How To Calculate Net Credit Sales: Formula and Examples for Efficient Accounting

Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

Purpose of Finding Net Credit Sales on the Balance Sheet

It is typically listed as a separate line item under the revenue section of the income statement. The average collection period measures the time necessary for a company to obtain cash payments from customers. Let’s proceed to the next step, where we will identify the total sales returns and allowances. When looking at gross credit sales, it refers to the total amount of credit sales made by a company before accounting for any discounts or returns. A company’s financial statements contain a great deal of information, and you may not need all of that information at a given time. You can quickly pick out a specific section of that data, such as annual credit sales, if you know where to find it within the statements.

The first step in calculating net credit sales is to determine the total credit sales for the period you are analyzing. Credit sales refer to transactions where customers purchase goods or services on credit, meaning they do not make an immediate payment but agree to pay at a later date based on agreed-upon terms. It’s important to note that the net credit sales calculation focuses specifically on credit transactions and does not include cash sales. Cash sales are payments made by customers at the time of the purchase and are not considered part of net credit sales.

Look for line items specifically labeled as “Sales Returns” or “Allowances.” These figures represent the total monetary value or percentage of sales that have been returned or granted as allowances. Understanding the net credit sales formula is similar to deciphering the heartbeat of a business. Just as a doctor monitors a patient’s heartbeat to gauge their health, a business must track its net credit sales to assess its financial well-being.

Utilizing Accounts Receivable Turnover Ratio for Analysis

Analyzing net credit sales over time and comparing them to industry peers can help identify trends, market competitiveness, and potential areas for where to find net credit sales on financial statements improvement. By segmenting customers, assessing credit policies, and analyzing accounts receivable turnover, businesses can optimize their credit management processes and enhance cash flow efficiency. Understanding net credit sales is important for businesses to evaluate their sales performance and assess the effectiveness of their credit policies. By monitoring changes in net credit sales over time, companies can identify trends and patterns that can help them optimize their credit and sales strategies. Additionally, it provides valuable insights into the company’s ability to collect receivables and manage its cash flow efficiently. Net credit sales are an indicator of a company’s ability to generate revenue from credit sales transactions.

Where to find net credit sales on financial statements?

The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction.

The company’s sales include the credit sales amount, and to calculate credit sales from total, we deduct the sales returns and sales allowances. It provides a snapshot of the company’s financial performance and helps stakeholders assess its profitability. Understanding the net credit sales figure and its implications helps businesses make informed decisions regarding credit management, sales strategies, and overall profitability. Calculating the net credit sales helps the company understand its sales performance, evaluate the effectiveness of its credit policies, and manage credit risks. It provides valuable insights into the financial performance of the business, allowing for better decision-making and strategic planning. In the process of calculating net credit sales, the next step is to identify the total sales returns and allowances.

- Net credit sales is a crucial component of the income statement, as it represents the revenue generated from credit sales transactions.

- Regularly reviewing the net sales formula helps companies catch any issues with their accounts receivable turnover ratio early, allowing them to fix problems before they escalate.

- For example, if a company sells $100,000 worth of goods on credit and subsequently receives $20,000 in returns and allowances, the net credit sales would be $80,000.

- To calculate net credit sales, subtract any returns, allowances, or discounts from the total sales figure.

While net credit sales is not directly reported on the statement of cash flows, it does have an impact on the cash flow from operations section, which is a significant component of this statement. Next, we will explore how net credit sales impact the statement of cash flows, providing information about the company’s cash inflows and outflows. Next, we will explore where net credit sales can be found on financial statements and how it influences other aspects of a company’s financial reporting. The gross credit sales metric neglects any reductions from customer returns, discounts, and allowances, whereas net credit sales adjust for all of those factors. This means that the retail company generated $470,000 in revenue from credit sales after accounting for $20,000 worth of returns and $10,000 in allowances. Once you have located the total credit sales figure, make note of it as it will be used in the subsequent steps to calculate the net credit sales.

How Does Payroll Work? Best Practices and Tools

Automated payroll is a way to simplify the process of paying your employees. A payroll automation software saves you time on tasks including filing taxes, processing direct deposits, generating payroll reports, and calculating tax withholdings. All of these processes would take much longer to do without payroll automation.

- Automating your payroll process boosts efficiency throughout your entire business.

- You’ll also pay more if you add additional features, such as Time and Attendance, HR, and Employee Benefits Administration.

- This will ultimately save your business money as you’ll be paying fewer salaries and wages.

- For example, a tool to automate time-off requests may automatically approve or deny time-off submissions based on available coverage or other employer-set parameters.

Better yet, you might consider using payroll software to simplify both your payroll process and how you file and pay your taxes, so consider making the investment to save yourself a lot of time. Using payroll software is like having a combination of a powerful, knowledgeable payroll services team with the lower cost of handling payroll manually in-house. With payroll software, you can enter an employee’s salary and deduction information, and check it before each pay period to ensure everything is right, and the software does a lot of the work for you. This is convenient whether you’re using an all-in-one global HR solution like Remote, or integrating with multiple tools. While implementing payroll automation can bring numerous advantages, it is crucial to acknowledge the potential challenges that may arise. Payroll automation, once a novel technology, has now become a staple in modern business operations.

Why develop payroll automation software?

Even if you aren’t in payroll or accounting, you’ve undoubtedly heard of Intuit’s QuickBooks. It has a number of plans, but all of them include full-service payroll features. These are just you work for a company that provides payroll automation some of the benefits of developing a payroll management system. Now it’s time to get down to the features that you can add to a custom solution to streamline your business processes.

ADP Run Review 2024: Pricing, Pros and Cons – MarketWatch

ADP Run Review 2024: Pricing, Pros and Cons.

Posted: Wed, 07 Feb 2024 08:00:00 GMT [source]

This type of software typically charges a base fee (around $40 per month) and a per-employee fee (around $6 per employee monthly). Taxes are undeniably confusing, but an automated payroll software makes it a little bit easier to navigate. Payroll automation will handle things like withholding federal income tax from employees’ wages, so you don’t have to figure it out on your own. Not only will this make things easier for you, but you can also enjoy peace of mind knowing that you’re complying with IRS regulations and tax laws. Running payroll by hand requires a lot of time and resources that could be spent on other business matters that require your attention.

Life at Paylocity

As your business grows internationally, managing your global payroll can become a huge challenge. Think of payroll automation not just as a tool, but as a strategic ally in your business growth. Whether you’re a small startup or a growing enterprise, the right payroll system can make a world of difference. So, take the leap, choose wisely, and watch as payroll automation transforms the way you do business.

Our integrated systems automatically record work hours, manage overtime, track sick leave, and ensure accurate pay calculations based on attendance data. Preparing a global benefits program for your business can be a daunting task. Fortunately, automation streamlines this process by providing access to unified employee data and user-friendly tools. This allows you to create and manage tailored benefits plans in different locations while remaining compliant at all times.

Timely, accurate pay

Additionally, it can help ensure employees who qualify for a certain coverage or benefit receive it (with HR’s approval, of course). And for states that require PTO payout, automated payroll can even pay this as soon as an employee resigns or is terminated. Stay compliant, collect employee data, and streamline tax filing – all while putting time back in your day with our automated payroll software. With the assurance of an error-free workflow, you can get back to what matters most – your people. Learn how our modern solutions get you out of the tactical and back to focusing on the bigger picture.

For hourly employees, all you need to do is multiply the number of hours worked and the employee’s hourly rate. All plans offer new-hire reporting, 24/7 support, automated employment, and income verification, paycards, and multistate payroll capability, as well as complete tax reporting and remittance. For smaller businesses with limited budgets, Payroll4Free can be a lifesaver. If you absolutely must have tax reporting and remittance, Payroll4Free offers complete tax service for $15/month.

How do you use the Shareholders Equity Formula to Calculate Shareholders Equity for a Balance Sheet?

Investors contribute their share of paid-in capital as stockholders, which is the basic source of total stockholders’ equity. The amount of paid-in capital from an investor is a factor in determining his/her ownership percentage. If the same assumptions are applied for the next year, the end-of-period shareholders equity balance in 2022 comes out to $700,000. From the viewpoint of shareholders, treasury stock is a discretionary decision made by management to indirectly compensate equity holders. Otherwise, an alternative approach to calculating shareholders’ equity is to add up the following line items, which we’ll explain in more detail soon. This is another theoretical number because actual growth can’t be measured without knowing how volatile a stock will be after it’s awarded.

Ask a Financial Professional Any Question

A company’s share price is often considered to be a representation of a firm’s equity position. These earnings, reported as part of the income statement, accumulate and grow larger over time. At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity. Shareholders Equity is the difference between a company’s assets and liabilities, and represents the remaining value if all assets were liquidated and outstanding debt obligations were settled. The weighted average cost of capital is the average cost of equity and debt financing combined. This number is important for examining a company’s capital structure.

What are the Components of Shareholders Equity?

From the point of view of an investor, it is essential to understand the stockholder’s equity formula because it represents the real value of the stockholder’s investment in the business. The stockholder’s equity is available as a line item in the balance sheet of a company or a firm. The company’s stockholders are usually interested in the stockholder’s equity, and they are concerned about the company’s earnings. Further, the Shareholder’s purchase of company stock over a period gives them the right to vote in the board of directors elections and yields capital gains for them.

Calculation Formula

Private companies set the share price using a business valuation, while public share prices are determined by stock market activity. Retained earnings, also known as accumulated profits, represent the cumulative business a board member’s guide to nonprofit overhead earnings minus dividends distributed to shareholders. To fully understand this concept, it’s helpful to know how to calculate retained earnings, as it provides insight into a company’s profitability over time.

Why Is It Important for a Company to Have Enough Stockholders’ Equity?

- If a business has more liabilities than assets or does not have enough stockholders’ equity to cover its debt, then it will need to turn to outside sources of capital.

- Stockholders’ equity is a company’s total assets minus its total liabilities.

- The $65.339 billion value in company equity represents the amount left for shareholders if Apple liquidated all of its assets and paid off all of its liabilities.

- Successful investors look well beyond today’s stock price or this year’s price movement when they consider whether to buy or sell.

- In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

How Do You Calculate Equity in a Private Company?

In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends. In contrast, early-stage companies with a significant number of promising growth opportunities are far more likely to keep the cash (i.e. for reinvestments). Learn six steps to start buying stock, including researching the ones that interest you and deciding how many shares to buy. The following is data for calculating the Shareholder’s equity of Apple.Inc for the period ended on September 29, 2018. Therefore, the stockholder’s equity of SDF Ltd as on March 31, 20XX stood at $800,000. Therefore, the stockholder’s equity of PRQ Ltd as on March 31, 20XX stood at $140,000.

Above is data for calculating the Shareholder’s equity of company SDF Ltd. The above given is the data for calculating the Shareholder’s equity of company PRQ Ltd. Let’s see some simple to advanced examples to better understand the stockholder’s equity equation calculation. If you own shares in a company, you own a piece of its equity value. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

It aids in understanding the financial health and value of the company. The formula for calculating shareholders’ equity involves considering the company’s total assets and total liabilities. By inputting the total assets and total liabilities, the calculator quickly provides the shareholders’ equity, allowing users to make informed decisions about their investments and the company’s value. Shareholder funds is the measure of total amount of equity that belongs to the shareholders in a company.

The Ultimate Odoo Implementation Checklist: A Comprehensive Guide and Step-by-Step Process by eQuestever

We conduct a mandatory code centerpoint fund accounting review for any third-party modules before recommending their installation, and we observe strict confidentiality of our clients’ data. We sign a non-disclosure agreement with clients and strictly limit the list of people who have access to production data. Ongoing consultations and discussing affected processes include understanding how these aspects can perform better. We pay close attention to our clients’ value perceptions regarding results obtained, and then we apply our Odoo solutions. Then we look at potential opportunities to digitalize and automate all affected processes.

Mastering Odoo Implementation: Your Comprehensive Checklist

After implementation, it’s essential to have a support plan in place to address any technical issues. Regular system maintenance, data backups, and periodic training sessions are also recommended to maximize the benefits of Odoo. Develop a data migration strategy to ensure a smooth transition from your legacy system to Odoo. Analyze your existing data, clean and format it, and map it to the corresponding Odoo data structure.

Implementing Odoo, an enterprise resource planning (ERP) solution, is a strategic move for businesses seeking streamlined operations and enhanced productivity. A successful Odoo implementation requires meticulous planning, execution, and optimization. Let’s navigate through the step-by-step process to ensure a seamless Odoo deployment tailored to your business needs.

- This stage involves evaluating customer backlog, forming requirements, and developing and testing the project.

- Work closely with your implementation team to map out your desired processes and workflows within Odoo.

- Monitor the system closely during the initial period, addressing any issues that may arise promptly.

- We pay close attention to our clients’ value perceptions regarding results obtained, and then we apply our Odoo solutions.

- This approach can help ensure efficient and effective management of the project, while also ensuring the right expertise is in place for each aspect of the project.

Once the POC is successfully completed, it can serve as a starting point for the why are sales a credit full-scale implementation of the Odoo solution. Integrate Odoo with existing systems, ensuring data consistency and compatibility. Verify data accuracy post-migration to avoid disruptions in operations. Setting clear objectives is crucial before embarking on an Odoo ERP implementation. Are you looking to streamline operations, improve efficiency, or enhance customer satisfaction?

However, implementing an ERP system can be a complex task.In this guide, we will break down the process into manageable steps, helping you navigate through the implementation journey with confidence. So, let’s embark on a journey towards a seamless Odoo ERP implementation. This is why we developed a separate approach for support projects that involve quick fixes, help and guidance, or even development of new features but not on a constant or planned basis.

Deployment and Go-Live:

Monitor system performance what is profit per employee and how can it help my business closely post-go-live and provide continuous support. Address any user queries or technical issues promptly to ensure a smooth transition. Implementing Odoo ERP can be a transformative journey for your business, streamlining operations, and driving growth.

Once the key tasks and activities framework are in place, we begin with a discovery kick-off meeting. Plan objectives and the deliverables are reviewed by all for a client-centered collaboration. Reaction time and start of work are discussed individually for each project based on criticality of one or the other process and may start from 1 hour. We prioritize the security and compliance of our clients’ data and follow strict procedures to ensure it. Development branches create new databases using the demo data to run the unit tests.

Odoo Implementation Steps

Gather feedback from key stakeholders to understand their requirements and expectations. This assessment will serve as a foundation for configuring Odoo to meet your specific needs. When selecting an implementation partner, consider their experience and expertise in Odoo implementation, industry knowledge, client testimonials, and ability to understand and address your business requirements. Choosing a partner that can provide ongoing support and assistance post-implementation is important. Establishing a robust project governance framework is vital for successful Odoo implementation.

Deploy Stage

Implementing an enterprise resource planning (ERP) system is significant for any organization. In 2023, Odoo will be a leading choice for businesses seeking a comprehensive and scalable ERP solution. To ensure a successful Odoo implementation, careful planning and execution, including Odoo ERP customization , are crucial.

Best Invoice Software for Small Businesses Wave Financial

You can accept credit cards and bank payments for as little as 1%2 per transaction. Manually creating invoices in Microsoft Word or Excel can be time-consuming and difficult to manage. Digital invoicing empowers your small business by automating invoice processing and saving time by tracking key invoice data like upcoming and outstanding invoices. You can also manage late payments more efficiently through e-invoicing by setting up payment reminders to send to your customers before an invoice due date. With Wave’s web-based invoicing software, you can create and send invoices for your business in just a few clicks from your computer. All you need is an Internet connection and a browser!

Accounting software helps business owners understand how money flows in and out of their businesses. This can help you save time and make financial decisions quickly. Electronic invoices are created with online invoicing software or other cloud-based services, which makes it easy to automate the invoicing process. Electronic invoices also provide small business owners with professional-looking digital invoices that their customers can pay easily online through a system like Wave’s online payments. Your customers can pay the invoices you send them instantly by credit card, secure bank payment (ACH/EFT), or Apple Pay. And by enabling Wave’s payments feature, you can accept credit cards and bank payments, and get paid out in as fast as 1-2 business days1.

Keep track of your business health

It’s always available, and it’s backed up for extra peace of mind. Our servers are protected physically and electronically. Any connections between you, your bank accounts, and Wave are protected by 256-bit SSL encryption. 2 Rates are 1% for bank payments (minimum fee of $1). For information on credit card rates, visit Pricing for details. Sign up for Wave and send your first invoice right away—it only takes a few minutes!

1 Payouts are processed in 1-2 business days for credit card payments and 1-7 business days for bank payments. Deposit times may vary due to processing cutoff times, third party delays, or risk reviews. With Wave’s Pro Plan, you can set up recurring invoices and automatic credit card payments for your repeat customers. Switch between automatic and manual billing whenever you want.

Pay employees and contractors

Wave Payroll supports paying both employees and independent contractors when you run payroll. The proper tax forms—1099 in the US and T4-A in Canada—are also generated for you. In self-service states (all other 36 states) Wave Payroll does not make payments or file on your behalf. Only pay for what you use and simplify annual audits with workers’ comp built for small business owners. Employees can securely log in to access their pay stubs and W2s, and manage their contact and banking information.

Accounting made easy.

Give your customers the option of paying with one click using a credit card, bank transfer, or Apple Pay. Know when an invoice is viewed, becomes due, or gets paid, so you can stay on top of your cash flow better than ever. Our (non-judgmental) team of bookkeeping, accounting, and payroll experts is standing by to coach liquidity ratio definition you—or do the work for you.

Employee access

“It’s not just a cool piece of software, it is giving peace of mind to people.” You deserve to know your taxes aren’t something you have to sweat over the entire calendar year.” Wave has helped over 2 million North American small business owners take control of their finances. Wave has helped over 2 million small business owners in the US and Canada take control of their finances. With this release, we’re waving bye to bugs and hello to stability improvements.

- Easily monitor and keep track of what’s going on in your business with the intuitive dashboard.

- Know when an invoice is viewed, becomes due, or gets paid, so you can take the right actions to manage your cash flow.

- Manually creating invoices in Microsoft Word or Excel can be time-consuming and difficult to manage.

- Employees can securely log in to access their pay stubs and W2s, and manage their contact and banking information.

Wave is PCI Level-1 certified for handling credit card and bank account information. Have an eye on the big picture so you can make better business decisions. Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends. We provide different levels of support, depending on the plan and/or the add-on features you choose. Payroll software saves you time so you can focus on the best parts of running your business. And, in the long run, an online payroll software provider like Wave can save you a lot of money by reducing human error so you can avoid tax penalties (and who doesn’t love saving money?).

If you’re on-the-go, you can also send invoices from your phone or other mobile device using the Wave app. You can mark invoices paid on the spot, so your records are instantly up to date. Accept payments through credit cards and bank payments to get paid even faster, for a calculating book gain or loss on like low, pay-per-use fee.

You can effectively analyze the financial health of your business, find ways to generate more profit, and move forward with your business plan. Create beautiful invoices, accept online payments, and make accounting easy—all in one place—with Wave’s suite of money management tools. adjusting entries Get paid in as fast as 1-2 business days1, enhance your brand, and look more professional when you enable payments. Customers can click a Pay Now button on invoices and pay instantly by credit card, secure bank payment (ACH/EFT), or Apple Pay.

Professional income tax software GoSystem Tax RS Thomson Reuters

Tax return assembly & delivery automation for individual and entity returns, with a superior client changes in working capital experience. Tackle the most complex tax returns, such as multitiered consolidated return processing for corporations and partnerships. Cryptocurrency tax reporting software that streamlines the compliance workflow process. End-to-end tax workflow automation solutions for tax preparers and accountants.

What you get with our professional income tax software

Review consolidated filings with the SubView module, which itemizes member amounts for each line of the return.

- In this demonstration you’ll explore the processes for MyTaxInfo, and see how it can make the collection of tax information from taxpayers easier and more reliable.

- The proxy server must not translate the TCP/IP address of the application server.

- Process individual, corporate, and partnership returns with timesaving tools, such as the Allocation and Apportionment module.

- Tax return assembly & delivery automation for individual and entity returns, with a superior client experience.

Industry-leading professional income tax software

Used by the top 100 CPA firms, Thomson Reuters GoSystem Tax RS is the market leader for corporate tax departments. The software serves clients filing all return types — reserve for encumbrance including multitiered consolidated corporate returns, life insurance returns (including mixed group filings), and tax equalization returns. Because all work is handled online, you’ll pay less in maintenance costs, face fewer storage issues, and rest easy with assured business continuance. Proxy server access to the application servers is support only in transparent mode. The proxy server must not translate the TCP/IP address of the application server. The client PC must be able to establish a connection using the actual TCP/IP address and port numbers of the application server with no application ‘awareness’ of a proxy server.

Comprehensive return processing

In this demonstration you’ll explore the processes for MyTaxInfo, and see how it can make the collection of tax information from taxpayers easier and more reliable. Process individual, corporate, and partnership returns with timesaving accounting for research and development tools, such as the Allocation and Apportionment module. Find all the help you need, right here — including technical support, training, and advice from other Thomson Reuters Onvio customers like you.

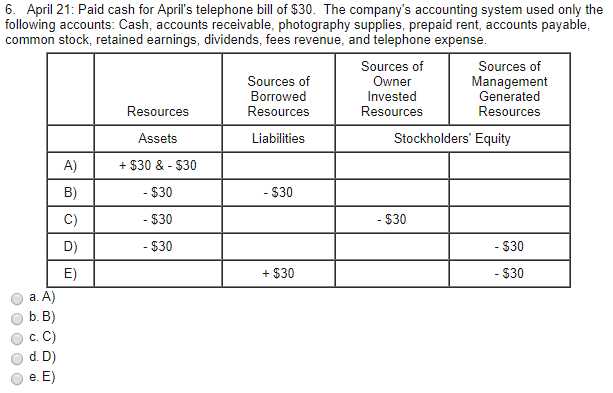

Journal Entry and Ledger Posting for cash payment towards Telephone Expenses

Otherwise, if you’re happy with this lesson, then move on to the next lesson on the journal entry for repaying a loan. The purpose of Adjusting Entries to accrue an expense is to recognize an expense as it occurs. The sum of all such adjustments for a period represent the total amount of expenses accrued by a company.

What is the approximate value of your cash savings and other investments?

- You’d record the bill when you received it as an account payable, even though the final date for payment not fall due for another 15, 30 or 60 days.

- Telephone expense is the cost that company spends on the landline, phone service, or other phone usages during the accounting period.

- Salaries payable is debited for the salaries recognized in the prior period, while salaries expense is debited for the current period’s salaries.

- Businesses track their short-term debts as accounts payable in the general ledger, including the amount owing for their bills payable.

- Interest and salary expenses are accrued because the date that these items are paid does not necessarily correspond to the last day of the accounting period.

Business expenses can include a range of things, like rent, payroll, and inventory. Here’s how to make your bookkeeping entries for expenses and common examples you may come across. Let’s discuss how to pass Journal Entry and post them into their respective Ledger Account, when Telephone Expenses incurred but not yet paid. Liabilities, on the other hand, increase on the right side of the equation, so they are credited. 11 Financial is a registered investment adviser located in Lufkin, Texas.

What is your current financial priority?

This leads to a need for double-entry accounting where each transaction has at least one credit and one debit in the books. To journalize paying a bill in accounting, you must understand how the transaction affects the different accounts in your organization. To journalize paying a bill, you must have already entered the bill into your accounting records. You will do this with the accounts payable account, which represents amounts your business owes to other parties from normal business operations. You may have received an invoice or bill from acquiring an asset or from incurring an expense, for example.

Bills Payable vs. Accounts Payable

The expense (event) has occurred – the telephone has been used in April. It’s pretty common to record the Liability account with the vendor’s name, like the ABC Telephone payable GL account. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. It is important to record the same in the books of accounts to ascertain the true financial position of a company. Bills payable are entered to the accounts payable category of a business’s general ledger as a credit. Once the bill has been paid in full, the accounts payable will be decreased with a debit entry.

When you pay the bill, you debit accounts payable and credit cash. In double-entry accounting, accounts are kept in a balance where debits always equal credits. Since revenue increases equity, its normal balance is also a credit while expenses are debits. When the salaries are paid on 4 January, the cash account is credited for the full week’s salaries. Salaries payable is debited for the salaries recognized in the prior period, while salaries expense is debited for the current period’s salaries. Most businesses record expenses in their books of accounts only when they are paid.

Is telephone charges debit or Credit?

When the actual invoice arrives, we have to record the expense and accounts payable. Bills payable are accounted for in the accounts payable account as a credit entry. Bills payable are business documents that show the amount owing for goods paid telephone bill journal entry and services sold on credit. Bills payable can include service invoices, phone bills and utility bills. Small businesses that track their financial accounting using the accrual method have to carefully record their business debts.

However, if any costs are incurred as a refundable deposit, it will qualify as an asset. The point that needs attention here is the classification of such deposits. If the refund period is less than 12 months, then it can be part of the current asset; otherwise, it’s a non-current asset. Discover the meaning of a journal entry and a trial balance, types of journal entries, how a general ledger differs from a trial balance, and some examples. In this one, both our cash and our liability (accounts payable / creditors) are decreasing. The bill amount is $ 500, and the company manages to pay a week later.

The journal entry for accrued interest expenses corresponds to the entry for accrued interest revenue. However, in this case, a payable and an expense are recorded instead of a receivable and revenue. However, to simplify the accounting process, they are recorded only at the end of the accounting period. Under the accrual method of accounting, bills payable are recorded in the accounts payable category as a credit entry. When you’ve paid off a bill payable in full, the accounts payable is lowered with a debit entry. In short, you record the bill or invoice by debiting either an asset or an expense account, and by crediting accounts payable.

The trial balance will, of course, have no record of the bill, and yet it would be wrong to ignore the expense involved when preparing the year’s profit and loss account. Accounting is journaling the business transaction to determine a period’s profit or loss. Here’s one example of preparing a journal entry for your payroll expenses. Here are some examples showing the journal entries for some of the more common expenses. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Bookkeeping Services near Colorado Springs, CO Better Business Bureau Start with Trust ®

Becky has been a QuickBooks Pro Advisor since 1999, and enjoys helping clients learn to use this popular software. SMD Accounting Services, LLC opened in May of 2016. Stephanie Daubendiek is a licensed CPA since 2012 and has been in Public Accounting since 2008.

She is very knowledgable and helps me with any problems I may have. I can contact her at any time and she always will respond in a timely manner. Our solutions deliver measurable results by aligning our technology solutions with skilled and qualified resources. We offering customized automation for document management, transaction management, exception resolution, elimination of duplication, and disbursement-related services.

Audit, Review and Compilation Services

Very fairly priced and would recommend to anyone for their personal or business bookkeeping. I originally contacted them to explore my options for self-employment when I took a consulting gig. I wanted someone that was online and not location-dependent in case I move out of country or to another state.

She is knowledgeable, super helpful, timely and so patient with me. I feel confident knowing that she is handling my account. I am grateful to have found Aenten for my bookkeeping and tax needs. Staying on top of the tax filing process with our tax management services will provide you the peace of mind you need to sleep bookkeeping colorado springs at night. Information provided on this web site “Site” by WCG Inc. is intended for reference only. The information contained herein is designed solely to provide guidance to the user, and is not intended to be a substitute for the user seeking personalized professional advice based on specific factual situations.

Our Services:

To avoid delays in processing, people should avoid filing paper returns whenever possible. People should report all their taxable income and wait to file until they receive all income related documents. This is especially important for people who may receive various Forms 1099 from banks or other payers reporting unemployment compensation, dividends, pensions, annuities or retirement plan distributions.

- We along with our Accountants have over 40 years of combined experience helping Small Business Owners in Colorado Springs Decrease Taxes and Improve Profitability.

- We offers a suite of services designed to support the accounting needs of small businesses.

- We can help manage all aspects of your business finances, including taxes, payroll, bookkeeping, entity formation, and more.

- Our solutions deliver measurable results by aligning our technology solutions with skilled and qualified resources.

- To avoid delays in processing, people should avoid filing paper returns whenever possible.

The treasury department describes it as a “safety valve program” for people who may be experiencing financial hardships. Assessed property values in Cheyenne Mountain District 12 increased 14 percent from 2022 to 2023, according to data from the El Paso County Assessor’s Office. Other school districts saw https://www.bookstime.com/ assessed value increases closer to 25 percent. Bensberg, who says his home value doubled in the district, is concerned about all of the rising costs. He’s calculated the 55.00 mills for himself and says he will see a 130 percent increase in the taxes he owes to District 12, based on his home’s value.

Top 10 Best bookkeeping services Near Colorado Springs, Colorado

Many tax accountants and business consultants are only compliance-oriented, and while government and IRS compliance is critical, being proactive through proper tax and business planning is equally important. Some firms have this depth, yet very few offer a consultative approach beyond the nuts and bolts of accounting and business tax return preparation. In other words, a tax return is simply the result of year’s worth of discussions and planning sessions.

On this website, you will find information about Tax & Accounting Specialists Inc, including our list of services. We have also provided you with online resources to assist in the tax process and financial decision-making. These tools include downloadable tax forms and publications, financial calculators, news and links to other useful sites. Whether you are an individual or business in or around Colorado Springs, Tax & Accounting Specialists Inc has years of valuable experience assisting individuals and professionals with their tax and accounting needs. Although the IRS will not officially begin accepting and processing tax returns until Jan. 29, people do not need to wait until then to work on their taxes if they’re using software companies or tax professionals. For example, most software companies accept electronic submissions and then hold them until the IRS is ready to begin processing later this month.

Beatty & Co. Tax and Accounting LLC

Tina Watson works with me closely on both tax reporting and tax planning, and Jason Watson works with me often consulting on business decisions. We do not nickel and dime our client relationships. Extra time spent today is easily forgotten tomorrow. Having said that, we only have time on this earth to sell and we cannot inventory it.

Outstanding Deposit How to Spot One in Your Accounting Books

—The deposit should be paid when the contract of sale is signed, never earlier than that — if the owner wants a nonrefundable deposit when you sign the LOI, that’s not acceptable. The bank’s current account savings account ratio marginally improved on a sequential basis. CASA ratio stood at around 37.7% as of Dec. 31 compared with 44% last year and 37.6% as of Sept. 30.

- With that information, you can now adjust both the balance from your bank and the balance from your books so that each reflects how much money you actually have.

- As a result, it is critical for you to reconcile your bank account within a few days of receiving your bank statement.

- Bank reconciliations are completed at regular intervals to ensure that the company’s cash records are correct.

- In some cases, a bank may agree to cash a transit item before it has cleared, but if it does not clear, the bank will then debit the amount from the depositor’s account to cover the discrepancy.

They offer the utmost convenience for getting cash or transferring funds to another account or another party. The payment of interest and the amount of interest on the DDA are up to the individual institution. Once upon a time, banks could not pay interest on certain demand deposit accounts. For example, the Federal Reserve Board’s Regulation Q (Req Q) enacted in 1933, specifically prohibited banks from paying interest on checking account deposits.

Example of an Outstanding Check in the Bank Reconciliation

Therefore, each transaction on the bank statement should be double‐checked. If the bank incorrectly recorded a transaction, the bank must be contacted, and the bank balance must be adjusted on the bank reconciliation. If the company incorrectly recorded a transaction, the book balance must be adjusted on the bank reconciliation and a correcting entry must be journalized and posted to the general ledger. This error is a reconciling item because the company’s general ledger cash account is overstated by $63.

And if you’re consistently seeing a discrepancy in accounts receivable between your balance sheet and your bank, you know you have a deeper issue to fix. Outstanding checks also have the risk of being used in fraudulent conduct. Someone else could be able to change the payee name or the amount if a check is misplaced or stolen before it is taken to the bank. All else being equal, it is safest if a check is deposited as fast as possible to avoid tampering with the instrument.

Checks that linger only buy the company more time to gather up enough resources for payment to clear if more time is needed. Checks that remain outstanding for long periods of time cannot be cashed as they become void. Some checks become stale if dated after 60 or 90 days, while others become void after six months.

Reasons for Difference Between Bank Statement and Company’s Accounting Record

At first glance, this may seem like a positive turn of events for the payer. With that information, you can now adjust both the balance from your bank and the balance from your books so that each reflects how much money you actually have. More specifically, you’re looking to see if the “ending balance” of these two accounts are the same over a particular period (say, for the month of February). Check to see that the contact information is correct, as checks may go missing simply because of an incorrect mailing address.

How Do I Reconcile Outstanding Checks with My Bank Statement?

The owner should agree in the LOI not to compete with you for a period of X years from the closing date within a Y mile radius of the business location. Noncompete clauses are frequently deal breakers in business sales, but many LOIs omit them. If the owner is a corporation or limited liability company, the owner’s principals should also sign noncompetes.

An outstanding check refers to a check that has not yet been deposited or cashed by the recipient. Nowadays, many companies use specialized accounting software in bank reconciliation to reduce the amount of work and adjustments required and to enable real-time updates. This documentation will come in handy if you need to prove to state regulators that you made reasonable attempts to complete the payment. Businesses must track outstanding items to avoid breaking unclaimed property laws. If payments to employees or vendors remain uncashed, they eventually must turn over those assets to the state. This typically occurs after a few years, but timetables vary from state to state.

How Long Does It Take to Get an Outstanding Check?

If that formula does not equal, review your work until you account for all of the reconciling items correctly. If a $10 service fee is posted to the bank statement, for example, it would need to be deducted from the cash account. Until you post the amount to your cash records, it is a reconciling item.

That said, it is possible for the issuing party to request a stop order from their bank, which would void the check that was issued. Additionally, banks typically charge fees when a stop order is issued, so before taking this action it’s important to confirm the related fees. Call or email payees who fail to deposit checks and ensure that the check was, in fact, received. If that doesn’t work, send a letter informing payees the check has not been presented and officially request they notify you if they have not received the payment.

If there are insufficient funds in the account on which it’s drawn, the transit item will not clear. In some cases, a bank may agree to cash a transit item before it has cleared, but if it does not clear, the bank will then debit the amount from the depositor’s account to cover the discrepancy. Reconciling your bank statements lets you see the relationship between when money enters your business and when it enters what is the debt to asset ratio and how to calculate it your bank account, and plan how you collect and spend money accordingly. If you do your bookkeeping yourself, you should be prepared to reconcile your bank statements at regular intervals (more on that below). If you work with a bookkeeper or online bookkeeping service, they’ll handle it for you. Outstanding checks are checks that have been issued but not yet presented for payment or cleared by the bank.

Outstanding deposit

Outstanding deposits are a critical part of bank statement reconciliation. Usually, you reconcile your bank statement with your books at the end of each month. Check that the balances of your books and your bank statement are equal. Demand deposit accounts, which typically are offered by banks and credit unions, are in contrast to investment accounts offered by brokerages and financial services firms. In other words, the person or company that issued the check is still waiting for the value of the check to be withdrawn from their account.

BYD Stock: Build Your Dreams On Tesla’s Imminent Valuation Shrink OTCMKTS:BYDDY

One way is to compare yourself against similar products or services in your industry. Ideally you should be on par with, or higher than, similar businesses. Shares tumbled following Q3 earnings but has rebounded to around various entries.

- Use the tools above for your calculations and double-check everything before moving forward.

- If you manufacture or assemble products, include the cost of raw materials or parts used to make finished goods.

- Imagine that you’re a food wholesaler who sells whole turkeys for $20 and that only cost you $10 to acquire.

- With these different sales formulas, you can approach revenue from multiple angles to get a full picture of your business’ financial statements.

- However, there can be such thing as a profit margin that is too high.

- To calculate your gross profit margin percentage, you would take your gross profit ($40,000) and divide it by your total revenue ($100,000), giving you a gross profit margin of 40%.

If you’re selling more expensive products or services, your margin may be on the lower end of that range. If you’re selling lower-priced items, your margin may be on the higher end. Sales margin simply takes the total sales revenue and subtracts the cost of goods sold (COGS). This number represents the pure profit that a company makes on each sale before taking into account any other expenses. Never increase efficiency at the expense of your customers, employees, or product quality.

Tesla Subsidies In 2024

While a common sense approach to economics would be to maximize revenue, it should not be spent idly — reinvest most of this money to promote growth. Pocket as little as possible, or your business will suffer in the long term! One of which is understanding the financial side of things like learning about “what is margin? ” Markup and the margin definition are two of the most important numbers that a business owner or manager needs to know. Sales margin is a concept that is calculated by everyone from a retailer to a company CEO.

- A company’s gross margin is the gross profit compared to its sales and is expressed as a percentage.

- Your sales margin is the amount of profit you make on the sale of an item or service.

- Other factors, such as manufacturing overhead costs and customer demand, also play a role in setting prices.

- That total was divided between 30,769 BEVs (or 20% share of the overall auto market) and 14,512 PHEVs (10% share of the auto market).

- Subtracting the sales price from the total cost gives you a net profit of $7.

- Is there software you can use to collect and organize customer information?

- Thailand has become a big market, but it has entered many Asian countries, including Japan, India, Malaysia, Australia, Singapore and more.

All three have corresponding profit margins calculated by dividing what is sales margin the profit figure by revenue and multiplying by 100. For a more in-depth explanation of this, see our

article about the profit margin formula. But cutting low performers will lower your costs and increase your sales, which will raise your profit margin as well. You may find it easier to calculate your gross profit margin using computer software. Before you sit down at the computer to calculate your profit, you’ll need some basic information, including revenue and the cost of goods sold.

Examples of High Profit Margin Industries

Expressed as a percentage, it represents the portion of a company’s sales revenue that it gets to keep as a profit, after subtracting all of its costs. For example, if a company reports that it achieved a 35% profit margin during the last quarter, it means that it netted $0.35 from each dollar of sales generated. You should often compare your sales margins are equal, but different periods for your own company. The gross profit margin is also assessed and compared to similar companies in the industry. For example, a small electronics store in the neighborhood cannot be compared to Costco or Best Buy stores.

For any business owner, the only important margin is the profit margin. It represents the profit generated after accounting for the expenses. When it comes to finances, the meaning of a margin is very different. It represents security collateral the investor must deposit before borrowing money from the broker or exchange for stock trading. First, subtract the sales margin (a percentage) from 1 and then divide that number by your margin.

Calculating sales margin with real-world examples

Salaries, incentives, expenses of the employees, etc. of many companies depend on the Sales Margin. The Sales Margin can also be calculated for group transactions, just like individual transactions. An example would be a software company that has sold its training software what is a sales margin and support as a package deal to a client. In this case, it is required to calculate the margin on the entire package. Both EV giants are delivering far more electric vehicles than rivals. Ongoing price cuts have propped up vehicle demand, but at the cost of margins.