitable for small organisation where the number of employee and job is small.

- Familiarity with RE & property management apps is a plus (e.g. AppFolio, Yardi, Buildium, Stessa, etc.).

- Stjude.org traffic estimate is about 9,157 unique visitors and 16,483 pageviews per day.

Some gap will must recorded in the Income Statement for the period as acquire or loss. Track every second worked and increase billable time by nearly 10%2 You can also oversee team productivity and project status, and adjust budget, deadlines, and resources as needed. We have big plans to disrupt the accounting and bookkeeping industry – and we’re off to a great start. Our ideal candidate has either held in-house accounting leadership roles or Senior Accountant type positions in accounting firms. A key part of the role is to establish a personal rapport with your clients, to get to know them, and to earn their trust.

Suggested accounts

It’s a juggling act, with multiple outstanding checks with different services, goals and personalities. Can describe a few different functions, from the time your offer is accepted to the day you close on your home — and even after you become a homeowner with a mortgage. Discuss the importance of conceptual framework and why it is important when establishing new accounting rules. Let’s say FedEx spends $1 million for a series of television commercials.

On the other hand, in a holding escrow transaction, holdback escrow fees are split between the buyer and seller. In any other holdback escrow transaction, the money is released at the end of the merger acquisition or online purchase. If he fails to identify, then there will be professional misconduct by the Auditor, so the Audit has to check the same. Therefore, a company following the accrual concept can save itself. In other cases, companies using cash accounting actually get tax benefits later. It depends on the transaction type and when money is changing hands.

Technical Program Manager(Release Management)

So, the cost of the machine is offset against the sales in that year. This matches costs to sales and therefore gives a more accurate representation of the business, but results in a temporary discrepancy between profit/loss and the cash position of the business. Because of this difficulty, advertising expenditures are recognized as expense in the period incurred, with no attempt made to match them with revenues. Some assets, expense recognition principle for instance, are measured at their net realizable value. For example, if customers purchased goods or services on account for $10,000, the asset, accounts receivable, would initially be valued at $10,000, the original transaction value.

It’s difficult to determine when, how much, or even whether additional revenues occur as a result of that particular series of ads. Consider using the “h1” element as a top-level heading only (all “h1” elements are treated as top-level headings by many screen readers and other tools). An “img” element must have an “alt” attribute, except under certain conditions. For details, consult guidance on providing text alternatives for images. McAfee assesses stjude.org for a meaningful set of security threats.

Featured dangers from annoying pop-ups to hidden Trojans, that can steal your identity, will be revealed. McAfee does not analyze stjude.org for mature or inappropriate content, only security checks are evaluated. Google Safe Browsing notifies when websites are compromised by malicious actors. These protections work across Google products and provide a safer online experience. SafeSearch works as a parental control tool to filter out any content that might be inappropriate for your children.

The landlord might also desire to ending aforementioned lease because the payments have did made or are live structural damaged, illegal activities, or noise nuisance. Get time tracking software for construction, landscaping, home healthcare, and more. No matter how big or small, see how QuickBooks Time can help your business thrive. Get valuable business insights so you can predict job costs, plan for payroll, and boost profitability.

It gives in detail the activities of the worker and the time spent in each job. One sheet is allotted to each worker and a daily record is made therein. It is suitable for small organisation where the number of employee and job is small. Time booking signifies the time spent by a worker on each job, process or operation. It is more important in case of direct workers as compared to indirect workers.

Is That Black Enough for You?!? movie review (2022) – Roger Ebert

Is That Black Enough for You?!? movie review ( .

Posted: Fri, 28 Oct 2022 07:00:00 GMT [source]

https://1investing.in/ is an ambitious, innovative accounting & bookkeeping firm founded in 2016 with operations in 4 countries. We are growing fast and looking for exceptional individuals to join our team. Each worker is given a time sheet wherein jobs done in a week are recorded. It reflects a consolidation of the total hours worked during a particular week.

Relying on Google Mobile-Friendly test stjude.org is well optimized for mobile and tablet devices, however website page loading time may be improved. Stjude.org traffic estimate is about 9,157 unique visitors and 16,483 pageviews per day. Now that business is expanding, get tools to simplify new demands and set everyone up for success. Rest easy knowing who’s working, what they’re working on, and what job they’re doing at any time.

In this card the worker enters the time of commencement of a job as well as time of finishing the job. The entries in the job card may be made with the help of machines like time-recording clock. M&A uses a mechanism that is known as holdback escrow, where a portion of the purchase price is put in a third-party account to serve as security for the buyer. As inbound any diverse case, the difference between the two would be noted on the financial statements as gain conversely loss. According toward the Global Financial Reported Standards, which liability and asset value shall be changed for exact represent an partial lease discontinuation.

Elizabeth Leach Has Made Her Gallery a Paradise for Visual Artists – Willamette Week

Elizabeth Leach Has Made Her Gallery a Paradise for Visual Artists.

Posted: Tue, 06 Dec 2022 08:00:00 GMT [source]

In both of those cases, the buyer would want to compare those interest rates to the APR of the discount to determine which course of action would suit them best. If they can borrow from a line of credit for anything less than 18.18%, then they would be better off paying the invoice on day 10 with borrowed funds and pay back the borrowed funds on day 30. This means that a customer is allowed to deduct 1% of the invoice amount, if payment is made within 10 days . In other words, the customer saves 1% for paying 20 days early. Therefore, an invoice of $1,000 with terms of 1/10, net 30 means that the $1,000 obligation will be settled in full for $990 if it is paid within 10 days. If your company has performance targets related to financial metrics, early payments can help you reach these goals.

GoSystem Tax RS Multi Factor Authentication MFA Single Sign On SSO SAML

Automatically import your QuickBooks desktop income and expense accounts. GoSystem Tax RS also integrates with a variety of third-party applications which include EMC Documentum, SurePrep, and Copanion, which all use OCR processing technology. Integration with Checkpoint, PPC Deskbooks, and Partner Bridge is also available.

- Automatically import your QuickBooks desktop income and expense accounts.

- Cryptocurrency and NFT tax software built to save time & maximize refund.

- Protect your data with multiple layers of security, including network security, virus protection, encryption schemes, and more.

- TurboTax® Business CD/Download is business tax software that makes preparing business taxes easy.

- GoSystem Tax RS does not currently offer a portal directly within the application, though it does integrate with the NetClient CS Portal.

Enable 4 Popular Free and Open Source Accounting Software Tax RS login with SAASPASS secure single sign-on (SSO) and allow your users to login to GoSystem Tax RS and other SAASPASS integrated applications, all at once. Secure access to GoSystem Tax RS with SAASPASS multi-factor authentication (MFA) and secure single sign-on (SSO) and integrate it with SAML in no time and with no coding. Log into your GoSystem Tax RS services securely without ever having to remember passwords on both your computer and mobile with SAASPASS Instant Login (Proximity, Scan Barcode, On-Device Login and Remote Login). GoSystem Tax RS supports both federal and state e-filing, with users able to review, edit, and validate any completed return prior to e-filing. GoSystem Tax RS supports multiple users, making it easy for a team to work on a return simultaneously. Diagnostic messages are available throughout the application and users can click on any line in a completed return to view a complete audit trail for the amount entered.

Because all work is handled online, you’ll pay less in maintenance costs, face fewer storage issues, and rest easy with assured business continuance. 1099 form is one of several IRS tax forms used in the United States to prepare and file an information return. The software offers tools to verify the buyer’s location and transaction at point of sale with accurate tax calculation. The Visual dashboards used to measure the real-time revenue data with alerts. TurboTax® Business CD/Download is business tax software that makes preparing business taxes easy. Supports s Corp, partnership, C Corp, and multi-member LLC or trust tax forms.

Golden Opportunities Scholarship and Competitive Programs Application System

Two-step verification and secure single sign-on with SAASPASS will help keep your firm’s GoSystem Tax RS access secure. GoSystem Tax RS also features an automatic calculation option, allowing users to view return calculations as information is entered with an option to turn the feature off if desired. Beginning July 31, 2023 Thomson Reuters has extended its support options to include global shared service centers located outside the United States to service you. Protect your data with multiple layers of security, including network security, virus protection, encryption schemes, and more. Note that students must be admitted to the university in order to access the scholarship portal. Secure single sign-on (SSO) and two-step verification with SAASPASS will help keep your firm’s GoSystem Tax RS secure.

Tax return assembly & delivery automation for individual and entity returns, with a superior client experience. Cryptocurrency tax reporting software that streamlines the compliance workflow process. In this demonstration you’ll explore the processes for MyTaxInfo, and see how it can make the collection of tax information from taxpayers easier and more reliable. You’ll also see how MyTaxInfo virtually eliminates transcription errors, ensures accuracy, improves speed and efficiency, and how it can be customized for your firm and client needs thanks to its complete integration with GoSystem Tax RS.

Users can also navigate directly to a specific form using the QuickForm feature, with links available to choose from numerous form options. Once a return is completed, users have the option to preview the return for errors or omissions. GoSystem Tax RS supports multiple monitors, making it easy to view various sections of a return simultaneously. If errors are found, corrections can be made directly in the organizer, with the option to refresh the return to reflect the changes. Those using Thomson Reuters GoFileRoom or FileCabinet CS can automatically save the completed return directly without leaving the application. GoSystem Tax RS has a minimalist approach, using intuitive user entry screens that are populated only with necessary features and functions.

Bloomberg Income Tax Planner

GoSystem Tax RS offers an excellent selection of help and support options, with users able to access help files from any screen in the application. A variety of online tools and resources are also available to users through the password protected website, including access to a robust user community. Users can also utilize the Help and How-To Center for access to a searchable knowledgebase as well as the GoSystem Tax RS support page, which includes access to product updates and new releases, as well as detailed user training information. Users can contact support via the help page or by using the toll-free number.

Available exclusively online, GoSystem Tax RS was one of the pioneers of online tax compliance, with firms able to access the application using an online virtual office or as a SaaS application. The product also works offline, with data synching with the core application upon reconnection. Used by the top 100 CPA firms, Thomson Reuters GoSystem Tax RS is the market leader for corporate tax departments. Highly scalable, it can handle your workflow no matter the size of your firm. The software serves clients filing all return types — including multitiered consolidated corporate returns, life insurance returns (including mixed group filings), and tax equalization returns.

GoSystem Tax RS is best suited for larger firms or corporate tax departments who are tasked with preparing complex tax returns for a variety of clients. The application also offers top-notch integration with other CS Professional Suite applications that increase functionality tremendously. GoSystem Tax RS pricing is customized for each firm, starting at around $4,000 annually for a single-user system. GoSystem Tax RS from Thomson Reuters is part of the CS Professional Suite of applications. A good fit for larger accounting firms as well as corporate tax departments, GoSystem Tax RS is equipped to handle the complex corporate returns, life insurance returns, and tax equalization returns, easily handling individual returns as well.

This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Process individual, corporate, and partnership returns with timesaving tools, such as the Allocation and Apportionment module.

Secure GoSystem Tax RS with SAASPASSTwo-Factor Authentication (2FA) and Single Sign-On (SSO) with SAML Integration

Clients can file all types of returns using the software, including multitiered corporate returns, life insurance returns (including mixed groups filings) and tax equalization returns. You will save money on maintenance, have fewer storage problems, and can rest assured that your business will continue to function. You can tackle the most complex tax returns such as multitiered consolidation return processing for corporations or partnerships.

Tackle the most complex tax returns, such as multitiered consolidated return processing for corporations and partnerships. We blend tax knowledge and technology to provide superior compliance tools. Over 100 thousand users trust our 10+ years of experience in digital tax and regulatory reporting. Cryptocurrency and NFT tax software built to save time & maximize refund. Import crypto transactions from wallets and exchanges.Watch the platform calculate gains and losses for all transactions trading, staking, NFTs, or anything else. Once user view the transaction history, download tax report with the click of a button.

- Tax return assembly & delivery automation for individual and entity returns, with a superior client experience.

- Users can contact support via the help page or by using the toll-free number.

- Users can also navigate directly to a specific form using the QuickForm feature, with links available to choose from numerous form options.

- Clients can file all types of returns using the software, including multitiered corporate returns, life insurance returns (including mixed groups filings) and tax equalization returns.

- Understanding business and tax registration requirements in each state is time-consuming and distracting.

- Corptax transforms the business of tax through technology, business process expertise and award-winning support.

A variety of data can be imported including a trial balance, a client organizer, and tax forms. Professional tax software for tax preparers and accountants with a full line of federal, state, and local tax programs including 1040 individual, 1120 corporate, 1065 partnership, 1041 estates and trusts, and multi-state returns. Reduce duplicate data entry through automatic linking between business entities and personal tax returns, using data-sharing throughout the CS suite.

Ledgible Crypto Tax Pro

CheckMark 1095 forms are used to display the health care coverage provided by the employers for their employees as per IRS and ACA (Affordable Care Act) It’s suitable for both size businesses to report and file or transmit ACA requirements. Yearli by Greatland is a complete federal, state, and recipient W-2, 1099 and 1095 filing program designed to help you generate, file, print and mail all related forms. Register for payroll taxes in 10 minutes and let Middesk take over your ongoing state compliance. Understanding business and tax registration requirements in each state is time-consuming and distracting. Spend 5 minutes telling us about your business, and we’ll create all of the accounts you need to operate and pay employees in any state.

Provide the easiest to use and most convenient secure access to GoSystem Tax RS with SAASPASS two-factor authentication and single sign-on (SSO) with SAML integration. Log into your GoSystem Tax RS securely without remembering passwords on both your computer and mobile with SAASPASS Instant Login (Proximity, Scan Barcode, On-Device Login and Remote Login). Enable GoSystem Tax RS login with SAASPASS secure single sign-on (SSO) and allow users to login to GoSystem Tax RS and other SAASPASS integrated apps, all at once. You can enable GoSystem Tax RS login with SAASPASS secure single sign-on (SSO) and provide your users the ability to login to GoSystem Tax RS and other SAASPASS integrated apps, all at once. GoSystem Tax RS offers complete integration with other CS Professional Suite applications which include Accounting CS, Workpapers CS, Trial Balance CS, Write-Up CS, and both FileCabinet CS, and GoFileRoom, mentioned earlier.

You can deploy your team simultaneously to a single tax return, so each specialist can perform their role simultaneously. Multiple layers of security are available to protect your data, including network security and encryption schemes. GoSystem Tax RS does not currently offer a portal directly within the application, though it does integrate with the NetClient CS Portal. The portal offers easy document exchange between clients and firms, with clients provided secure access to the portal, where they can upload or download documents at any time. Data importing options are also outstanding in GoSystem Tax RS, with users able to import data from just about any accounting system.

GoSystem Tax RS makes good use of tax organizers, allowing users to access the client organizer or the tax forms. The QuickTrack feature offers access to organizer details, with a series of links available for quick access to a particular area within the organizer. A good fit for larger accounting firms as well as corporate tax departments, GoSystem Tax RS is equipped to handle the complex corporate returns, life insurance … GoSimpleTax is a highly awarded online tax return and self assessment software. Corptax transforms the business of tax through technology, business process expertise and award-winning support. Clients achieve breakthrough tax performance using the first and only single-platform solution on the market.

Comprehensive return processing

Entrust your reputation with our gold standard for high volume and complex returns since 1978. The Golden Opportunities Scholarship and Competitive Programs Application System (GO System) is the hub for all scholarships at The University of Southern Mississippi. It houses a variety of scholarship opportunities for incoming and continuing students (both undergraduate and graduate).