14 2: Direct Method of Allocation Business LibreTexts

Understanding how costs are structured is crucial for making informed financial decisions and ensuring long-term sustainability. Direct expenses refer to expenses that are incurred as a result of the manufacturing of goods or rendering of services, and are easily identifiable with a specific activity or service. Direct costs are the ones that aid every organization in strategic management of the finance thus enhancing the budgeting, pricing and the making of profits. For each expense assess its directness or contribution to the output of the concerned product or project. Include only those specific expenses related to the final product and omit any generic or overhead ones such as power bills or remuneration of office assistants.

Create a Free Account and Ask Any Financial Question

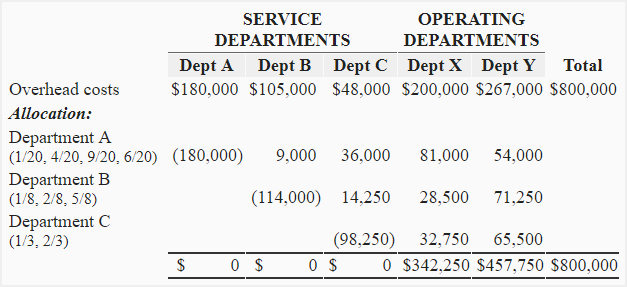

The total cost of each service department, including the allocated costs, is allocated step-by-step until all service departments have been allocated. One effective strategy is to implement a hybrid allocation model that combines elements of direct, step-down, and reciprocal methods. This approach allows organizations to tailor cost distribution to the specific dynamics of each department. For instance, direct allocation can be used for easily traceable costs like departmental supplies, while step-down allocation might be applied to more interconnected services such as facilities management. Reciprocal allocation can address the intricate interdependencies of departments that frequently exchange services, ensuring a comprehensive reflection of resource usage.

Which activity is most important to you during retirement?

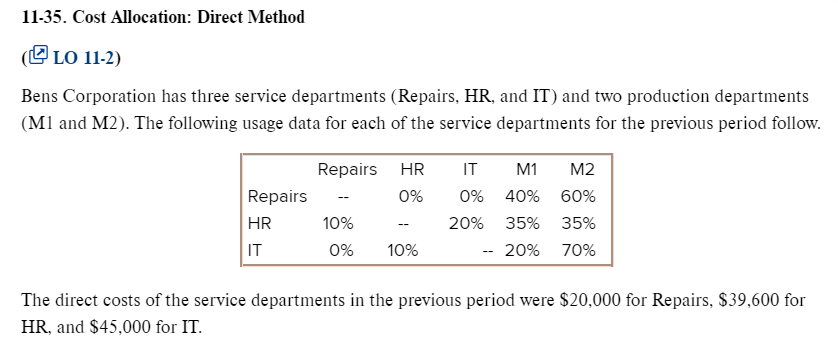

Suppose the after split-off costs, such as collecting and packagingthe parts are estimated to be $25 for 2,000 pounds of feet, beaks and gizzards. If the company does not inventory theseby-products and uses the cost reduction method, the entries are as follows. The self services (the 50 KWH’s used by S1 and the 30 labor hours used by S2) are ignored along with the reciprocal services (the 100 KWH’s used by S2and the 20 labor hours used by S1) in developing the proportions. Thus, the denominator for developing the proportions for S1 is 800,not 950 and the denominator for developing the proportions for S2 is 250, not 300. For instance, if a department hires a consultant for a specific project, the consulting fee can be directly allocated to that department.

Types of Costs

Explore the intricacies of cost structures, including direct and indirect costs, and learn about various cost allocation methods across different industries. The direct method of cost allocation is particularly effective when allocating direct costs that have a clear cause-and-effect relationship with the cost objects. This method accurately assigns direct costs, such as materials and labor, as their relationship with the cost driver is typically more direct and easily measurable.

Automation through cost allocation software can significantly improve accuracy, efficiency, and transparency in the allocation process. While cost allocation can be complex, following certain best practices can help organizations streamline the process, ensure fairness, and enhance profitability analysis. The direct expenses are related in calculation with the cost of goods sold since they are incurred in the manufacturing process. Luckily, modern planning software can transform cost allocation from a time-consuming, Excel spreadsheet-based headache into a precise, streamlined process. Departments occupying a larger square footage of office space pay a larger share of rent and building maintenance costs. There are several cost allocation methodologies, each suited to different situations.

How Liam Passed His CPA Exams by Tweaking His Study Process

If one department produces more units, it will bear a larger share of the labor costs. Other examples of pushed cost allocation drivers are the number of processed invoices for finance or the number of new employment contracts for the HR department. Drawing on insights from cost allocation expert Sander den Hartog, CEO of CostPerform, we will break down the process and its challenges in a clear and structured manner. Additionally, the concept of economies of scale plays a significant role in cost structure. As businesses expand their operations, they often experience a reduction in per-unit costs due to increased efficiency and bargaining power.

Conversely, diseconomies of scale can occur when a company grows too large, leading to inefficiencies and increased per-unit costs. Balancing growth with operational efficiency is therefore a strategic consideration for any business. We then multiply the service department overhead by the above factors to obtain the amount of overhead to be allocated to each production department. A solution like Phocas will integrate directly with your business systems—from ERP and financial software to human resource and production tracking tools. When an employee joins your team or production volumes shift, your allocations update instantly. Fixed costs are the steady, predictable costs that don’t change with business activity.

This approach involves allocating the joint costs to products in proportion to these estimated sales values. It provides an alternative to the previous approach when the productscan not be sold at the split-off point, i.e., without further processing. Since this is not likely to be an accurate assumption concerning the values added by the separate joint and after split-off processes, the NRVestimates of values at the split-off point are likely to be misstated. However, if there are no identifiable sales values at the split-off point, this methodseems to provide the next best alternative. The step-down, or sequential method, ignores self services, but allows for a partial recognition of reciprocal services. As a result, the step-down method is different from thedirect method in that some service department costs are allocated to other service departments.

- Allocate the service department costs to both service departments and producing departments based on the allocation proportions provided in Table 1.

- Therefore, the joint cost allocations should not imply that trueprofitability has been obtained.

- Cherry Bekaert Advisory LLC and its subsidiary entities are not licensed CPA firms.

- She explains how data can work for business people without all the tech jargon.

- Use the direct method and make the following calculations for the Purchasing and Receiving cost allocations to the Cooking and Canning Departments.

For example, if a company runs a $100,000 advertising campaign that promotes three different product lines at the same time, it might allocate the marketing costs based on the sales volume of each product. If Product A generates 50% of total sales, it will be allocated 50% of the marketing expenses. Push allocations are commonly used when management needs to assign overhead costs to specific units for more accurate profitability analysis. By following these steps, businesses can maintain accurate financial records, make informed pricing decisions, and optimize budget management based on precise cost calculations.

This could mean over-pricing, which can discourage customers, or under-pricing, which could lead to business losses. The advent of advanced technology has revolutionized cost allocation methods, offering unprecedented accuracy and efficiency. Modern software solutions, such as enterprise resource planning (ERP) systems and specialized cost management tools, have automated many aspects of the allocation process. These systems can handle complex calculations, everett washington irs office track resource usage in real-time, and generate detailed reports, significantly reducing the administrative burden on financial managers. For instance, an ERP system can automatically allocate utility costs based on real-time energy consumption data from smart meters, ensuring precise and timely cost distribution. Reciprocal allocation is the most comprehensive and complex method, as it fully recognizes the mutual services provided among departments.