What to Expect for Refunds This Year Internal Revenue Service

Content

- Tax Refund FAQ

- Refund Related

- Sign up to our latest Newsletter

- IRS Enforcement and Compliance Operations

- Tax agency now pays 4% interest to waiting individual filers; it made $3.3 billion in interest payments last fiscal year

- Delayed refunds. Poor service. Why even the IRS says the 2022 tax season will be a mess

- IRS to refund late-filing penalties for 2019 and 2020 returns

Your financial institution may also play a role in when you receive your refund. Since some banks don’t process financial transactions during the weekends or holidays, you may experience a delay in processing. At one time, the IRS issued an annual tax refund schedule to let taxpayers know when they were likely to receive their refunds. Though the IRS no longer does this, we’ve put together estimates of when your refund may arrive in 2023 based on the schedule in previous years. The IRS says if you file early and electronically, you’ll typically receive your tax refund in fewer than 21 days. “We remain focused on doing everything possible to expedite processing of these tax returns, and we continue to add more people to this effort as our hiring efforts continue this summer,” Rettig said.

- According to the IRS, the best way to avoid delays on your tax refund is to file an accurate tax return using e-file software to file electronically and opting to receive your refund via direct deposit.

- For most filers, the tax deadline is April 18, and the IRS urges Americans to prepare before filing to avoid processing and refund delays, along with future IRS notices.

- The delays compound the very cash flow problems the credit was meant to help businesses avoid.

- That’s why Loyd targets a mid-March filing date, to make sure clients have all the necessary forms — including documents that may need corrections.

If the return includes errors or is incomplete, it may require further review that may slow the tax refund. Having all information available when preparing the 2021 tax return can reduce errors and avoid delays in processing. Requesting refunds via direct deposit is among three leading recommendations by IRS and Treasury officials to help taxpayers. They’ve also urged accurate, electronic filing to help taxpayers stay out of paper processing, though some 10 percent of taxpayers have continued filing paper returns. Processing paper returns is labor-intensive for IRS workers, who also must contend with e-filed tax returns flagged for errors that require manual review. Some returns, filed electronically or on paper, may need manual review, which delays the processing, if our systems detect a possible error or missing information, or there is suspected identity theft or fraud. Some of these situations require us to correspond with taxpayers, but some do not.

Tax Refund FAQ

When payments are delivered automatically to those whose 2019 taxes have been processed, the IRS can’t deduct other money a taxpayer owes to the federal government, except for child support. However, when they are claimed as credits on 2020 taxes — which will happen to millions of people simply because the IRS is behind in processing returns — all of those debts will be subtracted from the credit given. Both letters include important information that can help people file an accurate 2021 tax return. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

Typically, skipping these details triggers an automated notice from the IRS, which may delay processing or take time to resolve, he said. Crapo, the top Republican on the Finance Committee, pushed back on Wyden’s assertion in the April 7 hearing, arguing the IRS has long failed to adopt technology and practices that could speed processing of tax documents. Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news. Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments. Annuity.org partners with outside experts to ensure we are providing accurate financial content. Managing editor Emily Miller is an award-winning journalist with more than 10 years of experience as a researcher, writer and editor.

Refund Related

But the situation could have been handled better, according to Roger Harris, president of a small business accounting firm called Padgett Business Services that has clients still waiting on millions of dollars worth of claims. “While this was welcome news, there is a continued risk that low- and middle-income filers will receive confusing notices while they wait for IRS to process their correspondence or returns,” said Rep.

https://intuit-payroll.org/payer service sites nationwide, which are typically only staffed Mondays through Fridays, are now open on weekends too. “I can’t stress this enough to people, but if you need an extension, just go ahead and file that form 4868 with the IRS,” Khalfani-Cox said. “That will give you an extra six months and then you’ll have until Monday, Oct. 16, to actually submit your taxes.” “In 2021, parents were getting what folks call the enhanced child tax credit,” Khalfani-Cox said. “It was either $3,000 for children under 18 or $3,600 for kids under 6 years old.” Because of the government response to the COVID-19 pandemic, many Americans got a $1,400 stimulus check in 2021, the third of such payments. Second, now is a great time to check your credit report and make sure that there are no issues.

Sign up to our latest Newsletter

The IRS encourages everyone to have all the information they need in hand to make sure they file a complete and accurate return. Having an accurate tax return can avoid processing delays, refund delays and later IRS notices.

- “Particularly for lower income taxpayers who receive Earned Income Tax Credit benefits, tax refunds may constitute a significant percentage of their household income for the year,” Collins wrote.

- Erb offers commentary on the latest in tax news, tax law, and tax policy.

- “When we look at our consumer trends data from the prior-year tax returns, what we saw was four to six times the number of clients taking unemployment, and starting their own side hustle or small business.

- Taxpayers in Maine or Massachusetts have until April 19, 2022, to file their returns due to the Patriots’ Day holiday in those states.

- However, as of Jan. 8, the IRS said it still had 2.3 million unprocessed Forms 1040-X in its inventory.

If you are claiming your children as dependents, make sure they are not claiming themselves on any Irs Distributing Tax Refunds Slower Than Usual This Year After Delayed Start they file. “If that happens, that can delay your refund,” says Rodriguez Reiffert. Divorced couples must make sure only one parent is claiming any children as dependents, notes Deerwater.

Сервера Майнкрафт с BlockParty IP, Minecraft, ТОП

Это очень просто и позволяет каждому пользователю найти сервер согласно личным предпочтениям. Обращайте внимание на поддержку версий и модов, тогда конфликтов не возникнет. Вечеринка блоков – это весёлый способ отдохнуть от ванильного Майнкрафта и погрузиться в необычную мини-игру.

Сервера Майнкрафт с BlockParty

Отыскать такие миры было бы труднее, если бы не существовал удобный мониторинг серверов Майнкрафт https://www.tokenexus.com/ru/eos/. В списке вы найдёте только рейтинговые миры, которые регулярно посещаются определённым количеством игроков. Пользователей будет достаточно, чтобы вы забыли о том, что значит скука. Но теперь создан специальный список, куда попали только рабочие адреса.

Сервера Майнкрафт с BlockParty

Весело провести время в многопользовательской игре можно, зайдя на сервера Майнкрафт БлокПати. Данный плагин добавляет интересную мини-игру в мультиплеерную Как купить Blockparty площадку, которая привлекает много игроков. Если один из них покажется вам неудобным, всегда можно попробовать другую мультипллеерную площадку.

- Если один из них покажется вам неудобным, всегда можно попробовать другую мультипллеерную площадку.

- Вечеринка блоков – это весёлый способ отдохнуть от ванильного Майнкрафта и погрузиться в необычную мини-игру.

- Пользователей будет достаточно, чтобы вы забыли о том, что значит скука.

- Данный плагин добавляет интересную мини-игру в мультиплеерную площадку, которая привлекает много игроков.

- Весело провести время в многопользовательской игре можно, зайдя на сервера Майнкрафт БлокПати.

Сервера Майнкрафт с BlockParty

Сервера Майнкрафт с BlockParty

- Если один из них покажется вам неудобным, всегда можно попробовать другую мультипллеерную площадку.

- Отыскать такие миры было бы труднее, если бы не существовал удобный мониторинг серверов Майнкрафт BlockParty.

- Обращайте внимание на поддержку версий и модов, тогда конфликтов не возникнет.

- Данный плагин добавляет интересную мини-игру в мультиплеерную площадку, которая привлекает много игроков.

Сервера Майнкрафт с BlockParty

Сервера Майнкрафт с BlockParty

Nordfx Отзывы

Содержание

Несмотря на указанные на сайте данные о солидном возрасте и многолетнем опыте брокера, в сети все чаще можно встретить негативные комментарии трейдеров. Заслуживает ли доверия брокер Nord Fx — узнайте из нашего обзора компании. На фоне продвинутых европейский компаний с серьезной регуляцией, сервисы брокера NordFX трудно назвать конкурентоспособными. Тем не менее, новичкам для обучения и знакомства с форекс-трейдингом здесь создана вполне благоприятная среда. Эти счета будут интересны инвесторам, а также трейдерам, которые могут создавать в платформе неограниченное число счетов, работать с инвестиционными портфелями, стратегиями.

- Есть пожелание – увеличить количество инструментов для счетов типа “микро”.

- Для меня как для новичка данная форекс биржа просто находка.

- Депозитные средства были возвращены Вам на Вашу карту в ПОЛНОМ объеме.

- И вообще какую я могу нести ответственность за то, как он торгует?

- Партнер торговал с использованием нескольких экспертов (по-видимому) или вручную, но он порекомендовал мне использовать эксперта, который использует себя сам – в чем здесь нарушение?

Ответим на этот вопрос в подробном nordfx отзывые брокера. За 4 месяца я осознал, что для достижения результата – нужно старание, а также хорошая база первоначальных знаний. Дня новичков – это неплохой вариант учебной платформы.

Две недели рассылал ссылку и получилось пригласить три человека. Сразу же получил партнерские деньги. Правда, спустя неделю мой счет был заблокирован, все партнерские обнулили, весь мой депозит зачислили мне на карту. Пытался выяснить, что же я там нарушил, но ничего не понял. Сбрасывали мне какой-то пункт правил, но там ничего не понятно. Спасибо, хоть, мои сбережения вернули, с партнерками больше не вожусь.

Если у вас есть рабочая стратегия, но нет капитала, то вы можете открыть ПАММ-счет в качестве управляющего и привлекать инвесторов, показывая хорошую доходность. Если у вас есть средства, но нет стратегии или времени для торговли, то вы можете стать инвестором, выбрав лучшие ПАММ-счета из рейтинга. Не первый год тут торгую, еще в 2015 зарегистрировался. Инструментов тут много, на тот момент регистрации, для старта торговли много заводить не надо было. У них отличное исполнение, ордера мгновенно обрабатываются, поэтому проскальзывания бывают очень редко. В мою торговлю они не вмешивались никогда.

Регистрация на NordFX

Администрация оставляет за собой право не публиковать любые отзывы и комментарии, которые, по своему усмотрению, посчитает нечестными, либо помечать такие отзывы любым способом. На мои просьбы объяснить в чем дело, что я нарушила — никаких ответов от брокера. Но в какой-то момент мне просто закрыли счет без предупреждения. Я открыла у них аккаунт, пополнила, начала торговать. Задать вопросы менеджерам компании можно по телефону, через форму обратной связи, через онлайн-чат.

Торговля сопряжена с высокой степенью риска. Статистически только 11%-25% трейдеров зарабатывают при торговле на Forex и CFD. Остальные 74%-89% клиентов теряют вложенные средства. Инвестируйте капитал, который готовы подвергнуть высоким рискам. Автоматизированные торговые системы — это возможность создания пассивного заработка на финансовых рынках для всех пользователей.

В алгоритм советников интегрированы успешные и проверенные стратегии, что позволит зарабатывать на ценообразовании активов не вникая в тонкости технического или компьютерного анализа. Торгую у данного брокера по их же аналитике. По соотношению профитных сделок у убыточным я в явном плюсе.

В 2008 году на форекс рынке появилась инвестиционная компания NordFX, предоставляющая услуги институциональным и частным инвесторам. Место регистрации и главный офис в Вануату, имеются представительства в Индии, Китае, Бангладеш, России. Собственник бренда компания NFX CAPITAL VU INC. На данный момент у этого брокера более 1,3 млн клиентов, в рейтинге 2021 года он занимает четвертое место.

Проблем с выводом средств не возникало. Брокер использует четыре торговые платформы. У меня Метатрейдер 4, проблем не заметила. Начинающим можно поучиться на бесплатном демо-счете. Для новичков каждый месяц проводится конкурс на демо-счете, приз $3500 реальных денег.

Каждый трейдер, который оставляет отзыв на странице компании, влияет на общий Рейтинг по голосованию, повышая или понижая его. NordFx — инновационный брокер, где каждый человек независимо от опыта получает возможность попробовать свои силы, построить карьеру трейдера и получить финансовую независимость. Стандартный STP-счет с минимальным депозитом 250 долл.

https://fxdu.ru/ил не так много, но без задержек и проблем. Техподдержка всегда на связи, планирую и дальше оставаться на этой бирже и зарабатывать. Очень даже неплохой брокер, сотрудничаю уже несколько месяцев и очень доволен. Вообще не встречал ни каких неприятностей. Надежный брокер, что касается котировок, функционирования платформы и вывода средств.

Аналоги NordFX

Пока еще не до конца понял, можно ли здесь зарабатывать или нельзя, буду покупать обучение, а там уже все станет ясно. Nord Fx — брокер, отзывы о котором бывают двух типов — реальные и проплаченные. Потому что все положительные рецензии описывают несуществующие преимущества компании, презентуя ее как надежного международного брокера.

Я знаю, по крайней мере, несколько человек, использующих этот домен. Однако это не аффилированные лица. Это не закрытая учетная запись, и любой может зарегистрироваться на нее. Напомню, Стэн, после регистрации я прошла обязательную процедуру проверки.

Поставщики ликвидности и технологии исполнения ордеров

Далее выберите тип счета, валюту и укажите размер кредитного плеча. Обзор наиболее популярных и рекомендации трейдерам по их выбору. Какие показатели говорят о доходности и потенциальной прибыльности торгов. Из аналитических инструментов на сайте компании есть только календарь важных событий и еженедельные прогнозы. Достаточно часто наблюдаются проблемы в работе терминала на Fix счетах. На Pro и тем более Zero таких проблем нет, скорость открытия сделок очень высокая.

Я получала партнерскую комиссию и торговала используя комисионные. Быстрое исполнение, минимум проскальзываний. Бинарные Опционы – электронные контракты с фиксированной высокой доходностью. Благодаря бинарным опционам можно зарабатывать на акциях различных компаний, товарах, валютах, причем, не только на росте их курсов, но и на падении. Это возможность зарабатывать большие деньги, просто определяя, повысится или понизится рыночный курс актива. Весь принцип торговли очень прост, да и никаких программ устанавливать не нужно.

Отсутствие бонуса при первом пополнении счета, конкурсов, турниров, трейдинга по выходным. Профессиональный ECN-счет с минимальным депозитом 5000 долл. Плавающий спред от 0,0 пункта с комиссией 0,0035% от суммы сделки. Стандартный STP-счет с минимальным депозитом 10 долл. Точность котировок — 4 цифры (4-значные котировки). Сервис, позволяющий передавать деньги в доверительное управление профессиональным трейдерам.

Счет Pro

Призовой фонд на год составляет долларов. Принять участие в конкурсе может любой желающий. Подробности на сайте компании NordFX. Брокером NordFX пользуюсь 11 месяцев. Это мой первый брокер, все проходила с нуля.

• ZuluTrade – торговля по сигналам ведущих трейдеров. • MultiTerminal – софт для работы с несколькими торговыми счетами. Главный минус – необходимость верификации счета для возможности участия в партнерской программе. Вывод средств возможен тем способом, каким был произведен депозит. Заявки обрабатываются в рабочие дни с 9 до 18 часов (по CET).

Поэтому лучше заранее обратиться в суппорт и узнать, что для нее понадобится. Если зайти на официальный сайт «НордФХ», можно увидеть, что брокер дает выход на крупных поставщиков ликвидности, а также предлагает использовать технологию ECN. Но не указывает названия организаций.

Реальные отзывы о Nord Fx

Впечатления только положительные . Проблем с вводом/выводом никогда не было , всё чётко и оперативно . Работа терминала проблем не вызывает , брокер не мешает торговать и зарабатывать .

Income Statement Under Absorption Costing: Explanation, Example, And More

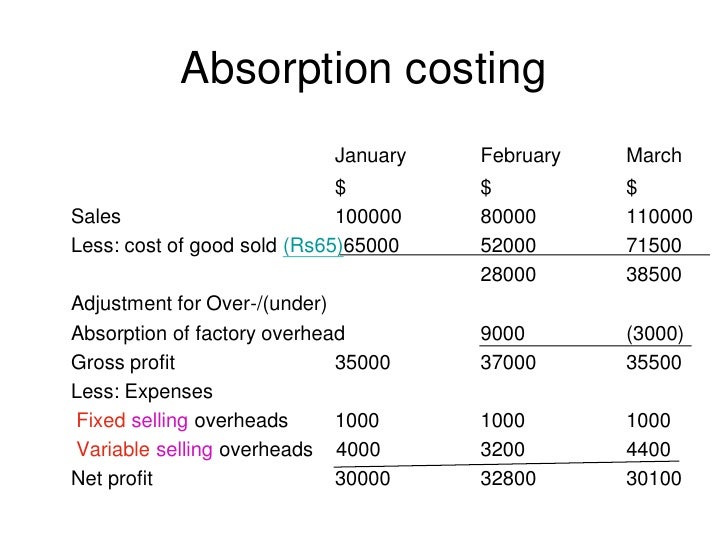

In the article about income statements under marginal cost, we discussed that marginal costs give a higher net profit figure as compared to absorption costing. Here, we are going to discuss the income statement under absorption costing and see how the net profit differs. Before we look at the income statement, let us have a look at what absorption costing is. Absorption costing is the accounting method that allocates manufacturing costs based on a predetermined rate that is called the absorption rate. It helps company to calculate cost of goods sold and inventory at the end of accounting period. Both the above methods are accounting techniques that companies use to allocate the cost of production over the total number of units produced.

New Segment Reporting Disclosures

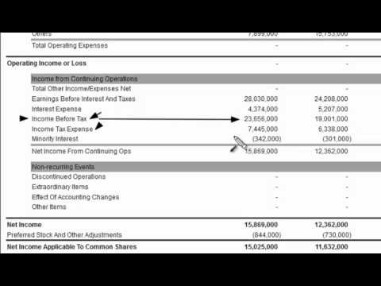

Moreover, the method can provide a more stable basis for performance evaluation, as it avoids the potentially misleading cost fluctuations that can arise from only considering variable costs. When doing an income statement, the first thing I always do is calculate the cost per unit. Under absorption costing, the cost per unit is direct materials, direct labor, variable overhead, and fixed overhead. In this case, the fixed overhead per unit is calculated by dividing total fixed overhead by the number of units produced (see absorption costing post for details).

Chapter 6: Variable and Absorption Costing

- Once you have the cost per unit, the rest of the statement is fairly easy to complete.

- Calculate the unit cost first, as that is the most difficult portion of the statement.

- It includes all product costs, which are both fixed and manufacturing product costs.

- Careful COGS calculation as per GAAP standards is essential for accurate financial reporting.

- Managers can manipulate income by changing the number of units produced Producing more products gives a higher income.

Unlike variable costing, it covers fixed costs and inventories while calculating the cost per unit. If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit. Although fixed costs do not vary with changes in production or sales volume, they may change over time. Each unit of a produced good can now carry an assigned total production cost.

Net Income Determination in Absorption Costing

This artificially inflates profits in the period of production by incurring less cost than would be incurred under a variable costing system. Under the absorption costing method, all costs of production, whether fixed or variable, are considered product costs. This means that absorption costing allocates a portion of fixed manufacturing overhead to each product. The adoption of absorption costing has direct implications for a company’s tax liabilities.

Key Principles of Absorption Costing

Advocates of absorption costing argue that fixed manufacturing overhead costs are essential to the production process and are an actual cost of the product. They further argue that costs should be categorized by function rather than by behavior, and these costs must be included as a product cost regardless of whether the cost is fixed or variable. Under absorption costing, the inventory carries a portion of fixed overhead costs in its valuation. This means the cost of ending inventory on the balance sheet is higher compared to variable costing methods. Compared to variable costing, absorption costing income statements tend to show less volatility in operating income from period to period. This is because fixed costs are smoothed into COGS rather than impacting the period they are incurred.

Variable costing considers the variable overhead costs and does not consider fixed overhead as part of a product’s cost. It is not in accordance with GAAP, because fixed overhead is treated as a period cost and is not included in the cost of the product. While companies use absorption costing for their financial statements, many also use variable costing for decision-making.

Calculate the unit cost first, as that is the most difficult portion of the statement. Absorption costing is typically used in situations where a company wants to understand the full cost of producing a product or providing a service. This includes cases where a company is required to report its financial results to external stakeholders, such as shareholders or how to estimate bad debt expense regulatory agencies. Include an amount for “other items,” which is the difference between the total relevant expense caption on the income statement and the aggregate of separately disclosed expense categories. An ethical and evenhanded approach to providing clear and informative financial information regarding costing is the goal of the ethical accountant.

Absorption costing is an accounting method that captures all of the costs involved in manufacturing a product when valuing inventory. The method includes direct costs and indirect costs and is helpful in determining the cost to produce one unit of goods. Additionally, absorption costing can obscure the true variable cost of production, making it more challenging to conduct break-even analysis and perform cost-volume-profit (CVP) analysis. Managers seeking to make decisions based on the marginal cost of production may find the data less accessible, as fixed costs are distributed across units regardless of the actual production level.

The absorption cost per unit is the variable cost (\(\$22\)) plus the per-unit cost of \(\$7\) (\(\$49,000/7,000\) units) for the fixed overhead, for a total of \(\$29\). Despite its widespread use and compliance with accounting standards, absorption costing is not without its detractors. One of the primary critiques is that it can potentially distort a company’s financial performance, particularly in the short term. By deferring the recognition of fixed costs, absorption costing can inflate profits in periods of increasing inventory, which may not accurately reflect the economic reality of a company’s operations. This can lead to decisions that prioritize production over market demand, resulting in excess inventory and potential write-downs in the future. The service sector presents a different set of challenges for absorption costing due to the intangible nature of its products.

What is the difference between debt and liability?

However, if your liabilities become too great for your income level and you no longer have the assets necessary to pay your debts when they’re due, you might find yourself considering bankruptcy. While this legal process resolves liabilities due to an inability to pay, it also has an adverse effect on your credit score and ability to borrow in the future. When some people use the term debt, they are referring to all of the amounts that a company owes. The flip side of liabilities is assets — resources the company uses to generate income. Assets include inventory, machinery, savings account balances, and intellectual property. For example, buying new equipment may mean taking out a loan to finance the purchase.

One—the liabilities—are listed on a company’s balance sheet, and the other is listed on the company’s income statement. Expenses are the costs of a company’s operation, while liabilities are the obligations and debts a company owes. Expenses can be paid immediately with cash, or the payment could be delayed which would create a liability.

A lot of times, liabilities are debts that are assumed to be the same thing. Debt is a financial arrangement between an organization and the lender, where the lender generally extends finance to the seller. There are three broad categories in which all classes are categorized, which include assets, liabilities, and equity. During the normal course of the business, numerous different transactions occur within the firm. All transactions are supposed to be recorded in the financial statements under separate headings. It’s like when you join a fitness training program or weight loss program, you want to see the results early.

Debt

Current assets represent all the assets of a company that are expected to be conveniently sold, consumed, used, or exhausted through standard business operations within one year. Current assets appear on a company’s balance sheet and include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, prepaid liabilities, and other liquid assets. Short-term debt, also called current liabilities, is a firm’s financial obligations that are expected to be paid off within a year.

Or I may have the capability, but it’s not up to the standard we need. At that point, I can say for the next job, I don’t need to hire a ‘director of X,’ I need to hire to solve these gaps I just identified. How does one go from the investment banking world to the role of CFO? In Ralph Leung’s case, he didn’t take the more common path by nabbing what is the accumulated depreciation formula a job in corporate development. Instead, he took a CFO position at a small company, a route he calls “super humbling.” It meant learning about 80% of the role on the job, and making many mistakes in the process. The investment banker-turned-CFO discusses the company’s mission, finance’s hiring strategy, and the importance of working capital.

- However, if your liabilities become too great for your income level and you no longer have the assets necessary to pay your debts when they’re due, you might find yourself considering bankruptcy.

- That’s why interest rates will normally be higher for this type of debt.

- To cut down on your liabilities, you can take a personal inventory of everything you have.

- The most common accounting standards are the International Financial Reporting Standards (IFRS).

When the company pays its balance due to suppliers, it debits accounts payable and credits cash for $10 million. The indebtedness of a company must be proportionate to its operating capacity. It is reasonable, and even necessary at times, to resort to external capital to boost activity, but always with good planning. In any case, it is convenient to review the accounts and reduce the indebtedness or total liabilities as much as possible. A very high ratio generates a lot of dependencies and drives away new investors because in the event of insolvency it will be more difficult to recover the money. Many times, having to go into debt is a consequence of a moment of lack of cash.

Your Credit History and Score

Liabilities are categorized as current or non-current depending on their temporality. They can include a future service owed to others (short- or long-term borrowing from banks, individuals, or other entities) or a previous transaction that has created an unsettled obligation. The most common liabilities are usually the largest like accounts payable and bonds payable. Most companies will have these two line items on their balance sheet, as they are part of ongoing current and long-term operations.

What are Total Liabilities?

If a company’s product requires repairs or replacement, the company needs the funds available to honor the warranty agreement. Liability is an obligation to render goods or services or an economic obligation to be discharged off at a future date. If you’re unhappy with your net worth figure and believe liabilities are to blame, there are steps you can take. Strategies like debt consolidation and the “debt avalanche” — attacking debts with the highest interest rates first — can help you pay off debt efficiently.

What Is a Liability?

The term of the agreement to which the debt is to be paid back is called the interest. The arrangement for debt payback varies from an individual or organization to the other. This charge is always called the interest, and it is always calculated in terms of the percentage of the principal money received. In some cases, this may mean your liability transforms into an asset, like a mortgage balance becoming full home equity.

Understanding Short-Term Debt

When something in financial statements is referred to as “other” it typically means that it is unusual, does not fit into major categories and is considered to be relatively minor. In the case of liabilities, the “other” tag can refer to things like intercompany borrowings and sales taxes. On a balance sheet, liabilities are listed according to the time when the obligation is due.

It is important to understand that proper asset management facilitates cash flow, fuels cash, and eliminates unnecessary risk. In general, a liability is an obligation between one party and another not yet completed or paid for. Current liabilities are usually considered short-term (expected to be concluded in 12 months or less) and non-current liabilities are long-term (12 months or greater).

Chart of Accounts Example Format Structured Template Definition

As time goes by, you may find yourself wanting to create a new line item for each transaction, but doing so could litter your company’s chart and make it difficult to navigate. Current liabilities are classified as any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report. He frequently speaks at continuing education events.Charles consults with other CPA firms, assisting them with auditing and accounting issues.

Where does the revenue show up?

It’s also worth saying that depending on the idustry and a business’s structure, more accounts can form the COA. The basic set of accounts is similar for all businesses, regardless of the type, size, or industry. This way, whether you’re setting up restaurant bookkeeping or ecommerce accounting, you follow the standard chart of accounts. In the United States businessesand organizations widely use a standardized chart of accounts.

COA Structure

As mentioned, besides the standard five accounts, the chart of accounts may contain additional accounts, created for the sake of more granularity or to cater to a business’s particular needs. They can vary, but the most typical here are the COGS, gains and losses, and other comprehensive income accounts. Revenue appears at the top line of the income statement, showing the total amount of money earned from sales or other business activities.

And when it comes to audits (those thorough checks of financial records), having a clear COA makes everything a lot easier, keeping everyone happy and following the rules. So, a chart of accounts, as mentioned, organizes a company’s finances in an easy-to-understand way. It helps everyone in the company know exactly where the money is coming from and where it’s going.

Every transaction affects at least two accounts – one gets debited and another credited. Double-entry bookkeeping is a fundamental requirement for recording financial transactions under GAAP (Generally Accepted Accounting Principles), so you can’t record your transactions differently. The chart of accounts (COA) current liabilities and difference between current assets and liabilities is a list of accounts a company uses to record its financial transactions. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have.

- The chart of accounts provides the name of each account listed, a brief description, and identification codes that are specific to each account.

- But the final structure and look will depend on the type of business and its size.

- The most liquid assets (such as cash) are listed first, followed by less liquid assets (such as inventory and PP&E).

- Unlike a trial balance that only lists accounts that are active or have balances at the end of the period, the chart lists all of the accounts in the system.

If you don’t give your chart of accounts the early love it deserves, you may regret it. Creating a new accounting systems six years out, for example, would be a major headache. First, let’s look at how the chart of accounts and journal entries work together. To do this, she would first add the new account—“Plaster”—to the chart of accounts. But experience has shown that the most common format organizes information by individual account and assigns each account a code and description.

Organize account names into one of the four account category types

The COA, in this case, might include revenue accounts like Service fees and Consulting revenue to track earnings. An expense account named Professional fees can be added to monitor costs for hiring professionals. Marketing expenses is another expense account to track promotional costs.

Well, this should be listed between the cash and accounts receivable in the chart, but there isn’t a number in between them. A chart of accounts is a critical tool for tracking your business’s funds, especially as your company grows. An easy way to explain this is to translate it into personal finance terms. When you log into your bank, typically compute direct materials used you’ll get a dashboard that lists the different accounts you have—checking, savings, a credit card—and the balances in each.

With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done. For example, if you need to create a new account for ‘PayPal Fees’, instead of creating a new line in your chart of accounts, you can create a sub-account under ‘bank fees’. Similarly, if you pay rent for a building or piece of equipment, you might set up a ‘rent expense’ account with sub-accounts for ‘building rent’ and ‘equipment rent’. You’ll notice that each account in the chart of accounts for Doris Orthodontics also has a five-digit reference number preceding it.