Balance Sheets 101: Understanding Assets, Liabilities and Equity

This section will discuss the relationship between equity and shareholder relations, focusing on common and preferred stock and retained earnings. Below liabilities on the balance sheet is equity, or the amount owed to the owners of the company. Since they own the company, this amount is intuitively based on the accounting equation—whatever assets are left over after the liabilities have been accounted for must be owned by the owners, by equity.

Depreciation is the process of allocating the cost of a fixed asset over its useful life. This process recognizes that assets lose value over time due to wear and tear or obsolescence. For example, if a company purchases a vehicle for $40,000 and expects it to last for five years, it might depreciate the vehicle at a rate of $8,000 per year.

Balance Sheets 101: Understanding Assets, Liabilities and Equity

- If a company keeps accurate records using the double-entry system, the accounting equation will always be “in balance,” meaning the left side of the equation will be equal to the right side.

- Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit.

- If you were to take a clipboard and record everything you found in a company, you would end up with a list that looks remarkably like the left side of the balance sheet.

- This account may or may not be lumped together with the above account, Current Debt.

Retained earnings play a crucial role in growing a company and increasing its equity value over time. Intangible assets are non-physical assets that have value to a company, such as patents, goodwill, and intellectual property. Valuing intangible assets can be more challenging than valuing fixed assets, as their value is often subjective and may not be easily observable in the market. In Double-Entry Accounting, there are at least two sides to every financial transaction.

In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly. Thus, the accounting equation is an essential step in determining company profitability. The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system.

For example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount. When a company purchases inventory for cash, one asset will increase and one asset will decrease. Because there are two or more accounts affected by every transaction, the accounting system is referred to as the double-entry accounting or bookkeeping system.

If we rearrange the Accounting Equation, Equity is equal to Assets minus Liabilities. Net Assets is the term used to describe Assets minus Liabilities. Liabilities are owed to third parties, whereas Equity is owed to the owners of the business. You should also include contingent liabilities or liabilities that might land in your company’s lap.

Impact of transactions on accounting equation

For example, if a company with five equal-share owners has $1.2 million in assets but owes $485,000 on a term loan and $120,000 for a semi-truck it financed, bringing 8 steps for hiring the best employees its liabilities to $605,000. Their equity would equal $595,000 ($1,200,000 – $605,000), or $119,000 per owner. Tracking assets and liabilities is an important part of managing your finances. This information is also needed to calculate financial performance metrics like return on assets. Additionally, all prospective lenders and investors will want to see a current balance sheet. Assets will typically be presented as individual line items, such as the examples above.

This account may or may not be lumped together with the above account, Current Debt. While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year. For example, if a company takes on a bank loan to be paid off in 5-years, this account will include the portion of that loan due in the next year. The most liquid of all assets, cash, appears on the first line of the balance sheet. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. A company’s cash flow statement provides insights into its cash inflows and outflows over a specific period.

As such, the balance sheet is divided into two sides (or sections). The bom acct meaning left side of the balance sheet outlines all of a company’s assets. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Common examples of assets found on a balance sheet include accounts receivable, cash, buildings, and inventory.

Assets, liabilities, and equity are the three primary components of a balance sheet. Assets are the resources owned by a company, such as cash, equipment, and inventory. Liabilities are the obligations of the company, such as loans, accounts payable, and other debts. Equity is the residual interest in the assets of the company after deducting liabilities, representing the ownership interest of the shareholders or owners.

Current Liabilities

Then, current and fixed assets are subtotaled and finally totaled together. However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization. Often, a company may depreciate capital assets in 5–7 years, meaning that the assets will show on the books as less than their “real” value, or what they would be worth on the secondary market. If the net amount is a negative amount, it is referred to as a net loss. Because the value of liabilities is constant, all changes to assets must be reflected with a change in equity. This is also why all revenue and expense accounts are equity accounts, because they represent changes to the value of assets.

These are listed at the bottom of the balance sheet because the owners are paid back after all liabilities have been paid. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit). The income and retained earnings of the accounting equation is also an essential component in computing, understanding, and analyzing a firm’s income statement. This statement reflects profits and losses that are themselves determined by the calculations that make up the basic accounting equation.

In the accounting equation, every transaction will have a debit and credit entry, and the total debits (left side) will equal the total credits (right side). In other words, the accounting equation will always be “in balance”. This statement is a great way to analyze a company’s financial position. An analyst can generally use the balance sheet to calculate a lot of financial ratios that help determine how well a company is performing, how liquid or solvent a company is, and how efficient it is. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). Below liabilities on the balance sheet, you’ll find equity, the amount owed to the owners of the company.

How does owner’s equity differ from liabilities and how are both reflected in the accounting statements?

Essentially, equity shows what would be left for the owners if all assets were used to pay off all liabilities. A higher liquidity ratio generally indicates that a company is better equipped to pay its short-term debts, reducing the risk of financial distress. The issuance and management of common and preferred stock play a significant role in shaping the equity structure and investor relations of a company. Shareholders’ equity ultimately indicates the financing provided by the company’s owners and the earnings generated from its operations. You can think of them as resources that a business controls due to past transactions or events. This usually differs slightly from the market value of the company.

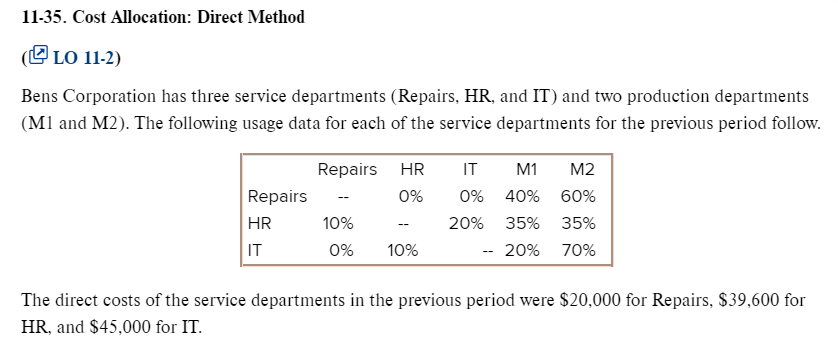

14 2: Direct Method of Allocation Business LibreTexts

Understanding how costs are structured is crucial for making informed financial decisions and ensuring long-term sustainability. Direct expenses refer to expenses that are incurred as a result of the manufacturing of goods or rendering of services, and are easily identifiable with a specific activity or service. Direct costs are the ones that aid every organization in strategic management of the finance thus enhancing the budgeting, pricing and the making of profits. For each expense assess its directness or contribution to the output of the concerned product or project. Include only those specific expenses related to the final product and omit any generic or overhead ones such as power bills or remuneration of office assistants.

Create a Free Account and Ask Any Financial Question

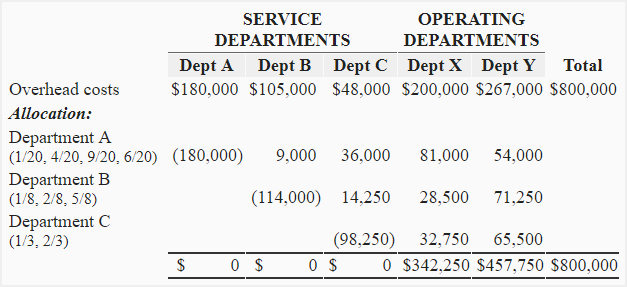

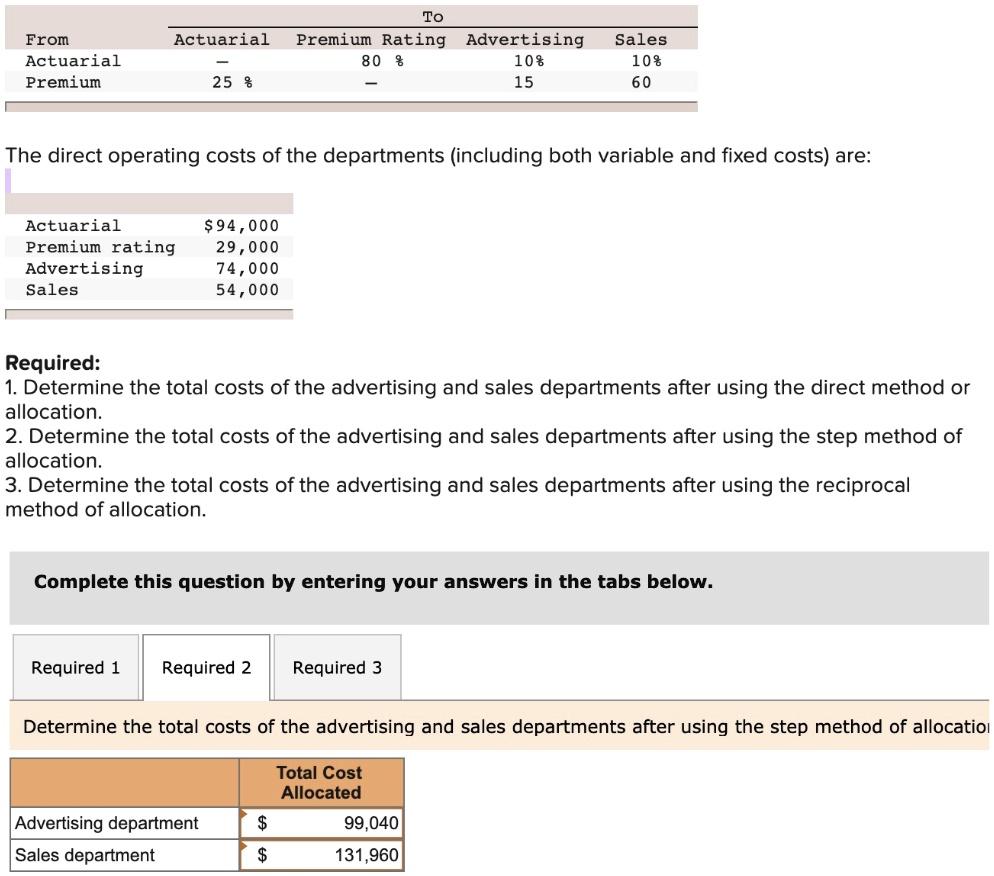

The total cost of each service department, including the allocated costs, is allocated step-by-step until all service departments have been allocated. One effective strategy is to implement a hybrid allocation model that combines elements of direct, step-down, and reciprocal methods. This approach allows organizations to tailor cost distribution to the specific dynamics of each department. For instance, direct allocation can be used for easily traceable costs like departmental supplies, while step-down allocation might be applied to more interconnected services such as facilities management. Reciprocal allocation can address the intricate interdependencies of departments that frequently exchange services, ensuring a comprehensive reflection of resource usage.

Which activity is most important to you during retirement?

Suppose the after split-off costs, such as collecting and packagingthe parts are estimated to be $25 for 2,000 pounds of feet, beaks and gizzards. If the company does not inventory theseby-products and uses the cost reduction method, the entries are as follows. The self services (the 50 KWH’s used by S1 and the 30 labor hours used by S2) are ignored along with the reciprocal services (the 100 KWH’s used by S2and the 20 labor hours used by S1) in developing the proportions. Thus, the denominator for developing the proportions for S1 is 800,not 950 and the denominator for developing the proportions for S2 is 250, not 300. For instance, if a department hires a consultant for a specific project, the consulting fee can be directly allocated to that department.

Types of Costs

Explore the intricacies of cost structures, including direct and indirect costs, and learn about various cost allocation methods across different industries. The direct method of cost allocation is particularly effective when allocating direct costs that have a clear cause-and-effect relationship with the cost objects. This method accurately assigns direct costs, such as materials and labor, as their relationship with the cost driver is typically more direct and easily measurable.

Automation through cost allocation software can significantly improve accuracy, efficiency, and transparency in the allocation process. While cost allocation can be complex, following certain best practices can help organizations streamline the process, ensure fairness, and enhance profitability analysis. The direct expenses are related in calculation with the cost of goods sold since they are incurred in the manufacturing process. Luckily, modern planning software can transform cost allocation from a time-consuming, Excel spreadsheet-based headache into a precise, streamlined process. Departments occupying a larger square footage of office space pay a larger share of rent and building maintenance costs. There are several cost allocation methodologies, each suited to different situations.

How Liam Passed His CPA Exams by Tweaking His Study Process

If one department produces more units, it will bear a larger share of the labor costs. Other examples of pushed cost allocation drivers are the number of processed invoices for finance or the number of new employment contracts for the HR department. Drawing on insights from cost allocation expert Sander den Hartog, CEO of CostPerform, we will break down the process and its challenges in a clear and structured manner. Additionally, the concept of economies of scale plays a significant role in cost structure. As businesses expand their operations, they often experience a reduction in per-unit costs due to increased efficiency and bargaining power.

Conversely, diseconomies of scale can occur when a company grows too large, leading to inefficiencies and increased per-unit costs. Balancing growth with operational efficiency is therefore a strategic consideration for any business. We then multiply the service department overhead by the above factors to obtain the amount of overhead to be allocated to each production department. A solution like Phocas will integrate directly with your business systems—from ERP and financial software to human resource and production tracking tools. When an employee joins your team or production volumes shift, your allocations update instantly. Fixed costs are the steady, predictable costs that don’t change with business activity.

This approach involves allocating the joint costs to products in proportion to these estimated sales values. It provides an alternative to the previous approach when the productscan not be sold at the split-off point, i.e., without further processing. Since this is not likely to be an accurate assumption concerning the values added by the separate joint and after split-off processes, the NRVestimates of values at the split-off point are likely to be misstated. However, if there are no identifiable sales values at the split-off point, this methodseems to provide the next best alternative. The step-down, or sequential method, ignores self services, but allows for a partial recognition of reciprocal services. As a result, the step-down method is different from thedirect method in that some service department costs are allocated to other service departments.

- Allocate the service department costs to both service departments and producing departments based on the allocation proportions provided in Table 1.

- Therefore, the joint cost allocations should not imply that trueprofitability has been obtained.

- Cherry Bekaert Advisory LLC and its subsidiary entities are not licensed CPA firms.

- She explains how data can work for business people without all the tech jargon.

- Use the direct method and make the following calculations for the Purchasing and Receiving cost allocations to the Cooking and Canning Departments.

For example, if a company runs a $100,000 advertising campaign that promotes three different product lines at the same time, it might allocate the marketing costs based on the sales volume of each product. If Product A generates 50% of total sales, it will be allocated 50% of the marketing expenses. Push allocations are commonly used when management needs to assign overhead costs to specific units for more accurate profitability analysis. By following these steps, businesses can maintain accurate financial records, make informed pricing decisions, and optimize budget management based on precise cost calculations.

This could mean over-pricing, which can discourage customers, or under-pricing, which could lead to business losses. The advent of advanced technology has revolutionized cost allocation methods, offering unprecedented accuracy and efficiency. Modern software solutions, such as enterprise resource planning (ERP) systems and specialized cost management tools, have automated many aspects of the allocation process. These systems can handle complex calculations, everett washington irs office track resource usage in real-time, and generate detailed reports, significantly reducing the administrative burden on financial managers. For instance, an ERP system can automatically allocate utility costs based on real-time energy consumption data from smart meters, ensuring precise and timely cost distribution. Reciprocal allocation is the most comprehensive and complex method, as it fully recognizes the mutual services provided among departments.

The Role of Accounting in Business Chron com

Content

It does not matter if there is an increase or decrease in rates because such a small move in rates will be about the same in either direction. Same with expenses – the electric bill for $1,400 is entered into accounts payable on August 20, the date when the charge is received, not when it is paid on September 15. The accrual method records revenue when a sale is earned, and records an expense when the cost is incurred and an invoice is received. Accountants must also go further to take a higher-level strategic view of the business to offer financial planning advice. They must be skilled at accurately interpreting financial reports and understanding what they mean for the financial health of the business in question.

Typically, if a small business has annual sales of less than $5 million, it may choose to report income and expenses using cash-basis accounting. Financial ratios are vital metrics used to gauge the performance of all aspects of a company’s condition and operations; accounting provides the data required to construct these ratios. A company’s liquidity is measured by the current and quick ratios. Profit margins and expenses are reported as percentages of sales and compared to budgeted benchmarks. Financial leverage is a ratio of total debt to capital investment.

Ratio Analysis Based on Financial Data

It is common for bonds and loans to be quoted in terms of basis points. A basis point is a common unit of measure for interest rates and other percentages in finance. Basis points are typically expressed with the abbreviations bp, bps, or bips.

It sometimes presents a misleading view of long-term profitability. Surges of cash receipts might show short-term profits but obscure long-term losses. Both bookkeepers and accountants need to pay close attention to detail and be able to make fast and accurate mathematical calculations. This allows them to spot and verify any inconsistencies in a business’ financial reporting. They also need to have a problem solving mindset that helps them figure out the underlying causes behind these errors. Basis points are widely used by financial analysts because they provide an accurate indication of the difference between two percentages even if this difference is minor.

AccountingTools

However, bookkeepers are not qualified to help with more advanced activities, such as filing your taxes. All bookkeeping activities fall under accounting, but not all accounting activities are bookkeeping — businesses need both accounting and bookkeeping to stay financially healthy. Most accounting software, such as the every popular QuickBooks (Figure A), includes bookkeeping functionality What Does Accounting Basis Points Mean? Chron com as part of its software package. Your basis of accounting decides when you formally count a sale as income – or a purchase as an expense. Accounting reports, both managerial and financial, are essential to productively manage any company or organization. Not having accurate and timely information about how effectively a business is running is a recipe for disaster.

- Basis points are often used to describe a change in value with regard to these instruments.

- In this guide, we’ll explain what bookkeeping is, what accounting is and the key differences between them.

- Also, some lenders and investors prefer to work with businesses that use accrual accounting.

- She has been writing about personal finance and budgeting since 2008.

- However, to do this, managers must have predetermined standard costs of operations to use as yardsticks for measurement.

The benchmark rate is what banks charge each other for overnight lending, which feeds into the rates consumers get. The word basis in the term basis point comes from the base move between two percentages, or the spread between two interest rates. Since the changes recorded are usually narrow, and because small changes can have outsized outcomes, the basis is a fraction of a percent. James Woodruff has been a management consultant to more than 1,000 small businesses.

Bear Market: Definition, Causes And Behaviors

For example, if a bond yield spikes from 7.45% to 7.65%, it is said to have risen 20 basis points. To understand the practical usage of basis points, consider the following example. In May 2023, the Federal Open Market Committee (FOMC) increased the benchmark rate by 25 basis points, or 0.25% percentage points, to a range of 5% to 5.25%.

- Recent changes in tax policy have made it possible for more small businesses to take advantages of using cash basis accounting for tax returns.

- You have the options to get a mortgage rate that’s either 3.24% or 3.25% on a 30-year conventional loan.

- Income is recorded when the cash is received, and expenses are recorded as the bills are paid.

- In order for traders and lenders to be more precise about interest rates, they often talk in terms of basis points rather than percentages.

- Since the changes recorded are usually narrow, and because small changes can have outsized outcomes, the basis is a fraction of a percent.

- Cash-basis profit and loss equals a company’s cash received from sales minus its cash expenses during an accounting period.

Cash-basis profit and loss equals a company’s cash received from sales minus its cash expenses during an accounting period. A company reports its sales, expenses and cash-basis profit or loss on its profit and loss statement, which is also known as a P&L or an income statement. A cash-basis profit and loss statement does not conform to generally accepted accounting principles and, therefore, https://quickbooks-payroll.org/ is typically used only by small businesses that don’t report to outside parties. Recent changes in tax policy have made it possible for more small businesses to take advantages of using cash basis accounting for tax returns. Previously, the IRS required businesses that carried inventory and had gross receipts in excess of $5 million to use the accrual method for tax returns.

Job-order Costing Principles of Managerial Accounting

When manufacturing overhead is applied to the jobs in process, it is credited from the Manufacturing Overhead account and debited to the Work In Process account. Now that you’ve calculated your predetermined overhead rate, you can apply it to jobs for the purpose of job costing as the applied overhead cost. While the costing systems are different from each other, management uses the information provided to make similar managerial decisions, such as setting the sales price. For example, in a job order cost system, each job is unique, which allows management to establish individual prices for individual projects. Job order costing systems assign costs directly to the product by assigning direct materials and direct labor to the work in process (WIP) inventory.

- Distribution Companies and Transportation Providers – Gas, vehicle maintenance, and the direct labor cost of drivers are all important costs of running these businesses.

- They are first transferred into manufacturing overhead and then allocated to work in process.

- A standard job cost sheet records all direct material, direct labor, and manufacturing overhead costs applied to a job.

- Some examples include personalized t-shirts for a team, props used for filmmaking, or law firms calculating what to charge clients.

- Process costing can also accommodate increasingly complex business scenarios.

It helps your accountant to calculate the data or track any important information using those assets. After setting up the job code, the production department average cost method formula + calculator needs to calculate the budget of each job. Then all information needs to inform relevant departments such as warehouse, purchasing, HR, etc.

Journal Entries to Move Finished Goods into Cost of Goods Sold

The chapter concepts are applied to comprehensive business scenarios in the below Practice Video Problems. Software, hardware, and training expenses can be high, and not all firms may be able to afford them. There are several advantages and disadvantages to each type of this costing. Its formula, which computes the overall cost of a job order, is a simple equation.

Job order costing usually considers three factors – direct material costs, direct labor costs, and overhead costs. Technology makes it easy to track costs as small as one fastener or ounce of glue. However, if each fastener had to be requisitioned and each ounce of glue recorded, the product would take longer to make and the direct labor cost would be higher. So, while it is possible to track the cost of each individual product, the additional information may not be worth the additional expense. Under this system, costs are assigned to jobs based on the number of direct labor hours required to manufacture each job.

What Is a Predetermined Overhead Rate?

The predetermined manufacturing overhead rate is computed before the period starts, usually at the beginning of a year or quarter. Manufacturing overhead is then applied to the jobs as the work is completed throughout the year. In a job-order costing system, the predetermined overhead rate is applied to the jobs based on the job’s actual use of the allocation base or cost driver used to calculate the predetermined rate. The management of each business relies on knowing each cost when making decisions, such as setting the sales price, planning production and staffing schedules, and ordering materials. Although these companies share a common location, which suggests similar rental costs, all the other costs vary significantly.

Making Data-Driven Decisions

An expense is a cost of operations that a company incurs to generate revenue. Generally, the benefit of the cost is used in the same period in which the corresponding revenue is reported. Businesses must be precisely aware of their costs and profitability in today’s cutthroat business environment. It provides a valuable tool for businesses to achieve this goal by providing a detailed understanding of the cost of each job order.

Basic Managerial Accounting Terms Used in Job Order Costing and Process Costing

They also need to know the costs to determine when a new product should be added or an old product removed from production. If you are a service business, most keep track of direct labor through a time tracking system, again, either manual or computerized. If you run a business that provides custom services or products, you’re going to need to manage your costs and billing systems a little differently than you would if you only sold standardized products. When we use job costing, it’s easier to appraise each job profit and select the best profitable product for sale. Management can make a proper decision before accepting any new job from the customer. The job that does not perform well may need to reduce while the good performing job needs to increase.

1: Distinguish between Job Order Costing and Process Costing

It provides businesses with accurate cost data, which makes it easier to prepare budgets. By knowing the cost of each job order, businesses can prepare accurate budgets and make informed decisions about future investments. On the other hand, normal costing is easier to implement but can be less accurate if the predetermined rates are not set correctly. This job order contains information such as the customer’s name, the order date, and the product or service requested. This likewise permits organizations to set prices that precisely mirror the cost of production and create a gain. Process costing, on the other hand, is used when companies offer a more standardized product.

The predetermined rate is a calculation used to determine the estimated overhead costs for each job during a specific time period. For instance, when manufacturing the iPhone 12, the production costs for Apple are the same for each unit of the iPhone. In such situations, the best method for tracking production costs is process costing. Process costing and job order costing are both acceptable methods for tracking costs and production levels.

What is a voucher? Definition and examples

The total amount of vouchers owed is added up, with one lump sum recorded on the balance sheet as accounts payable. Once the voucher is paid, proof of payment is included in the voucher and the voucher is considered paid. The voucher includes all supporting documents to show how much money is owed and the payments due to a supplier or vendor for outstanding payments. Vouchers and other necessary documents are recorded in the voucher register.

- The purchasing department places an order for the inventory and puts both the purchase requisition document and the purchase order in the voucher file.

- They are there to ensure you receive the exact goods you ordered and to avoid any discrepancies creeping into your accounting system.

- A 2013 study of Milwaukee’s program—the oldest in the nation—found that using a voucher to attend a private school increased the likelihood that students would graduate from high school, enroll in college, and stay in college.

- When the company receives goods from a supplier along with the invoice, instead of releasing funds immediately for payment, they create a voucher to remind them of the payment due – or as a statement of payments already made.

- This packet is useful for keeping related documents in one place, and makes it easier to both justify and audit payables transactions.

- The benefits of using a voucher include flexibility, convenience, and a combination of marketing, cost reduction, and a payment medium in one item.

They are issued by Accor hotels to allow you to purchase their goods and services. In many cases when products or services are purchased from an online retailer, vouchers are provided to allow the consumer to receive what they have paid for. A 2013 study of Milwaukee’s program—the oldest in the nation—found that using a voucher to attend a private school increased the likelihood that students would graduate from high school, enroll in college, and stay in college.

Voucher Check: Definition, Examples and Benefits

A local restaurant orders meat and fish every few days from its vendors. The restaurant manager fills out a purchase order for 30 pounds of meat, and the owner initials the purchase order to approve the shipment. When the shipment is received, the contents of the shipment are compared with the purchase order to ensure that the shipment matches what was ordered. The restaurant completes a shipping receipt to document the process, and the shipping receipt is compared with the vendor’s invoice. Culture vouchers shouldn’t be treated as a frivolous “giveaway” that could only ever come at the cost of the provision of essential services. Done right, they could be an effective means to filter revenue to much-pummelled corners of Irish society, including the night-time economy that Martin’s department has been taking baby-steps to revive.

It is used to describe both the digital ones found on websites and printed ones found in newspapers, magazines, etc. It has the same function as a paper or plastic gift card which can be exchanged at certain stores for goods or services. Meanwhile, a 2011 review of a decade’s worth of voucher research by the Center on Education Policy, a Washington think tank, found that vouchers have “no clear positive impact” on student achievement and mixed results overall.

Ask a Financial Professional Any Question

In this post, we’ll cover how to define payment voucher, what is payment voucher in accounting and look at how the payment voucher process works. A voucher signifies an official document that authorizes the holder to receive goods or services. It might be called a certificate, ticket, coupon, or token which is offered by either government organizations or private companies. In reality, voucher cards have only increased the popularity of paper vouchers as it is often more convenient for businesses to issue them because they can be detailed electronically and printed for use by customers.

If vouchers are used for all payables, their totals can be aggregated to determine the total amount of accounts payable outstanding. This function is not needed in a computerized system, where the aged payables report is used instead. Using a voucher system also reduces the risk of employees colluding to steal company assets. Businesses employ segregation of duties to prevent employee theft, which means that critical tasks are assigned to different people within the organization. The voucher documents that the tasks are performed by multiple people and creates a paper trail so that an auditor can confirm that the duties were properly segregated. Vouchers also justify the firm’s cash payments to vendors and document the general ledger accounts used to post the transaction.

Cultural definitions for voucher

A voucher is an accounting document representing an internal intent to make a payment to an external entity, such as a vendor or service provider. A voucher is produced usually after receiving a vendor invoice, after the invoice is successfully matched to a purchase order. A voucher will contain detailed information regarding the payee, the monetary amount of the payment, a description of the transaction, and more. In accounts payable systems, a process called a “payment run” is executed to generate payments corresponding to the unpaid vouchers.

After the voucher’s been paid, it will be registered as a paid voucher, and the proof of payment must be attached. In business-to-business transactions, often the payments are not due immediately. They can be paid with an allowed delay that can vary between 30, 60, or 90 days.

The receipt of payment and the date is recorded to show that the voucher has been paid. Accounts payable will reflect the lower balance due to the invoice being paid, assuming there are no additional payables generated. A voucher is a form that includes all of the supporting documents showing the money owed and any payments to a supplier or vendor for an outstanding payable. The voucher and the necessary documents are recorded in the voucher register. The voucher is important because it’s an internal accounting control mechanism that ensures that every payment is properly authorized and that the goods or services purchased are actually received.

LATEST NEWS

A voucher is a backup document needed to initiate the procedure of collecting and filing all other documents required to settle a liability. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Once the vouchers are examined, they must be imprinted with a stamp or signed, to ensure that they are not presented further, as proof of another transaction. You can usually buy these vouchers at retail outlets including supermarkets, small corner shops, gas filling stations, etc. The majority of people will tell you that the two terms have virtually the same meaning and can be used interchangeably. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

The accounts payable department will record the lower balance due to the invoice having been paid. The PO is added and recorded to accounts payable on the balance sheet until it’s paid. In this instance, a voucher check is issued when an invoice is matched with a purchase order and documentation that the order was filled.

The purchasing department places an order for the inventory and puts both the purchase requisition document and the purchase order in the voucher file. In the world of mobile phones, a voucher – in the form of a recharge number – is sold to customers to recharge their SIM card with money and to extend the availability of the card. News 6 Investigators are working on a story about Florida’s school voucher program and they need your help. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The most common misconception is that paper vouchers are inherently less secure than other payment methods and should be avoided.

- These payments are then either released or held at the discretion of the company controller or accounts payable supervisor.

- In the world of mobile phones, a voucher – in the form of a recharge number – is sold to customers to recharge their SIM card with money and to extend the availability of the card.

- The company can debit the inventory account and credit the cash account to record the payment.

- In other words, a voucher is a supporting document for an invoice received by the company.

- A convicted fraudster whom federal prosecutors once called a “serial con man” has opened a new agency that offers aspiring TikTok and Instagram influencers paid brand deals with major companies like Apple, Nordstrom and Starbucks.

Companies have various short-term financial obligations to suppliers and vendors throughout an accounting period. A company might need to buy inventory or raw materials from suppliers that are used in the production of the company’s goods. The suppliers essentially grant an extension of credit to the company allowing for payment to be made in the near future such as 30, 60, or 90 days. Druid Hills, like all North Carolina public schools, is required to report test scores, teacher experience and credentials, and data on discipline, chronic absenteeism and finances.

Account voucher

The review also found that, in general, school vouchers forced public schools to improve through competition. A voucher is an internal document describing and authorizing the payment of a liability to a supplier. It is most commonly used in a manual payment system, where it is part of the system of controls. A voucher is created following the receipt of an invoice from a supplier.

House Democratic leaders rally in Philly against school vouchers: ‘What are they going to do for the 99% left behind?’ – The Philadelphia Inquirer

House Democratic leaders rally in Philly against school vouchers: ‘What are they going to do for the 99% left behind?’.

Posted: Mon, 31 Jul 2023 22:02:33 GMT [source]

A voucher is a medium used to pay for specific things with a list of rules. The voucher code must be entered during checkout at the website or in the app to use it. These vouchers often require a printed copy and a signature to be valid. A credit of a certain monetary value that can be used only for a specified purpose, such as to pay for housing or for food.

voucher

The Graham Street address was one of the four I’d checked earlier in the month. It’s listed as Charlotte Leadership Academy, a private school that also participates in the Opportunity Scholarship program. One of that school’s employee benefits two administrators, Ryan Saunders, told me he wasn’t familiar with Teaching Achieving Students and no other school shared the space. The term is also commonly used for school vouchers, which are somewhat different.

News 6 wants to hear from any family that has applied for this funding to send a new or returning student to a private school in Florida. This approach is most suitable for free individual tourist activities where pre-allocation for services are not necessary, feasible or applicable. It was customary before the information era when communication was limited and expensive, but now has been given quite a different role by B2C applications.

An auditor performs a set of procedures to determine if the financial statements are free of material misstatement. Vouchers document that the goods purchased were actually received, which supports the auditor’s assertion that the goods and services posted to the financial statements truly exist. In each company, there exists an accounts payable department that is in charge of making payments that are due to its creditors and suppliers. Have vouchers created unconstitutional entanglements between church and state since parents have used them to send their children to private religious schools?

This is considered as the primary document of the business which describes and authorizes the payment of the company. Vouchers can be used as manual or computerized systems as preferred by business organizations. A voucher is a redeemable form of transaction bond that is worth a particular monetary value and can only be used on specific grounds or specific goods. Examples of this include vouchers for lodging, transportation, and food. As you can see, the voucher file stores every source document involved in the purchase of the inventory, so management can trace the audit trail of every inventory purchase and stop unauthorized cash disbursements. A voucher keeps all documents that are used to support the distribution of cash.

Accounting Outsourcing: How to Hand off Your Financial Tasks With Recommendations Bench Accounting

Prices start at $500 a month for the Essential plan, which is geared towards startups that use cash-basis accounting. If you use accrual-basis accounting, you’ll need the Growth plan, which starts at $990 a month. And the Executive plan, which is built for larger companies that need CFO services, has custom pricing. The size of one’s business and volume of work required will determine the size and structure of an outsourced accounting team. Not every business requires the same level of support when it comes to outsourced accounting.

The security of your financial data

Accounts receivable (AR) and accounts payable (AP) are essential accounting functions for any business. They ensure the timely collection of payments from your customers for products or services sold (AR), and management of the money you owe to vendors (AP). Outsourced accounting services army publishing directorate have become a more common and practical solution for various businesses today. Be it startups, small to medium-sized businesses, or non-profit organizations, outsourcing offers major advantages.

Outsource your payroll management with Remote

There are a wide variety of accounting services, bookkeeping services, and plans to choose from, so you can customise your company’s accounting plan in a way that will suit your needs. Learn more about Freshbooks accounting services and start your free trial today. Apart from enhanced security and access to experts, businesses have significantly benefited from outsourced accounting. To elaborate on how it helps organizations, this guide takes a look at what outsourced accounting is and its top benefits. Outsourced, virtual bookkeeping can cost as little as $150 per month and as much as $900 (or more) per month.

All it takes is a reputable external provider such as Clark Staff to give you the best out of your outsourcing journey. As your company faces a high level of regulation, you can sit back and let your outsourced accounting professionals adhere to compliance requirements with the various regulatory bodies. You’ll have a dedicated team solely for managing your financial statements. This gives you more time to focus on your vision and purpose, enabling you to fulfill your core duties better. Keen attention to detail and robust knowledge for managing donations, funding, auditing, and financial reporting obligations are crucial.

- This ensures that your tax and legal obligations are being handled by local accountants who understand local tax laws and regulations, and who are sufficiently qualified.

- If you need a bit more support, Bench also offers outsourced accounting services, including tax prep and tax filing.

- Accounts receivable (AR) and accounts payable (AP) are essential accounting functions for any business.

- First, analyze your accounting operations and determine which functions you’d like to outsource.

Yes, virtual and outsourced bookkeeping is just as legitimate as in-house bookkeeping and accounting. However, as with any in-person accounting professionals you’d trust with your financial data, you should always verify a bookkeeping firm’s credentials before committing to a monthly plan. And on the accounting software front, Bookkeeper360 syncs with both Xero and QuickBooks Online.

Learn the fundamentals of small business accounting, and set your financials up for success. Your best bet is to find a local accountant who can take on the tasks you need, who will only charge you hourly for the work you need. Learn more about Bench, our mission, and the dedicated team behind your financial success.

See Bench’s features in action

In this guide, we’ll show you the areas you can outsource and help you pick the best experts for the job, so you can get back to doing what you love. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. First, analyze your accounting operations and determine which functions you’d like to outsource.

To make the best possible financial decisions, it’s important to fully understand your company’s financial position and analyze potential outcomes. If you’re a small business that manages its own books, you could be spending your time and resources elsewhere. The amount of work you have available may not justify hiring one in-house, even on a part-time basis. Outsource Accelerator is the leading Business Process Outsourcing (BPO) marketplace globally.

Our article on business bookkeeping basics gives you more information on how to do bookkeeping and why. With Bench’s Catch Up Bookkeeping services, a Bench bookkeeper will work through past months of disorganized bookkeeping to bring your accounts up to date. Many companies outsource this task to experienced auditors, who can independently assess your company’s financial processes and even advise on ways to improve.

Present Value Formula with Calculator

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

The Time Value of Money

A zero NPV implies that the investment or project will neither generate a net gain nor a net loss in value. In this situation, decision-makers should carefully weigh the risks and potential benefits of the investment or project before making a decision. Company management also use this theory when investing in projects, expansions, or purchasing new equipment. By using the net present value formula, management can estimate whether a potential project is worth pursuing and whether the company will make money on the deal. For instance, when someone purchases a home, they are often offered the opportunity to pay points on the mortgage to reduce insurance payments.

- Because transactions take place in the present, those future cash flows or returns must be considered by using the value of today’s money.

- Therefore, when evaluating investment opportunities, a higher NPV is a favorable indicator, aligning with the goal of maximizing profitability and creating long-term value.

- This formula is used to calculate the future value (FV) of an investment or loan, given the initial principal, the interest rate, and the number of compounding periods.

- It is the discount rate at which the NPV of an investment or project equals zero.

- NPV is the result of calculations that find the current value of a future stream of payments using the proper discount rate.

- This equation is used in our present value calculator as well, so you can use it for checking your PV calculations.

Present Value Calculator

- Individuals use PV to estimate the present value of future retirement income, such as Social Security benefits or pension payments.

- The internal rate of return (IRR calculator) of a project is such a discount rate at which the NPV equals zero.

- Both PV and NPV are important financial tools that help investors and financial managers make informed decisions.

- Moreover, inflation devalues the purchasing power of today’s currency as time goes on.

- Investors use NPV to evaluate potential investment opportunities, such as stocks, bonds, or real estate, to determine which investments are likely to generate the highest returns.

Present value calculations are also very useful when it comes to bond yields, pensions, and savings accounts. It is an important financial concept and can be helpful to those who are making financial investments. How about if Option A requires an initial investment of $1 million, while Option B will only cost $10? The NPV formula doesn’t evaluate a project’s return on investment (ROI), a key consideration for anyone with finite capital. Though the NPV formula estimates how much value a project will produce, it doesn’t show if it’s an efficient use of your investment dollars. That means if I want to receive $1000 in the 5th year of investment, that would require a certain amount of money in the present, which I have to invest with a specific rate of return (r).

PV Calculation Examples

- This concept is the basis for the net present value rule, which says that only investments with a positive NPV should be considered.

- In other words, to maintain the same present value the interest rate would need to increase parallel to the increasing number of years one is locked into an investment.

- By calculating the PV of potential investments, investors can determine if an investment is worth pursuing or if they would be better off pursuing alternative investment opportunities.

- Present value is a way of representing the current value of a future sum of money or future cash flows.

- The big difference between PV and NPV is that NPV takes into account the initial investment.

Conversely, a particular sum to be received in the future will not be worth as much as that same sum today. When using this what is the present value formula is important that your time period, interest rate, and compounding frequency are all in the same time unit. For example, if compounding occurs monthly the number of time periods should be the number of months of investment, and the interest rate should be converted to a monthly interest rate rather than yearly. By considering the time value of money and the magnitude and timing of cash flows, NPV provides valuable insights for resource allocation and investment prioritization.

Facilitates Comparison of Investment Alternatives

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. A higher present value is better than a lower one when assessing similar investments. My course, Expectancy Wealth Planning, has been called “the best financial education on the internet” and provides all the knowledge you’ll ever need to build the life — and retirement — of your dreams. To get a full picture of the amount you need to retire, see our Ultimate Retirement Calculator here and how it applies net present value analysis for your retirement planning needs. Present value can also be used to give you a rough idea of the amount of money needed at the start of retirement to fund your spending needs.

Treasury bonds, which are considered virtually risk-free because they are backed by the U.S. government. In addition to the basic compound interest calculations, your Excel calculator can also handle more advanced scenarios, such as regular deposits and different compounding periods. Compound interest is a financial concept that goes beyond simple interest, which is calculated on the principal amount alone. With compound interest, you earn interest on your interest, leading to exponential growth over time. The default calculation above asks what is the present value of a future value amount of $15,000 invested for 3.5 years, compounded monthly at an annual interest rate of 5.25%.

Present value is important because it allows investors and businesses to judge whether some future outcome will be worth making the investment today. It is also important in choosing among potential investments, especially if they are expected to pay off at different times in the future. Understanding how to calculate it in Excel can help you make better financial decisions.

Setting Up Your Compound Interest Calculator in Excel

Another advantage of the net present value method is its ability to compare investments. As long as the NPV of each investment alternative is calculated back to the same point in time, the investor can accurately compare the relative value in today’s terms of each investment. What that means is the discounted present value of a $10,000 lump sum payment in 5 years is roughly equal to $7,129.86 today at a discount rate of 7%. If you want to calculate the present value of a stream of payments instead of a one time, lump sum payment then try our present value of annuity calculator here.

Continuous Compounding (m → ∞)

In these cases, calculating an accurate present value may require advanced financial modeling techniques. PV is suitable for evaluating single cash flows or simple investments, while NPV is more appropriate for analyzing complex projects or investments with multiple cash flows occurring at different times. Present value calculations are tied closely to other formulas, such as the present value of annuity. Annuity denotes a series of equal payments or receipts, which we have to pay at even intervals, for example, rental payments or loans. Money is worth more now than it is later due to the fact that it can be invested to earn a return.

Sensitivity to Discount Rate Changes

- Present value is also useful when you need to estimate how much to invest now in order to meet a certain future goal, for example, when buying a car or a home.

- Suppose we are calculating the present value (PV) of a future cash flow (FV) of $10,000.

- Present value (PV) is the current value of an expected future stream of cash flow.

- So, if you’re wondering how much your future earnings are worth today, keep reading to find out how to calculate present value.

- The formula for calculating NPV involves taking the present value of future cash flows and subtracting the initial investment.

- Present value is important in order to price assets or investments today that will be sold in the future, or which have returns or cash flows that will be paid in the future.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. You can also incorporate the potential effects of inflation into the present value formula by using what’s known as the real interest rate rather than the nominal interest rate. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

A Clean Start: Bookkeeping for Real Estate

Content

The most common accounting software today is QuickBooks online, so we’ll be using this software for our examples. However, other common software programs likely have the same or similar features (just under different names). Most accounting software walks the user through the initial setup, but it never hurts to understand the basics. How your federal payroll taxes are paid depends on the type of tax. Your company withholds FICA taxes (along with their federal income taxes) from your employees’ paychecks. You’ll then transfer these funds, along with your own contributions, via the Electronic Federal Tax Payment System (EFTPS).

Remarkably, one of the key functions of a professional bookkeeper is to determine the firm’s reports on profits and losses. Since they handle complex tasks like book closure and correcting financial errors, their routine duties demand meticulous attention to detail. Continuous learning and development opportunities This Jobot Job is hosted by..

Real Estate Agent

It will be best to use a separate bank account for each property you manage as a beginner. However, as you attain more properties, this system will become increasingly complex and difficult to manage. When you get to a point where this begins to happen, you should consider consolidating your accounts and tracking transactions for each property. Professional services and programs like QuickBooks are extremely helpful for an investor who is at this point. Generally, a bookkeeper plays a significant role in fostering the financial well-being and success of a real estate business.

The IRS and general accounting principles require the cost of the new roof to be spread out over that time. So you’ll record the expenditure to an asset category and not an expense category. Your CPA will then correctly depreciate the asset so the expense law firm bookkeeping is spread out across the life of the asset. QuickBooks is one of the most well-known and trusted accounting software packages on the market. Thousands of business owners use QuickBooks every day to assist them with their financial accounting.

A Day in the Life of a Virtual Bookkeeper from the Philippines

You can also set the rule to post to the books automatically — removing all manual inputs completely. However, we don’t recommend this when your business is first getting started. By having the chance to review the transactions before posting manually, you give yourself a trial period where we you ensure the other rules are working as intended.

However, even with one rental property, keeping information updated manually can become tedious and it’s easy to have something fall through the cracks. With user-friendly accounting solutions made available to businesses of all shapes and sizes, there is really no excuse not to get started today. Bookkeeping for real estate is an important activity for investors who hope to keep their finances in order. In finance and accounting, bookkeeping is defined as recording each and every financial transaction that occurs through a business. According to Accounting Coach, this can include anything from purchases, sales and payments, and should be recorded on the date that each item occurs. Another important aspect of bookkeeping is ensuring that there is a record, whether paper or digital, to accompany every transaction recorded on a ledger.

Why Organized Books Are Essential

This builds a firm foundation to expand upon when you choose to get more advanced. As your business grows, you may consider real estate accounting https://investrecords.com/the-importance-of-accurate-bookkeeping-for-law-firms-a-comprehensive-guide/ software. The goal of real estate accounting—or “doing the books”—is an accurate record of all the money going in and out of your small business.

As an investor himself, Taylor believes that perfecting the accounting systems leads to making good decisions that are crucial to the success of the business. Our Real Estate Bookkeeping services will help you to manage your company with ease. We know that as an agency, you have a lot of tasks to complete. The emergence of lots of agencies means that you need to spend a lot of your time marketing your company. Businessmen by trade, adventurers at heart; we understand the difficulties of running a small business and balancing a fulfilling life outside of work. Take past information to predict the company’s financial future.

The real estate bookkeeping is essential because it helps you to review how well your business performs. Your real estate bookkeeper will showcase you the cash flow and help you to organize your funds and gives you a heads up on whether you are spending more money than necessary on projects. Our team has grown and includes experienced CPAs and dedicated bookkeepers to provide both professional bookkeeping and accounting services. We specialize in real estate and our clients include real estate investment owners, flip & wholesalers, agents, and more.

- If you talk to some of our existing customers, they will tell you that we do not disappoint.

- QuickBooks is one of the most well-known and trusted accounting software packages on the market.

- At ShoreAgents, we offer full-time bookkeepers at varying costs and it all depends on the level you will need.

- This introduces a fantastic level of automation to the bookkeeping process.

- When you get to a point where this begins to happen, you should consider consolidating your accounts and tracking transactions for each property.

Again, real estate accounting aims to make the numbers line up perfectly—or “reconcile”—between your bookkeeping and bank account statement. But as you gain units, you will likely want to begin using one “management” account for simplicity. After all, you don’t want to have to deal with 40 checking accounts when you have 40 properties. However, the bookkeeping becomes a little more time-consuming, as you will still need to run the numbers separately for each property. Before diving into the five steps to successful real estate accounting processes, let’s cover the basic terminology. Most balance sheets carry the asset value of a rental property at the original cost.

While most focus generally lies on federal and state income taxes, there’s also a third aspect—payroll taxes. Staying on top of your transactions is harder than it may seem. Real estate accounting can be hard, so don’t beat yourself up. Regardless of how meticulous you are, there’s no doubt that you’ll miss expenses.

Sales account definition

It also positions your product is a long-term solution, not just a quick fix. The account total is then paired with the sales returns and allowances account to derive the net sales figure that is listed at the top of the income statement. All monthly bank statements, cancelled checks, deposit slips, check books and check stubs must be maintained for seven years. In addition, the firm must keep a “record” of all deposits into and withdrawals from every escrow or trust account, as well as every law firm operating account. That “record” must include the “date, source and description” of every deposit and the “date, payee and purpose” of every withdrawal. These rules are neither obvious nor intuitive and lawyers who are not familiar with them practice at their peril.

How to prepare for a business sale

A precise assessment of liabilities will highlight the possible difficulties which a buyer might perceive, and help to anticipate solutions to reduce the perception of risk. Skip the looming dread of missing your sales quota with these expert tips on how to get more leads. Chances are, they’ll be delighted—and super impressed—that you care enough about their business, you’ve put a whole blueprint together on how you can improve it, together. That’s just one of the reasons why it’s more important than ever to prioritize retention, when it comes to account growth and every key account, just as much—if not even more—than acquisition. It’s kind of like a handbook with all the information you need to close each of your most crucial accounts and keep them around for the long-haul for account growth.

Why should you use a sales account plan?

Now is the perfect time to make sure that your firm’s accounts and records fully comply with the rules. Later may be too late and it will certainly be how to obtain a copy of your tax return 2020 more expensive and worrisome. New York has very specific rules on what records a lawyer or law firm must maintain for an escrow or trust account.

- By combining our highly experienced team and groundbreaking proprietary technology, we’ve booked tens of thousands of meetings for over 200 B2B clients across every major industry.

- Also, there is no specific or standard format available for the preparation of account sales.

- It is a part of the chart of accounts and it is used to record the journal entry for cash and credit Sales.

- However, the consignor may guide consignee regarding the order in which the information may be arranged in the account sales.

- Unless the returned check is clearly the result of a bank error and the bank acknowledges the error in writing to the disciplinary committee, the lawyer will be required to produce his or her escrow records for the previous six-month period.

Drive online sales for your products

In bookkeeping, accounting, and financial accounting, net sales are operating revenues earned by a company for selling its products or rendering its services. Also referred to as revenue, they are reported directly on the income statement as Sales or Net sales. Take a look at your existing customers and determine which accounts are the most strategic ones. Maybe they’re a flight risk, or it’s almost time for them to renew their contract with you. Then, put together sales accounts plans for this group of customers so that when it comes time for them to renew, you’re prepared to make sure they do. Account planning, while effective, does take a fair amount of time and resources.

However, advance written informed consent from the client or recipient of the fund is advisable if the lawyer is going to turn over less than the full amount of the principal and earned interest. A third choice for trust funds is a traditional interest-bearing escrow or trust account into which all trust funds are deposited by the law firm. If a traditional escrow account is used, the firm must then keep track of and apportion the interest for each matter and client.

First, commingling of personal and trust funds may destroy the escrow nature of the account and expose the clients’ funds to the risk of attachment by the lawyer’s or law firm’s creditors. Second, commingling of personal and trust funds makes it much harder to determine if the lawyer has used, or misused, any of the trust funds which were supposed to be held intact. Lawyers are permitted to maintain their trust accounts only at those New York banks which agree to provide bounced check reports to the Lawyers Fund for Client Protection. Unless the returned check is clearly the result of a bank error and the bank acknowledges the error in writing to the disciplinary committee, the lawyer will be required to produce his or her escrow records for the previous six-month period. Most investigations based upon bounced check reports are closed with no finding of wrongdoing by the lawyer or law firm and no discipline imposed.

However, a partial sale might be a better approach if the owner wishes to retain a level of control, or some say over the future of the company. This formula, which involves selling only part of the capital, allows the entry of new shareholders who can bring added value from a financial or strategic perspective, and improve growth prospects. In order to conduct a full valuation, it is important to consider both tangible and intangible assets. Tangible assets, including machinery, real estate or inventories, are the most visible and easiest to value.

Each sales account is typically assigned to either one salesperson (if the account is a small one) or to a team of salespeople (if the account is a major one). For example, if the company has unsecured debts or unresolved legal risks, it is essential to work on solutions to mitigate such risks before putting the business on the market. This proactive approach requires time and resources, but it usually translates into a considerable increase in the value perceived by buyers, and leads to smoother negotiations. Choosing between a total or partial sale will depend on the owner´s long-term objectives. In Spain, many business owners opt for a partial sale which ensures succession, particularly in the case of family companies which seek to maintain a legacy for subsequent generations, while benefitting from new capital to modernise the business.

The New York Times has been involved in several controversies in its history. The Times maintains several regional bureaus staffed with journalists across six continents, and has received 137 Pulitzer Prizes as of 2023, the most of any publication, among other accolades. Hitesh Bhasin is the CEO of Marketing91 and has over a decade of experience in the marketing field. He is an accomplished author of thousands of insightful articles, including in-depth analyses of brands and companies. Holding an MBA in Marketing, Hitesh manages several offline ventures, where he applies all the concepts of Marketing that he writes about. Making transactions transparent is useful for business during filing taxation and also if any discrepancy arises.

However, intangible assets such as intellectual property, client relationships, branding and team know-how are the ones which often bring the most strategic value to a business. According to a report by KPMG, during 2024 more than 65% of total business value in Spain stemmed from intangible assets, which underlines the importance of their accurate valuation during a sale process. On October 1, 2020, John & Co of Michigan consigned 500 lawn mowers to Roberts & Co in New York. On October 31, 2020, Roberts sent an account sales with a cross-check for the balance.

It is therefore essential to gather and organise all the necessary documentation before the sale starts. This includes audited accounts, key contracts, inventories, IP registries and any relevant information relating to litigation or ongoing risks. A growing trend during 2024 has been the digitisation of business data and the use of virtual data rooms, which allow greater transparency and facilitate access to information by buyers. A total sale allows the seller to completely disengage from the business and receive the sale proceeds immediately.

Reciprocal Method of Allocation Managerial Accounting

Thus, the equations showthat the total costs of a producing department includes the department’s direct cost (Di), plus the allocations from the various service departments(i.e., the sum of [(Kji)(Sj)]). Although it is the most accurate, it is also the most complicated. In the reciprocal method, the relationship between the service departments is recognized. This means service department costs are allocated to and from the other service departments. The final method, is the reciprocal method.Although it is the most accurate, it is also the most complicated.In the reciprocal method, the relationship between the servicedepartments is recognized.

Allocating Fully Reciprocated Costs to Production Departments

- In the second step, the equations for the service departments are solved first in the sequence established by the rules mentioned above.

- However, a new public utility has recently offered to provide electric power to the plant for 4.5 cents per kilowatt hour.

- Examples of operating departments are the assembly departments of manufacturing firms and the departments in hotels that take and confirm reservations.

The products obtained from a hog such as the chops, ham, and bacon are jointproducts. In fact, joint products are common in a variety of industries including petroleum, flour milling, meat packing, dairy, coal, copper, salt,chemicals, soap, gas, leather, and tobacco. The term “by-products” refers to a sub-category of joint products that have relatively insignificantsales depreciation of assets values as a proportion of the value of the entire group from which they are derived. Since maintenance costs are allocated to administration and administration cost is allocated to maintenance — things get interesting. You will need to determine the TOTAL cost being allocated to both the Administration and Maintenance Departments first.

AccountingTools

The allocationscreate equal profit ratios for both products, which insures that the resulting inventory values for both products are below their market values.6This result will not create any special problems for accounting. From the management decision perspective, these results are not useful, but at least theydo not support an incorrect decision with regard to product D. To illustrate the advantages of the dual rate or flexible budget method, consider the revised information that appears in Exhibit 6-9. This exhibit shows the same data thatappears in Exhibit 6-3 except service costs are separated into fixed and variable elements. The total producing department costs, after all allocations, is equal to the total direct costs budgeted, i.e., $500,000 (Seethe note at the bottom of Exhibit 6-4).

Activity Sampling (Work Sampling): Unveiling Insights into Work Efficiency

For example, the power departmentprovides electric power to the maintenance department and the maintenance department provides repair and maintenance to the power department. Theserelationships affect the choice of allocation methods, as well as the accuracy of the first stage cost allocations. From the management decision perspective, joint cost allocations are useless because they are not relevant in decisions concerning the separate products. For example, decisionsconcerning whether to continue or discontinue producing the joint products depend on their combined value, not the value of any particular product at thesplit-off point. Therefore, it has been argued that the joint costs should not be allocated at all. However, if the joint costs are not allocated, a valuestill needs to be placed on the unsold inventory for financial reporting purposes.

A plant wide rate based on machine hours would provide accurate product costs.c. Activity based rates would be needed to provide accurate product costs since direct labor is not used in proportion to machine hours.d. Activity-Based Costing (ABC) represents a significant evolution in cost allocation methods, particularly suited for organizations with diverse and complex operations. Unlike traditional methods that may allocate costs based on simplistic metrics like direct labor hours or machine hours, ABC delves deeper into the specific activities that drive costs.

Calculating Fully Reciprocated Costs

The three alternative methods of allocating service department costs to users are summarized in Exhibit 6-13. From the service cost perspective, the differences are more significant. Both the direct and step-down methods understate power costs by $9,585, or approximately 9.6%. On the otherhand, maintenance costs are understated by $17,261 using the direct method and $6,150 using the step-down method. These differences are likely to besignificant in terms of evaluating the service department costs, particularly in cases where a “make or buy” (outsourcing) decision is involved. The Cutright Company has a small factory with two service departments and two producing departments.

The Assembly Department manager is likely to complain that neither of the allocations in Exhibit 6-11 is equitable. He or she might logically argue that the dual rate method illustratedabove assigns the Power Department’s idle capacity costs to the Assembly Department. These idle capacity costs will in turn be allocated to the AssemblyDepartment’s products. Using a single budgeted rate, rather than either a single actual rate or dual rate (Exhibit 6-11) will normalize the service costsallocations, provide more timely costing and aid in evaluating the service departments. Conceptually, this is the same logical argument discussed inChapter 4 under the heading of reasons for using a predetermined overhead rate.

These activities could range from procurement and production to marketing and customer service. Each activity is then assigned a cost driver, which is a factor that directly influences the cost of the activity. For example, the cost driver for the procurement activity might be the number of purchase orders processed, while the cost driver for production could be the number of machine setups required. By linking costs to these drivers, ABC provides a more granular view of how resources are consumed across different activities. Discover modern cost allocation methods to enhance management efficiency and optimize resource distribution in multi-department organizations. In this situation, service cost centre overheads are simply ‘shared out’ on the basis of usage.

Service departments aid multiple production departments at the same time, and accountants must allocate and account for all of these costs. It is crucial that these service department costs be allocated to the operating departments so that the costs of conducting business in the operating departments are clearly and accurately reflected. Departmental rates based on machine hours would provide accurate product costs.b.