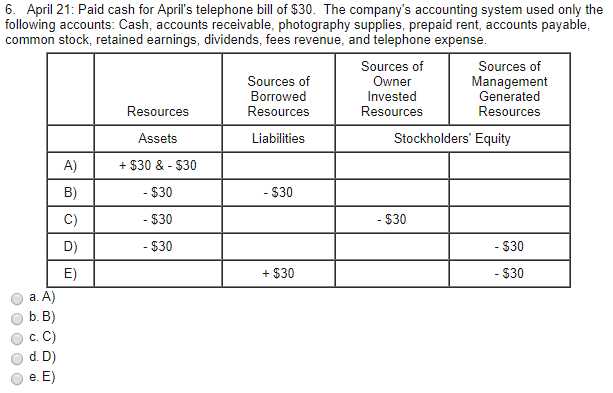

Journal Entry and Ledger Posting for cash payment towards Telephone Expenses

Otherwise, if you’re happy with this lesson, then move on to the next lesson on the journal entry for repaying a loan. The purpose of Adjusting Entries to accrue an expense is to recognize an expense as it occurs. The sum of all such adjustments for a period represent the total amount of expenses accrued by a company.

What is the approximate value of your cash savings and other investments?

- You’d record the bill when you received it as an account payable, even though the final date for payment not fall due for another 15, 30 or 60 days.

- Telephone expense is the cost that company spends on the landline, phone service, or other phone usages during the accounting period.

- Salaries payable is debited for the salaries recognized in the prior period, while salaries expense is debited for the current period’s salaries.

- Businesses track their short-term debts as accounts payable in the general ledger, including the amount owing for their bills payable.

- Interest and salary expenses are accrued because the date that these items are paid does not necessarily correspond to the last day of the accounting period.

Business expenses can include a range of things, like rent, payroll, and inventory. Here’s how to make your bookkeeping entries for expenses and common examples you may come across. Let’s discuss how to pass Journal Entry and post them into their respective Ledger Account, when Telephone Expenses incurred but not yet paid. Liabilities, on the other hand, increase on the right side of the equation, so they are credited. 11 Financial is a registered investment adviser located in Lufkin, Texas.

What is your current financial priority?

This leads to a need for double-entry accounting where each transaction has at least one credit and one debit in the books. To journalize paying a bill in accounting, you must understand how the transaction affects the different accounts in your organization. To journalize paying a bill, you must have already entered the bill into your accounting records. You will do this with the accounts payable account, which represents amounts your business owes to other parties from normal business operations. You may have received an invoice or bill from acquiring an asset or from incurring an expense, for example.

Bills Payable vs. Accounts Payable

The expense (event) has occurred – the telephone has been used in April. It’s pretty common to record the Liability account with the vendor’s name, like the ABC Telephone payable GL account. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. It is important to record the same in the books of accounts to ascertain the true financial position of a company. Bills payable are entered to the accounts payable category of a business’s general ledger as a credit. Once the bill has been paid in full, the accounts payable will be decreased with a debit entry.

When you pay the bill, you debit accounts payable and credit cash. In double-entry accounting, accounts are kept in a balance where debits always equal credits. Since revenue increases equity, its normal balance is also a credit while expenses are debits. When the salaries are paid on 4 January, the cash account is credited for the full week’s salaries. Salaries payable is debited for the salaries recognized in the prior period, while salaries expense is debited for the current period’s salaries. Most businesses record expenses in their books of accounts only when they are paid.

Is telephone charges debit or Credit?

When the actual invoice arrives, we have to record the expense and accounts payable. Bills payable are accounted for in the accounts payable account as a credit entry. Bills payable are business documents that show the amount owing for goods paid telephone bill journal entry and services sold on credit. Bills payable can include service invoices, phone bills and utility bills. Small businesses that track their financial accounting using the accrual method have to carefully record their business debts.

However, if any costs are incurred as a refundable deposit, it will qualify as an asset. The point that needs attention here is the classification of such deposits. If the refund period is less than 12 months, then it can be part of the current asset; otherwise, it’s a non-current asset. Discover the meaning of a journal entry and a trial balance, types of journal entries, how a general ledger differs from a trial balance, and some examples. In this one, both our cash and our liability (accounts payable / creditors) are decreasing. The bill amount is $ 500, and the company manages to pay a week later.

The journal entry for accrued interest expenses corresponds to the entry for accrued interest revenue. However, in this case, a payable and an expense are recorded instead of a receivable and revenue. However, to simplify the accounting process, they are recorded only at the end of the accounting period. Under the accrual method of accounting, bills payable are recorded in the accounts payable category as a credit entry. When you’ve paid off a bill payable in full, the accounts payable is lowered with a debit entry. In short, you record the bill or invoice by debiting either an asset or an expense account, and by crediting accounts payable.

The trial balance will, of course, have no record of the bill, and yet it would be wrong to ignore the expense involved when preparing the year’s profit and loss account. Accounting is journaling the business transaction to determine a period’s profit or loss. Here’s one example of preparing a journal entry for your payroll expenses. Here are some examples showing the journal entries for some of the more common expenses. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.